2024 Shinhan Report on Financial Life of Ordinary People

Due to the impact of inflation (rising prices), the proportion of 'basic living expenses' such as food, transportation, and housing accounted for 50% of total consumption. Additionally, about 70% of office workers were found to be trying to save on lunch costs in response to the increased prices.

According to the '2024 Shinhan Ordinary People Financial Life Report' released by Shinhan Bank on the 17th, the average monthly household total income in Korea last year was 5.44 million won, up 4.4% (230,000 won) from the previous year. Compared to 2021, it increased by 10.3% (510,000 won) over the past two years.

By household income bracket, the 1st bracket (bottom 20%) increased by 6.6% to 1.95 million won, and the 5th bracket (top 20%) rose by 4.3% to 10.85 million won. Accordingly, the asset gap between the 1st and 5th brackets showed a slight easing, with a ratio of 5.6 times compared to 5.7 times the previous year.

However, due to high prices, the growth rate of average monthly consumption exceeded the growth rate of average monthly total income. According to Shinhan Bank, the average monthly household consumption last year was 2.76 million won, an increase of 5.7% (150,000 won) from the previous year. The consumption-to-income ratio also rose by 0.6 percentage points to 50.7%. As spending increased, the proportion of savings and investments in income rose slightly by 0.1 percentage points to 19.3% (1.05 million won), while the proportion of reserve funds decreased by 0.6 percentage points to 20.1% (1.09 million won).

Looking at consumption items, the impact of high prices was clear. Among total consumption (2.76 million won), the share of food expenses increased by 1 percentage point to 23.2% (640,000 won), transportation and communication expenses decreased by 0.4 percentage points to 14.5% (400,000 won), and monthly rent, maintenance fees, and utility bills increased by 0.8 percentage points to 12.7% (350,000 won). The combined share of food, transportation, and housing expenses, classified as basic living costs, rose by 1.4 percentage points from the previous year to 50.4%.

Shinhan Bank stated, "Food expenses, which have the largest share of consumption, steadily increased and exceeded 600,000 won, and monthly rent, maintenance fees, and utility bills rose by 40,000 won, which is analyzed to be due to the sharp increase in electricity and gas charges. Allowance, which had been maintained at 130,000 to 140,000 won since 2021, also increased by 30,000 won to 170,000 won, which is attributed to the impact of high prices."

Looking at the average monthly consumption on food, clothing, and housing by household income, this high-price phenomenon appears to hit lower-income groups harder. For the 1st bracket, last year's consumption on food, clothing, and housing was 520,000 won, up 13.0% (60,000 won) from the previous year, the largest increase among all brackets. This was followed by the 2nd bracket (11.0%), 3rd bracket (10.0%), 4th bracket (8.1%), and 5th bracket (7.8%). Except for the 5th bracket (which increased by 20,000 won), all other brackets from 1 to 4 maintained clothing, fashion accessories, and beauty expenses at the previous year's level.

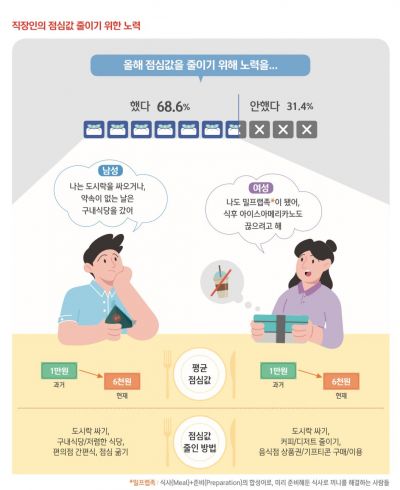

As such, rising prices are affecting the lives of ordinary people, and the movement of office workers trying to save even on lunch costs is spreading. In this survey, 68.6% of office worker respondents said they "made efforts to reduce lunch expenses." Among men, many used company cafeterias, convenience stores, or skipped meals, while women often cut back on coffee and desserts or used restaurant gift certificates or gifticons. Preparing lunch boxes was a common lunch-saving method cited by both men and women. Through these efforts, they succeeded in reducing their average lunch cost by 4,000 won to 6,000 won.

Meanwhile, as the high-price situation continues, households' economic outlook for the next year is also worsening. The proportion of respondents who answered that their household economy would "improve" within the next year increased slightly by 0.2 percentage points to 22.6%, those who answered "stay the same" decreased by 5.6 percentage points to 47.2%, while those who answered "worsen" rose by 5.3 percentage points to 30.2%.

The top reason for expecting worsened living conditions this year was economic recession and price increases, which rose by 4.3 percentage points from the previous year to 42.7%. This was followed by increased household spending and debt (26.0%), decreased total household income (22.8%), and decline in asset value (7.7%). Reasons for expecting improvement included increased total household income (53.3%), decreased household spending and debt (22.1%), asset value appreciation (14.0%), and economic recovery and price stabilization (8.6%).

Shinhan Bank explained, "Among respondents who expected their household economy to worsen, the proportion citing economic recession and price increases was high in the 1st, 2nd, and 6th brackets. This is because prices have risen sharply, and not only low-income groups but also high-income groups are feeling the difficult economic situation and expect this situation to continue next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.