Shinhan Investment Corp. Project Cost Loan

Increased Association Financial Burden Due to Contractor Replacement and 'Compensation'

Low Risk of Unsold Units...High 'Repayment Stability'

The ‘Shinbanpo 15th Reconstruction Association,’ which is facing a large-scale compensation payment after replacing the construction company from Daewoo Engineering & Construction to Samsung C&T, has increased its existing project financing (PF) loan from 150 billion KRW to 190 billion KRW. This is due to the increased financial burden caused by rising construction costs combined with compensation payments, just as completion and sales are imminent.

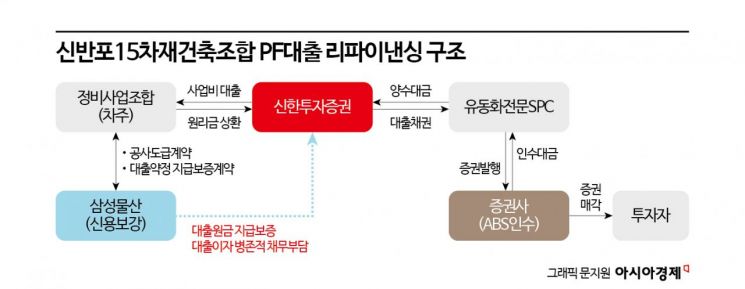

According to the investment banking (IB) industry on the 17th, the Shinbanpo 15th Reconstruction Association recently secured a PF loan of 190 billion KRW with Shinhan Investment Corp. as the lead underwriter. Shinhan Investment Corp. lent funds for construction costs and other expenses to the reconstruction association, then transferred the PF loan receivables to a special purpose company (SPC), which issued PF securitized bonds backed by these assets (a type of collateral).

The maturity of the PF loan is 6 months and 15 days, coming due in early November. The reconstruction association plans to repay the principal and interest of the loan using proceeds from general sales. Once the loan is repaid, the funds will be used to redeem the securitized bonds. Samsung C&T, the construction company, has provided a payment guarantee for this PF loan. This is a credit agreement whereby Samsung C&T will repay the loan on behalf of the association if the association faces difficulties in repaying the PF loan due to lack of funds or other reasons.

The Shinbanpo 15th Reconstruction Association is the implementing agency for the housing reconstruction project in Banpo-dong 12 area, Seocho-gu, Seoul. Samsung C&T is responsible for construction and is building the apartment complex ‘Raemian Onepentas’ (brand name) on the site where the old Shinbanpo 15th complex was demolished. The plan is to supply a total of 641 units across six apartment buildings ranging from 59 to 191 square meters, with heights from four basement levels to a maximum of 35 floors above ground.

Samsung C&T began construction in 2020 and is scheduled to complete it within the first half of this year. It is reported that general sales for 292 units, excluding those allocated to the association, will be conducted soon. The sales will proceed on a post-sale basis, with prices expected to be around 70 to 80 million KRW per pyeong (3.3 square meters), according to industry sources.

The Shinbanpo 15th Association plans to use the procured funds to repay the existing PF loan of 150 billion KRW obtained through KB Securities and to use the additional 40 billion KRW loan for extra construction costs and other expenses. With Samsung C&T expected to complete the apartment construction by June, the burden of costs for the reconstruction project has increased due to rising construction costs and market interest rates.

Compensation payments resulting from the change of the construction company are also cited as a factor increasing the association’s financial burden. The reconstruction association initially selected Daewoo Engineering & Construction as the contractor in 2018, but conflicts arose between the association and the contractor over design changes and increased construction costs, leading to the replacement of the contractor with Samsung C&T. Daewoo Engineering & Construction filed a lawsuit to confirm its status as the contractor, and the association ultimately lost the case after three trials.

Daewoo Engineering & Construction, recognizing that the project was nearing completion, is reportedly pursuing a damages lawsuit against the association instead of requesting the return of construction rights. The amount of damages is expected to reach several tens of billions of KRW, including unpaid loans, initial construction costs, and expected profits from project execution that the association failed to pay.

An IB industry official said, “Raemian Onepentas will begin move-ins in June, just over two months after sales, so the schedule for buyers’ final payments is quite tight,” adding, “If financial conditions are insufficient, potential buyers may hesitate to apply.” However, the official also noted, “Despite being post-sale, the project is located in the prime area of Gangnam, Seoul, and is subject to the price ceiling system, so the competition rate for subscriptions is expected to be high,” and predicted, “Considering the profitability of the reconstruction project, there should be no problem in repaying the PF loan.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)