Lotte Hotel Europe Secures 125 Million Euro Foreign Currency Loan

Poor Performance Despite Consecutive Debt Guarantees

Increased Foreign Currency Funding Burden Due to Exchange Rate Rise

Hotel Lotte continues to provide financial support, both directly and indirectly, to Lotte Construction, as well as ongoing financial assistance to overseas struggling affiliates. Although the group has made large-scale investments in overseas hotels and duty-free shops to expand its global business, it has been unable to reduce its financial burden due to continued poor performance caused by COVID-19 and the Ukraine war. Recently, the rising value of the euro against the Korean won and increasing interest rates have further increased the burden of foreign currency borrowings.

According to the investment banking (IB) industry on the 18th, Lotte Hotel Europe Holdings (LOTTE HOTEL HOLDINGS EUROPE B.V.) secured a foreign currency loan of 125 million euros (approximately 180 billion KRW) underwritten by KB Securities. The maturity is one year, with principal and interest due for repayment in April next year. KB Securities secured the loan funds by selling securitized notes backed by the loan receivables to institutional investors.

The parent company, Hotel Lotte, provided a capital replenishment agreement for this foreign currency loan. This is a credit facility contract in which Hotel Lotte agrees to provide the necessary funds for repayment if Lotte Hotel Europe struggles to repay the principal and interest properly. From the lender’s perspective, this means securing a guarantee from the relatively creditworthy parent company. Additionally, creditors entered into a foreign currency swap (CRS) contract with KB Securities as a hedge against exchange rate fluctuations. Lotte Hotel Europe plans to use the funds raised through this method to repay existing borrowings and cover operating expenses.

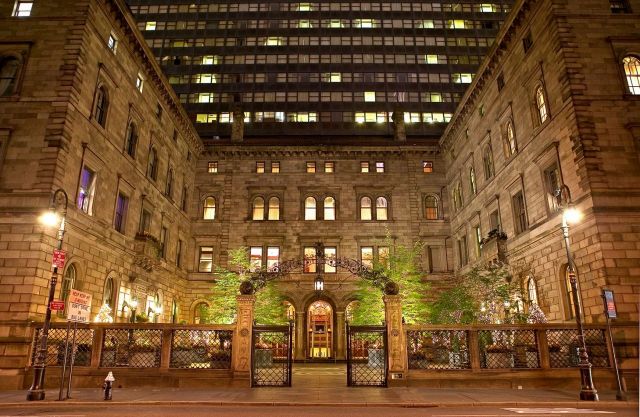

Lotte Hotel Europe is a European holding company wholly owned (100% stake) by Hotel Lotte. It was established in the Netherlands in 2008 to comprehensively manage Hotel Lotte’s businesses in Russia, including hotels, department stores, and confectionery, as well as European subsidiaries. Lotte Group affiliates such as Lotte Shopping, Lotte Confectionery, Lotte Chilsung Beverage, and Lotteria initially jointly invested, but during the launch of Lotte Holdings, all shares were acquired by Hotel Lotte to restructure governance and improve management efficiency.

Although created as part of Lotte Group’s global expansion policy, the company has experienced continuous poor performance since its establishment. The business deteriorated due to COVID-19, leading to poor results. After navigating the pandemic, the outbreak of the Ukraine war prevented the company from escaping a net loss position. It recorded net losses of 7.2 billion KRW in 2022 and 19.7 billion KRW last year.

Poor performance is also evident in many overseas subsidiaries invested in by Hotel Lotte. The U.S. subsidiaries, Lotte Hotel New York Palace and Lotte Hotel Seattle, posted net losses of 59.6 billion KRW and 15.5 billion KRW respectively last year. The Japanese resort company Lotte Hotel Arai and European investment firm Lotte Europe Investment also recorded losses of 12 billion KRW and 9.9 billion KRW respectively. Several duty-free business subsidiaries in Singapore and other locations reported deficits ranging from tens of billions to hundreds of billions of KRW.

The poor performance of overseas affiliates is also causing financial burdens for Hotel Lotte. Guarantee liabilities for funding overseas and domestic affiliates are increasing, and the company’s consolidated borrowings remain high. Consolidated borrowings stood at 8.8 trillion KRW last year, still considered an excessive borrowing scale. Recently, Hotel Lotte has also provided direct and indirect support such as capital increases, total return swaps (TRS), and debt guarantees to domestic affiliates like Lotte Construction, which has faced liquidity issues.

An IB industry official said, "Hotel Lotte has been unable to reduce its borrowing burden approaching 9 trillion KRW as it continues to provide financial support to overseas affiliates with poor performance in addition to funding construction companies last year." The official added, "Considering contingent liabilities such as guarantee obligations, Hotel Lotte’s actual financial burden is even heavier." The official also noted, "Recently, with increased exchange rate volatility, the foreign currency funding environment is worsening," and "the financial support burden for overseas affiliates seems to be increasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)