LiDAR Technology Developer Undergoing KOSDAQ Listing Process

Average Annual Growth Rate of 62.8% from 2020 to 2023

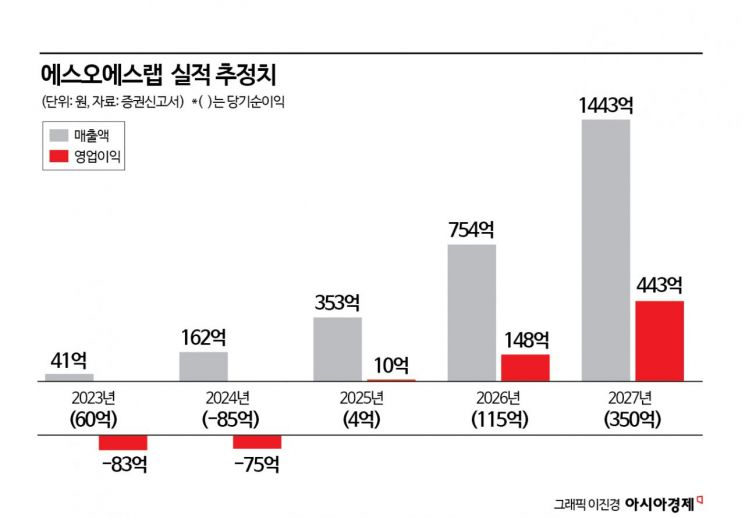

Projected Revenue of 144.3 Billion KRW by 2027

LiDAR development company SOS Lab is raising funds for research and development (R&D) and facilities through an initial public offering (IPO), but there are concerns that the future performance projections presented to estimate the appropriate corporate value are excessive. This comes as more investors have become meticulous in scrutinizing performance forecasts following the Pado incident.

According to the Financial Supervisory Service's electronic disclosure system on the 19th, SOS Lab will issue 2 million new shares to raise 15 billion KRW. The expected public offering price range is 7,500 to 9,000 KRW, and demand forecasting for institutional investors will be conducted from the 30th of this month to the 8th of next month, after which the public offering price will be finalized.

Jung Ji-sung, CEO of SOS Lab, confirmed the importance of LiDAR technology while participating in the "Korean Public Technology-Based Market-Linked Startup Exploration Support Program (I-Corps)" jointly conducted by Gwangju Institute of Science and Technology (GIST) and George Washington University. He founded SOS Lab with three researchers from GIST who were conducting research together. SOS Lab is a LiDAR (Light Detection and Ranging) technology development company engaged in LiDAR products and data solution businesses utilizing LiDAR. LiDAR is a sensor that uses lasers to measure distance or detect obstacles. It can be applied not only to autonomous vehicles and robots but also to industrial safety and security monitoring, defense, and aerospace sectors.

In 2022, SOS Lab developed a 3D fixed-type LiDAR product (ML) used in autonomous mobility such as vehicles and robots. The 3D fixed-type LiDAR ML is evaluated as overcoming the biggest weaknesses of LiDAR product commercialization, namely price and size. It improved accuracy and stability based on artificial intelligence (AI) technology. Since SOS Lab designs the LiDAR components directly, it has excellent price competitiveness. The company received the CES Innovation Award, the world's largest IT and electronics exhibition, in 2021 and 2022. It also holds 88 registered patents related to LiDAR technology, the most in South Korea.

Recognized for its technological prowess, the company's sales scale has rapidly increased. Sales, which were only 950 million KRW in 2020, grew to 4.1 billion KRW last year, recording an average annual growth rate of 62.8%.

The lead underwriter, Korea Investment & Securities, selected four listed companies?I3 Systems, Cowintech, Tobis, and Purentier?as comparable companies to estimate SOS Lab's appropriate corporate value. An average price-to-earnings ratio (PER) of 23.49 times was applied. However, estimated net profits for SOS Lab in 2026 and 2027 were used. It was judged that sales would increase as autonomous vehicles equipped with LiDAR enter full-scale mass production starting in 2026.

SOS Lab's sales estimates are 16.2 billion KRW this year and 35.3 billion KRW next year. It expects to achieve 75.4 billion KRW and 144.3 billion KRW in 2026 and 2027, respectively. This is a significant difference from last year's sales of 4.1 billion KRW. Operating profit is expected to turn positive from next year. It is projected to record 14.8 billion KRW and 44.3 billion KRW in 2026 and 2027, respectively.

Some in the financial investment industry point out that although the autonomous driving sector is a high-growth industry, the pace of sales increase is too rapid. This reflects a learning effect from the Pado incident, where discrepancies between forecasts and actual performance occurred. If institutional investors participating in demand forecasting do not understand the performance projections, it could become a source of uncertainty in finalizing the public offering price.

SOS Lab expects the growth rate to accelerate based on the funds raised through the IPO. It explained that starting this year, it will officially begin supplying products for robots and automotive applications, as well as data solutions for industrial safety and smart city infrastructure. The speed of developing new products and data solutions currently underway is also expected to increase. Since LiDAR is being introduced in various fields requiring object recognition, there is potential for LiDAR demand to grow faster than expected.

CEO Jung of SOS Lab said, "SOS Lab is a company with technology capable of competing with global LiDAR companies," adding, "There is also significant business expansion potential for growth in robots, automotive, industrial safety, and smart cities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)