2024 Shinhan Ordinary People Financial Life Report

Half of people in their 20s and 30s believe that this year’s housing prices have formed a 'peak.' Additionally, among those in their 20s and 30s who intend to purchase real estate, the majority hope to buy after two years.

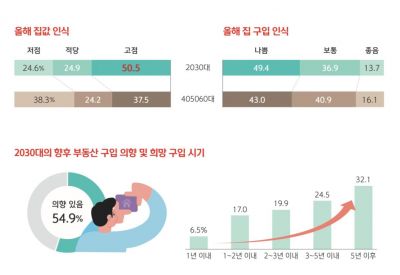

According to the '2024 Shinhan Ordinary People Financial Life Report' released by Shinhan Bank on the 16th, 50.5% of respondents in their 20s and 30s judged that housing prices are at a peak this year. Responses indicating a low point accounted for 24.6%, and those saying prices were appropriate made up 24.9%, both falling short of the peak perception.

In a survey regarding perceptions of home purchases this year, 49.4% answered 'bad,' while 'average' and 'good' responses were 36.9% and 13.7%, respectively. This contrasts with the perceptions of the older generations in their 40s, 50s, and 60s. Among those aged 40 to 60, only 37.5% believed this year was the peak for housing prices, 24.2% thought prices were appropriate, and a relatively higher 38.3% perceived it as a low point.

Among respondents in their 20s and 30s, 54.9% expressed an intention to purchase real estate in the future. The most frequently chosen desired purchase timing was after 5 years (32.1%), followed by within 3 to 5 years (24.5%), within 2 to 3 years (19.9%), within 1 to 2 years (17.0%), and within 1 year (6.5%). For those planning to buy real estate within the next two years, 71.7% intended to live in the property themselves, followed by investment purposes such as real estate value appreciation (24.7%), gifting or inheritance (2.1%), and business needs (1.3%).

The homeownership rate among people in their 20s and 30s who purchased within the last three years was 9%. Of these, 58.0% reported an increase in the value of their residence, 27.0% reported a decrease, and 15.0% said the value remained the same. The proportion of first-time homeowners was 92% for those in their 20s and 80% for those in their 30s, indicating that most of the 20s and 30s who bought homes in the past three years were purchasing their first home.

Regarding the proportion of loans and (parental or other) support in the purchase costs of homeowners in their 20s and 30s, the largest group (30.2%) had between 70% and less than 90% of their costs covered by loans or support, followed by 50% to less than 70% (26.0%), 90% or more (18.2%), less than 20% (16.7%), and 20% to less than 50% (8.9%). Among them, 67.5% said their loan situation was 'burdensome.'

The average monthly total income of homeowners in their 20s and 30s was 5.79 million KRW, with debt repayment accounting for 22% (1.27 million KRW) of their income. Considering that the average monthly total income for all people in their 20s and 30s was 4.24 million KRW and the debt repayment ratio was 10% (420,000 KRW), this means they are spending 2.2 times more on debt repayment compared to their peers.

Among renters living in jeonse (key money deposit lease) or monthly rent, the impact of 'jeonse fraud' was evident. For renters in their 20s and 30s, the proportion living in jeonse decreased by 4 percentage points to 50.0%, while monthly rent increased by 4 percentage points to 50.0%. In contrast, among those aged 40 to 60, jeonse increased by 0.7 percentage points to 56.4%, and monthly rent decreased by 0.7 percentage points to 43.6%, showing a difference.

A similar trend appeared in the housing types of jeonse renters. Among 20s and 30s jeonse renters, the proportion living in apartments increased by 6.2 percentage points to 50.9%, while the proportion living in villas or multi-family houses decreased by 5.5 percentage points to 28.0%. Conversely, for those aged 40 to 60, the apartment proportion decreased by 1.0 percentage point to 66.8%, and the villa/multi-family proportion increased by 0.6 percentage points to 21.5%.

In a survey of monthly rent tenants, 73.9% said they would 'maintain monthly rent' upon contract expiration. There were generational differences in reasons for maintaining monthly rent. Among people in their 20s and 30s, the highest reason was 'concern about jeonse fraud' at 30.2%, whereas for those aged 40 to 60, the most common reason was 'expensive jeonse deposit' at 41.4%.

Shinhan Bank stated, "Among respondents who said they would maintain monthly rent, those aged 40 and above cited expensive jeonse deposits as the reason, but people in their 20s and 30s were most concerned about jeonse fraud." They added, "This shows that the younger generation, who are relatively inexperienced with real estate systems and have been concentrated victims of jeonse fraud, are increasingly avoiding jeonse."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.