Rising Support for Abolishing Financial Investment Tax... Difficult to Realize

Need to Understand Industry Supply-Demand Characteristics Ahead of Next Year's Introduction

"Bonds Will Be Considered for Change After Portfolio Analysis"

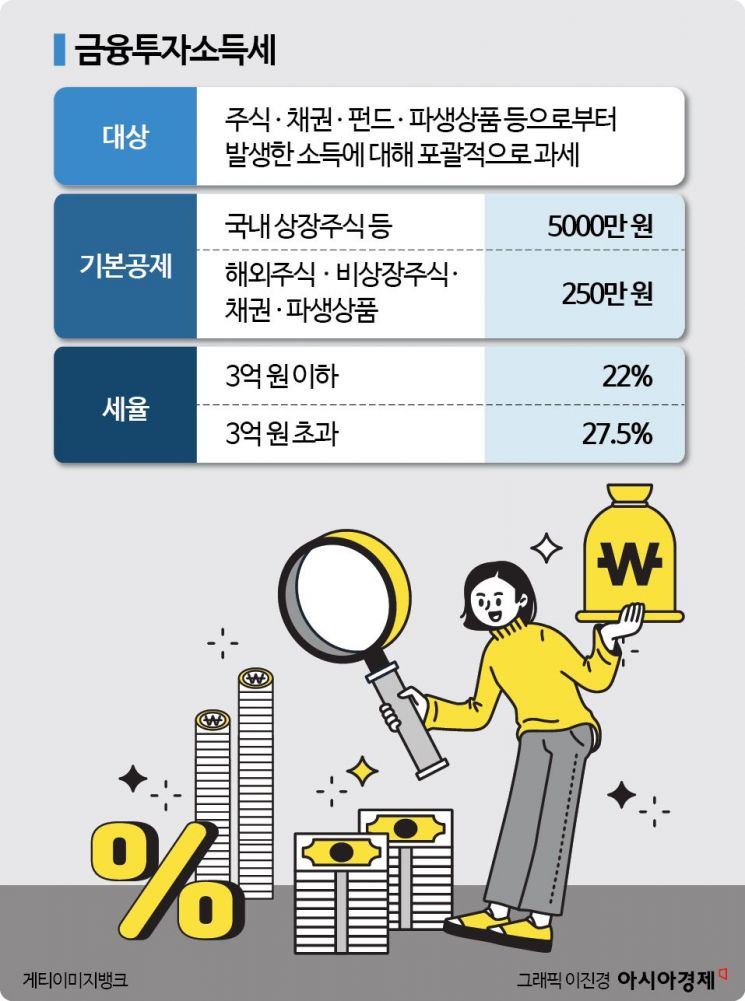

As the possibility increases that the Financial Investment Income Tax (금투세), which the current government is pushing to abolish to revitalize the capital market, will be implemented from 2025, concerns among individual investors are growing. The securities industry advises that rather than overinterpreting the shock the 금투세 introduction might have on the stock market, it is important to understand the characteristics of the individual assets affected and respond to market changes accordingly.

Volatility May Increase with 금투세 Introduction... Focus on Fundamental Investment Rather Than Excessive Worry

According to a National Assembly public petition on the 19th, the petition titled "Request for Abolition of the Financial Investment Income Tax, also known as 금투세" has surpassed 50,000 signatures. This petition, posted on the 9th, argues that 금투세 harms the capital raising function, causes stock price declines, and leads to the withdrawal of individual investors from the domestic capital market, and therefore should be abolished. The petition was referred to the National Assembly's Political Affairs Committee after receiving 50,000 signatures within 30 days of its publication. If it passes the committee review and the plenary session's deliberation and resolution, measures will be taken by the National Assembly or the government.

The Yoon Seok-yeol administration, which is actively promoting the abolition of 금투세, and the People Power Party, which included this tax abolition as a tax policy pledge in the last general election, are expected to include the abolition in the tax law revision bill this July, but its passage is uncertain. Originally, 금투세 was passed as a bill through bipartisan agreement during the Moon Jae-in administration in 2020 and its implementation was postponed until 2025. The government and ruling party have submitted amendments to the Income Tax Act and the Restriction of Special Taxation Act to abolish 금투세, but these bills are still pending. If the 21st National Assembly ends and the bills are discarded, it will be difficult to expect the abolition bills to pass in the 22nd National Assembly, where the opposition holds the majority.

Some voices express concern that unlike in the past, individuals now have a significantly greater influence on the financial market, raising worries about volatility caused by individuals offloading assets to avoid tax when 금투세 is implemented. In fact, participation of individual investors in the domestic stock market continues to increase. According to the financial investment industry, the number of individuals investing in domestic stocks has surged about fourfold to 15 million over the past five years.

In the securities industry, rather than excessive concern about the negative impact of 금투세 introduction, it is analyzed that strategies should be developed by company and sector. Lee Jae-seon, a researcher at Hyundai Motor Securities, noted, "Since the decision to postpone 금투세 on December 25, 2022, sectors such as steel, energy, and media, where individual demand was concentrated, have shown relatively poor returns compared to other sectors," adding, "The investment gains in sectors where individual buying was concentrated are not relatively high." He continued, "However, for companies where individual influence is significant, it is necessary to be somewhat cautious about year-end volatility if 금투세 is confirmed," mentioning, "In the case of KOSDAQ, individuals are the largest demand participants, and among the secondary battery group stocks, the POSCO group shows strong individual net buying." He added, "But ultimately, the macro environment and corporate earnings are what matter most for the overall market direction."

The opposition party is currently promoting financial product investment incentives for individual investors in parallel with opposing the introduction of 금투세, such as expanding tax exemption for Individual Savings Accounts (ISA) and incorporating virtual asset-related linked products into the regulatory framework. Kim Young-hwan, a researcher at NH Investment & Securities, explained, "There are concerns about liquidity as individual investors try to avoid tax payments due to 금투세 implementation, but considering positive factors such as increased ISA benefits, the claim that individual demand will continuously withdraw is an excessive worry."

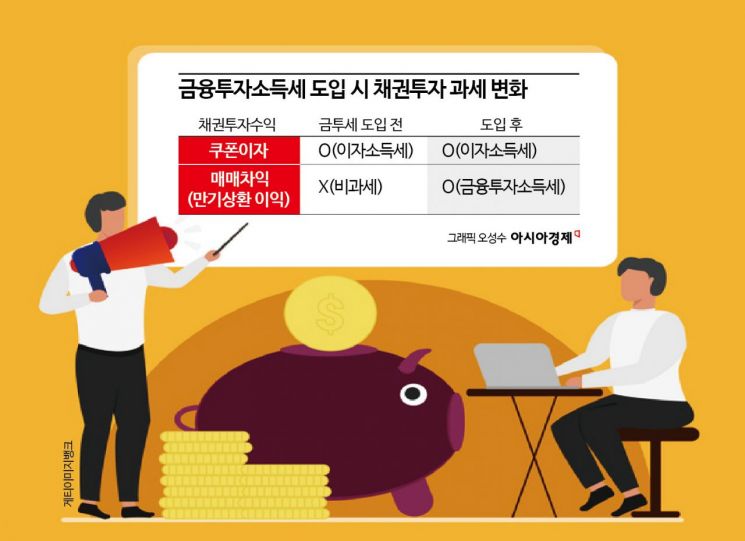

50 Trillion Won in Bonds Stir Individual Investors... Need to Consider Investment Direction

If 금투세 is introduced, capital gains on bonds will be taxed, which is expected to have a considerable impact on the bond market as well. According to the industry, the balance of individual investors' won-denominated bonds has surpassed 50 trillion won this year. This is nearly a fivefold increase over the past two years, driven by demand seeking capital gains amid expected interest rate cuts. However, if capital gains on bond price increases are taxed due to 금투세 implementation, the advantage of low-coupon long-term bonds, which are bought expecting capital gains, will disappear, affecting demand in the bond market. In fact, in 2022, when uncertainty about the postponement of 금투세 introduction existed, monthly purchases in the third quarter continued at around 3 trillion won but decreased to 2.5 trillion won in October, 2.4 trillion won in November, and 1.7 trillion won in December. As the year-end approached, individual bond demand weakened due to concerns about possible 금투세 implementation.

Accordingly, the securities industry suggests that if 금투세 is implemented, a change in bond investment strategy is necessary. Kim Myung-sil, a researcher at Hi Investment & Securities, said, "Recently, individual investors have been observed buying bonds such as card, capital, and corporate bonds with maturities within two years and yields around 3.4% to 5.6%," adding, "It is necessary to reorganize the bond portfolio by adding products other than low-coupon long-term government bonds." He continued, "There is no investment asset that is forever safe," and added, "Financial institutions' hybrid capital securities, which have low default risk but long duration to secure interest rate benefits, or ultra-short-term credit bonds that carry risk but offer high interest in a short period, can be considered as alternatives."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)