Russian Major Shareholder Claims "E1 Violates Shareholder Obligations"

"No Issues" Despite Legal Victory, Geopolitical Risks Remain High

Concerns Over Reduced Russian Energy Investments

Liquefied Petroleum Gas (LPG) supplier E1 was confirmed to have been sued last year in Russia with a petition to revoke its shareholder status. The lawsuit was filed by Salaudy Amerkhanov, the largest shareholder of the Russian company Vostok LPG, in which E1 has invested. There are concerns that this could become a negative factor for future investments by Korean companies in Russian energy.

According to industry sources and E1’s business reports on the 22nd, Amerkhanov, the largest shareholder of Vostok LPG, claimed that E1 violated shareholder obligations by not participating in the Vostok LPG founders’ meetings and by not signing the minutes of working meetings. He also stated that a plan to raise up to 20 billion rubles (about 300 billion KRW) from banks was canceled due to this. The same lawsuit was filed against other Korean shareholders of Vostok LPG, HL Holdings and Hyundai Chemical.

Earlier, in August 2021, E1 purchased an 8% stake in Vostok LPG for 400 million KRW. Although the amount was small, it was reportedly a decision made to seek local investment opportunities influenced by the government’s New Northern Policy at the time. Vostok LPG is the lead company for the LPG terminal project at Perevozhnaya Bay in Hassan, Primorsky Krai, a border area with China and North Korea. At that time, Primorsky Krai was attracting attention as a port that could become a logistics hub for Korea, China, and Russia.

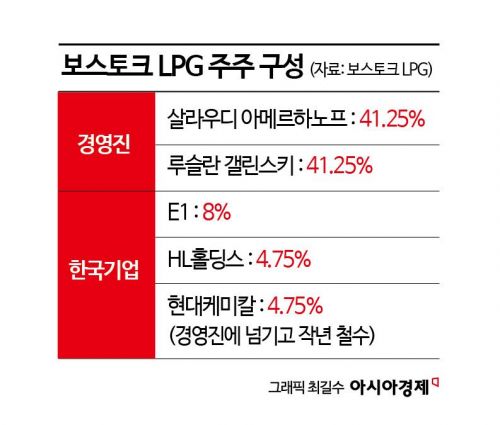

Looking at the shareholding structure of Vostok LPG, executives Amerkhanov and Ruslan Galinsky each hold 41.25% of the shares, while Korean companies E1 and HL Holdings hold 8% and 4.75%, respectively. Hyundai Chemical also held 4.75% but withdrew in June last year amid the shareholder expulsion lawsuit proceedings. Hyundai Chemical’s shares were transferred to the Vostok LPG management.

Vostok LPG received a building permit in September 2021 and, after completing terminal design and government engineering inspections, obtained project approval in January 2022. Vostok LPG planned to invest 4.5 billion rubles (about 66 billion KRW) in constructing an LPG terminal with an annual processing capacity of 1 million tons and infrastructure for LPG supply. However, the completion date was postponed several times.

The lawsuit ended in favor of the Korean companies. An E1 official said, "This year, the Russian court ruled in the shareholder expulsion lawsuit that ‘E1 has no issues.’ Initially, we missed a few meetings due to the distance between Korea and Russia, but after that, we continuously sent representatives." He added regarding the background of the lawsuit filed by the Russian side, "We are not sure whether it was an intention to have the LPG terminal business fully taken over by domestic companies or something else. Russian companies are well known for being difficult to understand."

Domestic company STX also invested 6 million USD (about 8 billion KRW) in 2018 in the Krasikino LPG tank terminal project in Primorsky Krai to expand its energy logistics business, and the terminal was completed in 2021.

Within the related industry, there is a pessimistic atmosphere as business with Russia involves high geopolitical risks and even minor issues lead to lawsuits.

An E1 official said, "It was a project we were exploring while looking for new investment destinations, and the political and economic situation in Russia at the time was different from now. There is no clear reason to dispose of the shares, and since the investment amount is small, we are monitoring the situation." As of the end of last year, E1 fully wrote off the 400 million KRW value of its stake in Vostok LPG as a loss.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.