Shinhan Bank CEO and KB Financial Group Chairman Lead

JB Financial and BNK Financial Also Compete in Buying Back Shares

Kim Ki-hong, JB Chairman, Holds Most Shares Among 7 Major Financial Groups

Many Also Recorded Negative Returns

Undervalued Financial Stocks... Means to Increase Corporate Value

Aiming to Enhance Shareholder Value and Strengthen Responsible Management

To increase corporate value, financial holding company chairmen and bank presidents are actively purchasing their own company shares. The purpose is to boost stock prices and contribute to the government-led ‘Corporate Value-Up Program.’ They also emphasize enhancing shareholder value and strengthening responsible management.

Many financial holding company chairmen and bank presidents have been buying back shares this year. On the 17th, Shin Sang-hyuk, President of Shinhan Bank, purchased 5,000 shares of Shinhan Financial Group at 42,000 KRW per share on the market. The total purchase amount was 210 million KRW. His holdings of Shinhan Financial shares increased from 8,551 shares to 13,551 shares. Last month, Yang Jong-hee, Chairman of KB Financial Group, bought 5,000 treasury shares at 77,000 KRW per share. Including the employee stock ownership association member accounts, Yang’s treasury shares totaled 5,914 shares.

Regional financial holding companies have also joined in. Earlier this month, Kim Ki-hong, Chairman of JB Financial Group, purchased 20,000 treasury shares at 12,577 KRW per share. Seven JB Financial executives additionally bought 25,708 shares. In February, Bin Dae-in, Chairman of BNK Financial Group, along with 68 executives, purchased about 210,000 treasury shares on the market. At that time, Chairman Bin bought 10,000 treasury shares.

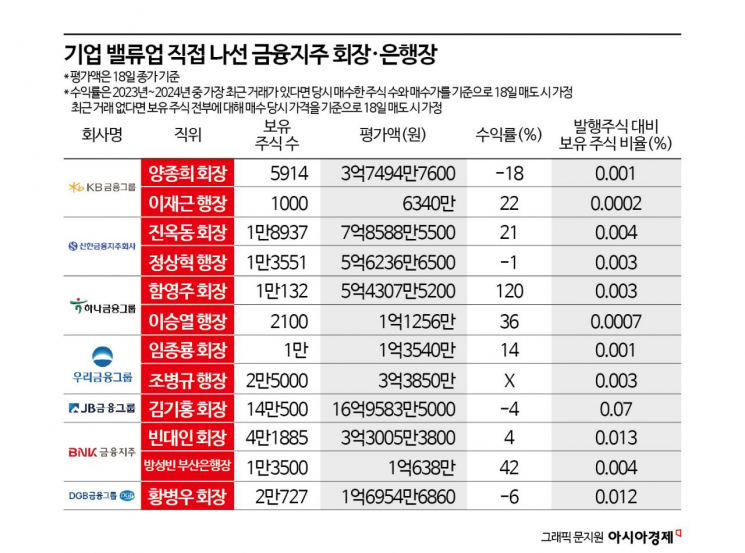

Among the seven financial holding companies (KB, Shinhan, Hana, Woori, BNK, DGB, JB), the person holding the most treasury shares is Chairman Kim Ki-hong. He holds 140,500 treasury shares, accounting for 0.07% of JB Financial’s issued shares. Based on the closing price on the 18th, the stock valuation is 1,695,835,000 KRW, the highest among them. The person holding the fewest treasury shares is Lee Jae-geun, President of KB Kookmin Bank, who holds 1,000 shares with a stock valuation of 63.4 million KRW.

Since last year, six holding company chairmen and bank presidents (Yang Jong-hee, Chairman of KB Financial; Jin Ok-dong, Chairman of Shinhan Financial; Shin Sang-hyuk, President of Shinhan Bank; Lee Seung-yeol, President of Hana Bank; Bin Dae-in, Chairman of BNK Financial; Kim Ki-hong, Chairman of JB Financial) have purchased shares (excluding acquisitions due to new appointments). Among them, Yang Jong-hee (-18%), Kim Ki-hong (-4%), and Shin Sang-hyuk (-1%) recorded negative returns. The highest return was by Lee Seung-yeol, President of Hana Bank (36%). The person with the highest return based on current holdings is Ham Young-joo, Chairman of Hana Financial (120%). However, Chairman Ham has not purchased treasury shares since 2020.

The reason financial holding company chairmen and bank presidents buy treasury shares is part of efforts to increase corporate value. KB Financial Group explained Yang’s reason for purchasing treasury shares as follows: “Amid the government-led ‘Corporate Value-Up Program’ aimed at resolving the Korea discount, the head of the country’s largest financial group has expressed a firm commitment to enhancing shareholder value and responsible management.” The Corporate Value-Up Program includes government support such as tax benefits to address the undervaluation of Korean companies in the stock market. In particular, benefits such as corporate tax reductions are expected for treasury share cancellations or increases in shareholder dividends.

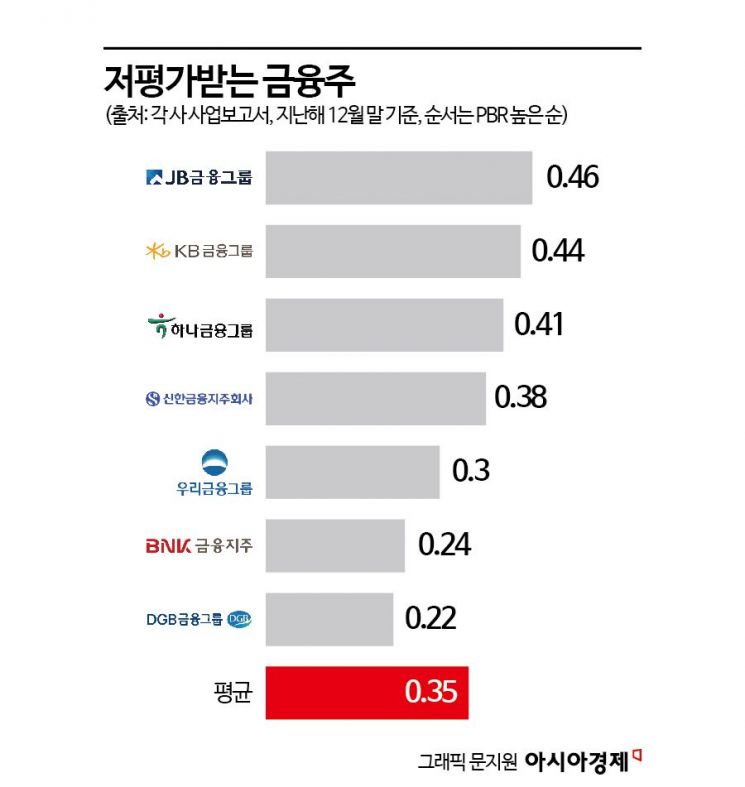

Among undervalued stocks, financial stocks are representative low PBR (Price-to-Book Ratio) stocks. PBR is the market capitalization divided by capital (net assets), indicating how many times a company’s net assets are traded per share. A value below 1 means the company is undervalued in the stock market to the extent that its market value does not reach its net assets. Looking at the PBR of the seven major financial holding companies, the average is 0.35 times. Basically, all financial stocks are undervalued. Among them, the most undervalued financial stock is DGB Financial (0.22 times), while the highest valued stock is JB Financial (0.46 times).

By purchasing treasury shares, companies aim to enhance shareholder value and demonstrate responsible management. Buying a large volume of treasury shares reduces the number of shares circulating in the market. This increases earnings per share, which in turn raises dividends per share, resulting in greater shareholder returns. JB Financial Group commented on Chairman Kim Ki-hong and the executives’ treasury share purchases, saying, “We will do our best to further strengthen responsible management and continuously increase shareholder value.” Shinhan Bank also stated, “We decided to purchase treasury shares to enhance responsible management and shareholder value.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.