First round selection of 9 asset management companies in May... Second round plan to select 4 asset management companies

Industrial Bank of Korea, Shinhan Asset Management, and Korea Growth Investment Corporation announced the Innovation Growth Fund contribution project on the 18th. The Innovation Growth Fund is a fund established over five years (2023?2027) with an annual scale of 3 trillion KRW, totaling 15 trillion KRW.

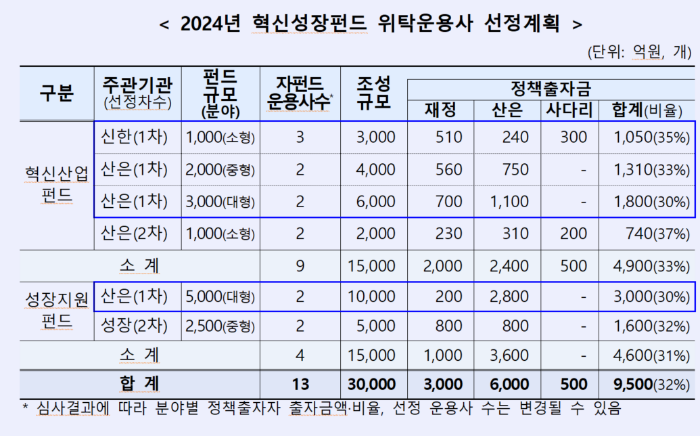

This year, the plan is to create a 3 trillion KRW fund by matching 0.95 trillion KRW of policy funds with 2.05 trillion KRW of private funds. Last year, the first-year project raised a total of 3.9 trillion KRW, exceeding the target (3.0 trillion KRW).

The Innovation Industry Fund is a fund that autonomously invests mainly in companies that meet the Innovation Growth Joint Standard items to foster national strategic industries such as global super-gap industries. In the second-year project, a separate sector was established to foster environmental and AI industries as national future strategic industries.

Additionally, the Growth Support Fund is a fund that invests in small and venture companies at the growth mid-to-late stages with high growth potential. It is expected to inject new vitality into scale-up investments in the domestic private investment market, where investments have been concentrated on early-stage venture companies.

Industrial Bank of Korea plans to select a total of nine entrusted asset managers in the first round in May. Proposal submissions will close on the 2nd of next month, and through a fair and prompt evaluation process by sector, asset managers will be selected by the end of May. Subsequently, four more entrusted asset managers will be selected in the second round consecutively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.