Continued Commodity Rally Amid Global Political Uncertainty

Silver's Appeal Grows Alongside Gold Prices

Assess Global Manufacturing Conditions Before Investing

Recently, amid a rally in raw materials driven by geopolitical crises originating in the Middle East, investor interest in silver, which is currently in a relatively undervalued phase, is growing. Unlike gold, silver has the characteristics of an industrial metal, and securities experts predict that it can yield higher returns than gold during periods of global manufacturing expansion.

Investor interest in silver, which is in a relatively undervalued phase, is increasing. [Image source=Pixabay]

Investor interest in silver, which is in a relatively undervalued phase, is increasing. [Image source=Pixabay]

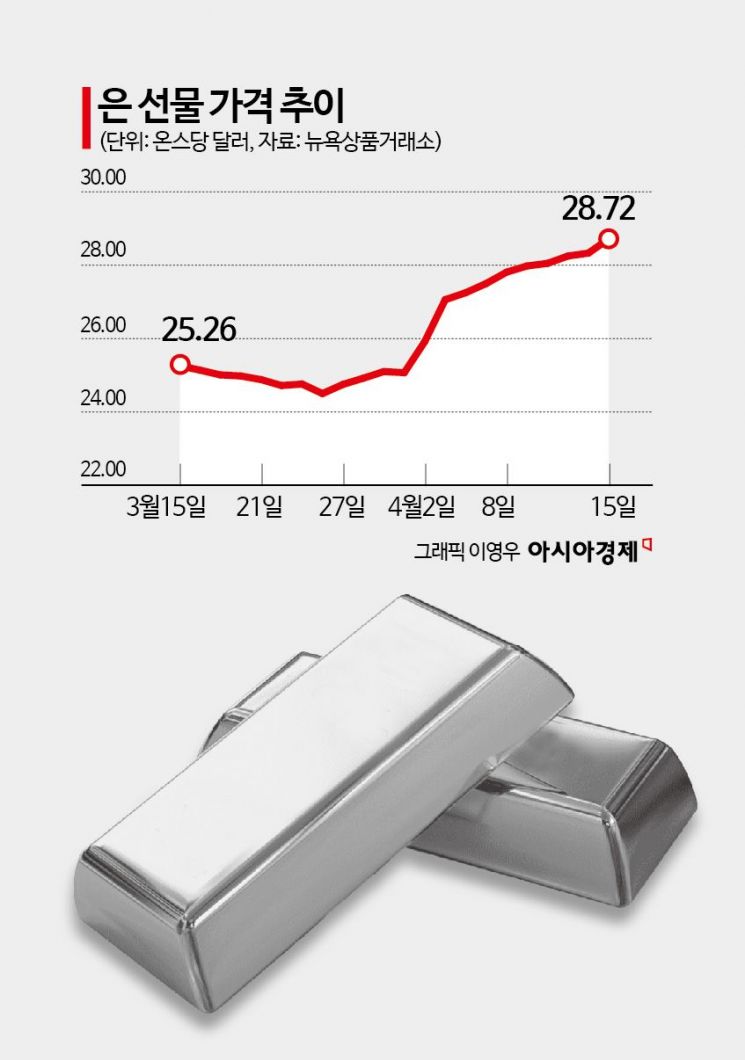

According to the Korea Exchange on the 17th, the KODEX Silver Futures (H) Exchange-Traded Fund (ETF), which tracks the price of silver futures listed on the New York Commodity Exchange (COMEX), has surged about 16% so far this year based on the previous day's closing price. In fact, the price of silver reached $29.90 intraday on the 12th (local time) at the New York Commodity Exchange, marking the highest level since February 2021. This is due to some investors turning their attention to silver, feeling burdened by the recent sharp rise in gold prices. It is expected that investors will continue to show interest in silver. Comparing the returns of gold and silver over the past month, silver has outperformed gold, and its price still falls short of the 2021 peak, leading to interpretations that it may be undervalued.

Silver typically exhibits larger rises and falls linked to gold, and is considered a leveraged product relative to gold. Looking at the long-term price trends of gold and silver, gold has shown resilience during downturns such as the 2008 global financial crisis and the 2020 COVID-19 shock, while silver experienced high volatility and sharp declines alongside other assets.

Accordingly, due to silver’s sensitivity to economic cycles, experts advise confirming the current economic phase before investing. Jaeyoung Oh, a researcher at KB Securities, said, "The gold-silver ratio, which is the exchange ratio between gold and silver, usually moves between 1:80 and 1:40. Especially after interest rate cuts, in the late stages of economic expansion, speculative funds raise silver’s value, significantly lowering the gold-silver ratio." He added, "Currently, since the risk of recession until 2025 cannot be ruled out, the gold-silver ratio is trading around 1:80, indicating that silver is relatively undervalued compared to gold." He further advised, "Investing in silver is an efficient strategy when the economic recovery phase is fully underway. It is effective to confirm the economic expansion phase after the U.S. Federal Reserve’s interest rate cuts before investing."

Meanwhile, there is also analysis suggesting that now is an opportune time to focus on silver investment, as signals indicate that manufacturing has already bottomed out. Jinyoung Choi, a researcher at Daishin Securities, pointed out, "The OECD Composite Leading Indicator, which precedes the global manufacturing economy, is signaling a recovery. The total number of policy rate cuts by central banks worldwide implies a manufacturing recovery, and China’s manufacturing sector, the largest consumer of industrial metals, is also attempting a rebound." He added, "Like gold, silver is an inflation hedge asset, but it also has high industrial demand for products such as solar power and electronic devices. Because of these characteristics, silver has historically outperformed gold during periods of manufacturing recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.