Royal Canin Korea, Operating Profit of 40 Billion KRW

Harim Pet Food, 25% Sales Increase Last Year

As the number of households raising pets increases and pet-rearing culture develops, the performance of pet food companies is also rising accordingly.

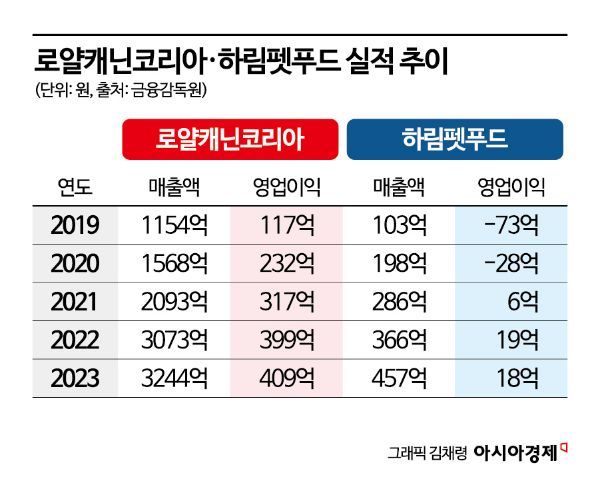

According to the Financial Supervisory Service's electronic disclosure system on the 19th, the global pet food company Royal Canin Korea, headquartered in France, recorded sales of 324.4 billion KRW last year, a 5.6% increase from 307.3 billion KRW the previous year. Sales, which were 115.4 billion KRW in 2019, steadily increased to 209.3 billion KRW in 2021 and 307.3 billion KRW in 2022 amid the COVID-19 pandemic, nearly tripling over the past four years through last year. It is not just the size that has grown. Operating profit, which was 11.7 billion KRW in 2019, also increased by 250% to 40.9 billion KRW last year.

Among domestic companies, Harim Pet Food's growth stood out after entering the market in 2017 with human-grade pet food brands such as ‘The Real’ and ‘Bapiboyak’. According to the audit report of Harim Pet Food, a subsidiary of Cheil Feed owned 88.11% by Harim Holdings, Harim Pet Food's sales last year reached 45.7 billion KRW, a 24.9% increase compared to 36.6 billion KRW the previous year. Starting with sales of 200 million KRW in its first year, Harim Pet Food surpassed 10 billion KRW in 2019 and gained momentum in growth, reaching the 40 billion KRW range last year. However, operating profit remained at a similar level of 1.8 billion KRW last year due to increases in raw material prices and advertising expenses.

As the domestic pet population increases and perceptions of pets change, the growth of pet food companies is becoming more distinct. According to the Korea Rural Economic Institute, the pet-related industry is identified as a high-growth industry growing at an average annual rate of 14.5%. The domestic pet-related industry, which was about 1.9 trillion KRW in 2015, rapidly expanded to approximately 4.6 trillion KRW last year and is expected to grow to about 6 trillion KRW by 2027.

Among pet-related industries, the pet food market holds the largest scale. The domestic pet food market is understood to be growing at about 10% annually. According to a survey by the Korea Agro-Fisheries & Food Trade Corporation, the domestic pet food market size grew from about 997.3 billion KRW in 2020 to 1.1803 trillion KRW last year, forming a market exceeding 1 trillion KRW.

There are various reasons for the growth of the pet industry, but a major cause is the increase in the number of households raising pets during the pandemic period when outdoor activities were restricted. According to the ‘2023 Korea Pet Report’ by KB Financial Group Management Research Institute, about 44% of respondents who recently adopted pets reported adopting them during the pandemic period.

Choi Jae-ho, a researcher at Hana Securities, said, “Considering that the average lifespan of pets is about 10 to 15 years, the future growth of related industries is obvious with the increased pet population,” and added, “As 'pet humanization,' which regards pets as family members, is highlighted, the future trend of the pet food market will steadily focus on customized and premium products.” Meanwhile, as of the end of 2022, households raising pets such as dogs and cats numbered 5.52 million, accounting for 25.7% of all households.

Since pet food such as feed and snacks is the biggest concern and largest expenditure item for the increased number of pet households, the number of companies entering related businesses is also increasing. Daesang Group established Daesang Pet Life corporation in February last year, incorporated it as a subsidiary of Daesang Holdings, and entered the pet food market by launching a new brand ‘Dr. Neuto’ in July. Pulmuone is also strengthening its competitiveness by launching functional new products under its pet food specialized brand ‘Pulmuone Amio.’

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.