Topten 'Balance' Surpasses 100 Billion KRW in Annual Sales Last Year

High Demand for Comfortable Clothing and Expansion of Hiking and Running Hobbies

E-Land, Hansae Yes24 Expanding into Activewear Sector

The fashion industry is laying the groundwork for growth with ‘activewear’ that can be used both as sportswear and everyday clothing. Since the COVID-19 pandemic, demand for comfortable clothing has surged, rapidly expanding the activewear market, especially as the MZ generation (Millennials + Generation Z) opens their wallets wide for hobbies like hiking, running, and tennis.

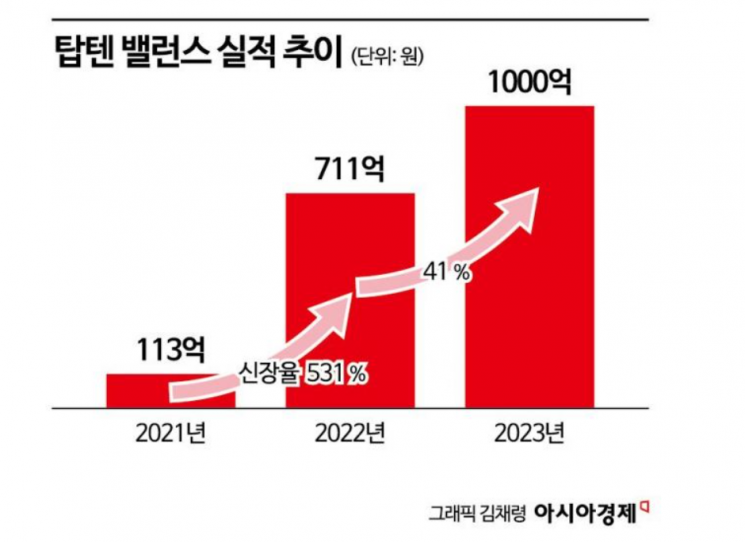

According to Shinseong Tongsang on the 22nd, the SPA brand Topten’s activewear line ‘Balance’ recorded sales of 100 billion KRW last year. Balance is Topten’s flagship line targeting consumers who enjoy active lifestyles such as yoga, running, hiking, health, and Pilates. Topten, which had been gradually introducing activewear products, officially entered the activewear market in 2021 by launching the ‘Balance’ line. That year, Topten earned 11.7 billion KRW in sales from Balance, and in just over two years, it achieved annual sales of 100 billion KRW, growing into a ‘mega brand’ level.

Thanks to its rapid growth, the sales proportion within Topten also increased. As of 2022, Balance accounted for about 9% of Topten’s sales, expanding to 11% last year. A Topten representative said, “Because we have factories that can produce products in-house as well as develop materials, we were able to offer competitively priced activewear. This year, we plan to add 20 more offline stores such as department stores and shopping malls, increasing the total to 60.”

Activewear refers to clothing that can be worn not only during exercise such as hiking and running but also in daily life. In the past, clothes were released in two categories: casual wear and athleisure, but the boundaries blurred after COVID-19.

Leading companies in the athleisure market, Andar and Jeximix, used to release products mainly focused on leggings and sportswear for tennis and golf, but they have expanded their product lines to activewear over the past few years. As they broadened their product range, both companies showed clear performance improvements and surpassed 200 billion KRW in sales last year. A fashion industry insider analyzed, “Even when looking at shoes, hiking shoes that can be worn daily are increasingly appearing. As sales centered on activewear grow, companies that used to make casual wear are adding functionality and releasing activewear.”

In fact, E-Land’s SPA brand SPAO launched activewear products earlier this year to test customer responses. Sales are currently limited to online malls and some stores. Since this is a testing phase before strategically concentrating resources, the product range including leggings, pants, and tops is not large. The company explained that the response from young customers has been positive, so they plan to continue additional testing.

Hansee Industry, an OEM and ODM company for apparel, is also aiming to enter the activewear market. Its main market is the United States, with production facilities located in nearby Guatemala. The goal is to achieve vertical integration by developing chemical fibers and fabrics as well. The products currently in production include ‘Kalia,’ a women’s activewear brand for Dick’s Sporting Goods, the largest sports goods retailer in the U.S. A Hansee Industry representative stated, “In January this year, we established a dedicated activewear team within the technical design department and plan to aggressively expand related businesses.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)