'Control the Exchange Rate'... Foreign Exchange Authorities Intensify Verbal Interventions

Short-Term Effects Expected, but High Exchange Rates Inevitable in the Long Run

On the 17th, the status board in the dealing room of Hana Bank's headquarters in Jung-gu, Seoul, displayed the KOSPI, KOSDAQ indices, and the KRW/USD exchange rate. On that day, the KOSPI opened at 619.15, up 9.52 points (0.36%) from the previous session, and the KOSDAQ index started at 839.3, rising 6.49 points (0.78%) from the previous trading day. The KRW/USD exchange rate began at 1,390.0 won, down 4.5 won from the previous day. Photo by Jo Yongjun jun21@

On the 17th, the status board in the dealing room of Hana Bank's headquarters in Jung-gu, Seoul, displayed the KOSPI, KOSDAQ indices, and the KRW/USD exchange rate. On that day, the KOSPI opened at 619.15, up 9.52 points (0.36%) from the previous session, and the KOSDAQ index started at 839.3, rising 6.49 points (0.78%) from the previous trading day. The KRW/USD exchange rate began at 1,390.0 won, down 4.5 won from the previous day. Photo by Jo Yongjun jun21@

As concerns over the Middle East war crisis escalate and vigilance against the strong dollar grows, the foreign exchange authorities are intensifying verbal interventions and making every effort to defend the exchange rate. There are also signs of swift fine-tuning measures. Although the foreign exchange authorities' actions have temporarily calmed the sharp rise in the exchange rate, if the strong dollar continues as a 'long-term battle' until the end of the year, the burden of defending the exchange rate is expected to be significant.

Choi Sang-mok, Deputy Prime Minister for Economy and Minister of Strategy and Finance, mentioned on the 17th (Korean time) in Washington D.C., USA, that appropriate measures could be taken in response to volatility in the foreign exchange market together with Suzuki Shunichi, Japan's Minister of Finance. This is the first time that the finance ministers of Korea and Japan have jointly made verbal interventions in the foreign exchange market, showing that both Korea and Japan are highly vigilant about the strong dollar.

Foreign Exchange Authorities Strengthen Verbal Interventions to Defend Exchange Rate

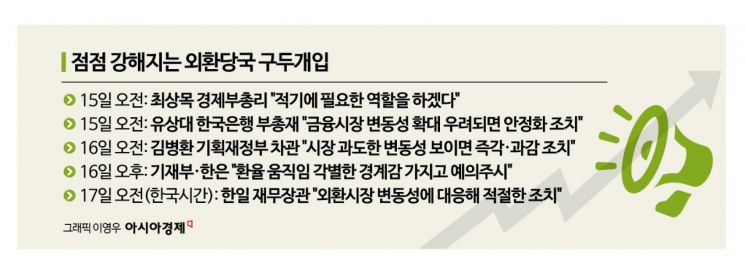

The foreign exchange authorities are employing a strategy of gradually increasing the intensity of verbal interventions. On the 15th, Deputy Prime Minister Choi hinted at the possibility of verbal intervention by stating, "We will take necessary measures in a timely manner." The very next day, Kim Byung-hwan, First Vice Minister of the Ministry of Strategy and Finance, raised the tone by saying, "If the market shows excessive volatility disconnected from our economic fundamentals, we will take immediate and bold action." Nevertheless, when the exchange rate breached the 1,400 won level during the day, the Ministry of Strategy and Finance and the Bank of Korea, through a director-level official, stated, "We are watching closely with special vigilance. Excessive concentration in the foreign exchange market is undesirable for our economy," and conducted verbal intervention for the first time in 1 year and 7 months.

The foreign exchange authorities expect such verbal interventions to suppress excessive strong dollar sentiment. This can block speculative demand and speculative psychology from further fueling the rise in the exchange rate. A foreign exchange authority official explained, "When the exchange rate rises due to global factors, speculative forces may emerge to ride on this trend," adding, "It is effective in giving a warning that the authorities may intervene at any time to those who try to push the exchange rate higher for short-term gains."

However, the consensus is that verbal intervention is not a fundamental solution. The market expects the timing of the U.S. interest rate cuts to be delayed more than anticipated due to high inflation and a strong economy in the U.S. Demand for the dollar as a safe haven is also increasing amid fears of escalation between Iran and Israel. If a war actually breaks out and risks increase, the resulting rise in oil prices could further delay the U.S. interest rate cuts due to inflationary pressures.

The atmosphere inside and outside the foreign exchange market regarding verbal intervention is also different from the past. The view is that it is less effective than before and only influences the market in the short term. Kim Sang-bong, a professor of economics at Hansung University, diagnosed, "Not only in Korea but also in other countries, verbal intervention is becoming less effective," adding, "There is a market sentiment that the foreign exchange authorities cannot intervene extensively because of concerns about being labeled as currency manipulators."

"Overuse Reduces Effectiveness"…What’s Next After Verbal Intervention and Fine-Tuning?

When the exchange rate soared in 2022, verbal intervention also failed to show significant effects. On August 23 of that year, when the exchange rate rose to the 1,340 won level, President Yoon Suk-yeol directly stated, "We will manage risks well through emergency economic meetings to ensure that the strong dollar and weak won currency situation does not negatively affect our market." The exchange rate briefly fell afterward but reversed to rise within half a day. Six days later, then First Vice Minister of Strategy and Finance Bang Ki-sun made a verbal intervention remark once, but the exchange rate still surpassed 1,350 won during the day, marking the highest level in over 13 years.

The foreign exchange authorities are also struggling with verbal intervention. If the government takes no action after verbal intervention or overuses it, the so-called "effectiveness" diminishes. Japan is a representative example. Recently, Japanese foreign exchange authorities have made strong verbal interventions whenever the yen falls, but have seen little effect. Yesterday, in the domestic foreign exchange market, there was a volume of dollar sales presumed to be fine-tuning following verbal intervention. This is interpreted as a move implying that the Korean foreign exchange authorities can actually lower the exchange rate.

It is uncertain whether institutional improvement measures for medium- to long-term exchange rate stabilization will be introduced as in 2022. At that time, the Ministry of Strategy and Finance and the Bank of Korea publicly announced a $10 billion foreign exchange swap deal with the National Pension Service. Measures such as supporting shipbuilders' forward foreign exchange sales and activating dividends from overseas subsidiaries of domestic companies were also announced one after another. Although these measures from that time have continued until now, the exchange rate has soared, leading to cautious assessments that verbal intervention and fine-tuning are virtually the only defense measures now.

The government remains tight-lipped about additional exchange rate defense measures. A Ministry of Strategy and Finance official said, "The scope of foreign exchange authorities' measures for exchange rate defense is broad and diverse," but added, "There are limits to disclosing them because explaining them could negatively affect the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.