2024 Shinhan Ordinary People Financial Life Report

A survey revealed that the average household assets surpassed 600 million KRW last year. On the other hand, the average debt balance declined for the first time since 2016. The debt holding rate is also the lowest in the past three years. It is analyzed that the impact of high interest rates and high inflation influenced both assets and debts.

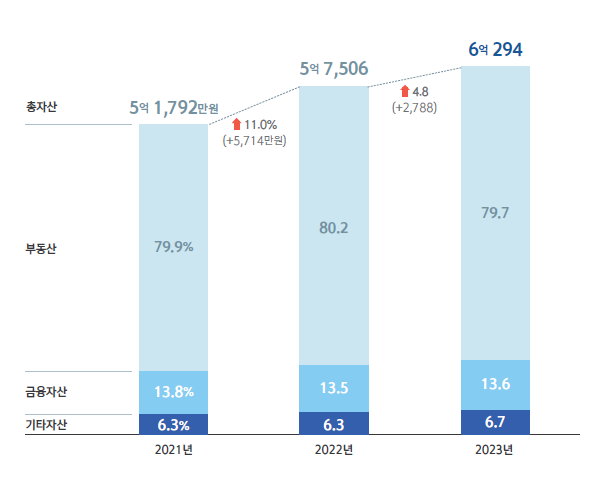

According to the ‘2024 Ordinary People’s Financial Life Report’ published by Shinhan Bank on the 17th, the average household assets, which had maintained the 500 million KRW range since 2021, exceeded 600 million KRW for the first time last year. However, the growth rate has slowed. In 2022, assets increased by 11% compared to 2021, but last year, the increase was 4.8% compared to the previous year (2022).

The average household assets by income bracket showed an increasing trend over two years. However, the scale of asset growth last year was only half of the previous year, slowing the pace of asset accumulation. As the asset growth rate moderated, the asset gap between income brackets 1 to 5 narrowed from 8.4 times in 2021 to 7.2 times last year. In this survey, household income brackets are divided into five groups. Bracket 1 includes households with income (after-tax net income) below 2.8 million KRW. Bracket 2 covers 2.8 million to 4 million KRW, bracket 3 is 4 million to 5.5 million KRW, bracket 4 is 5.5 million to 7.5 million KRW, and bracket 5 includes households earning over 7.5 million KRW.

The composition of assets remains similar to the past three years: real estate 79.7%, financial assets 13.6%, and other assets 6.7%. The real estate proportion changed slightly from 79.9% in 2021, 80.2% in 2022, to 79.7% last year. Shinhan Bank explained this as reflecting expectations that housing prices will decline and continue to fall for the time being.

The scale of real estate assets was 480.35 million KRW last year, an increase of 19.26 million KRW from the previous year. However, the growth rate weakened. While it rose 11.4% in 2022 compared to 2021, it increased by 4.2% last year. Real estate asset size also increased across income brackets, with higher-income households seeing larger increases. However, the amount of increase was less than half of that in 2022.

Financial assets have steadily increased since 2021, surpassing 80 million KRW last year. However, the capacity to save relative to income has declined over the past three years. Due to high interest rates and inflation, consumption spending and debt repayment have increased, reducing the capacity for saving and investing. Last year, under the high interest rate environment, stable financial assets such as savings deposits and subscription savings increased, while financial assets in aggressive investment products decreased.

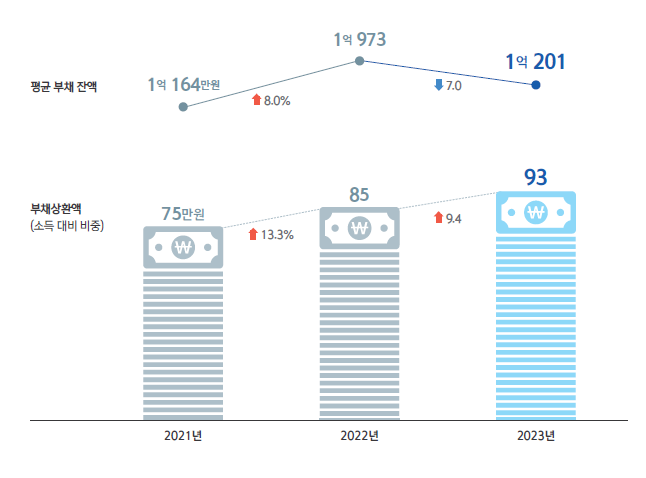

The average debt balance of households holding debt, which had continuously increased since 2016, decreased for the first time last year, returning to the 2021 level. The debt balance rose 8% from 101.64 million KRW in 2021 to 109.73 million KRW in 2022 but fell 7% to 102.01 million KRW last year. However, the average debt balance increased for households in brackets 1 and 2, while it decreased for other brackets. Debt repayment amount rose by 80,000 KRW to 930,000 KRW, reflecting the high interest rate environment to some extent.

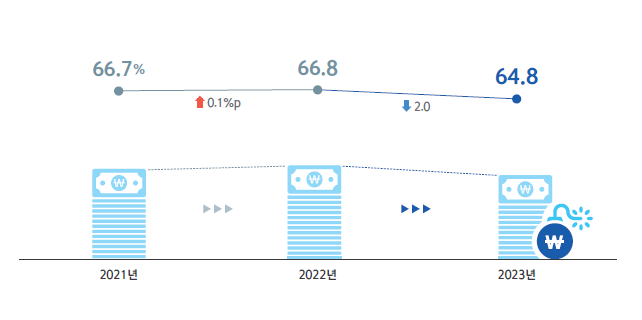

Last year, 64.8% of economically active households held debt. The debt holding rate, which had maintained the mid-60% range until the previous year, dropped by 2 percentage points. This also appears to reflect minimizing debt holdings due to high interest rates. However, when looking at debt holding rates by household income bracket, only bracket 1 showed an increase in debt holding rate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)