Bank of Korea Holds Base Interest Rate Steady at 3.50% Annually

10 Consecutive Holds Since February Last Year

Weakening Justification for Rate Cuts Amid Inflation Concerns, Tightening Policy Expected to Continue

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

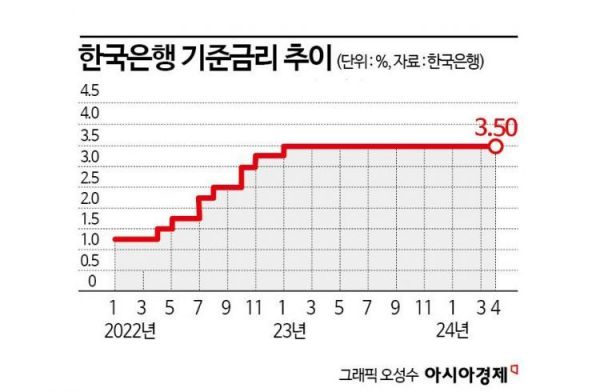

The Bank of Korea has kept the base interest rate steady at 3.50% for the tenth consecutive time. With persistent high inflation and the expected timing of the U.S. Federal Reserve's rate cuts being pushed back, the Bank of Korea's monetary tightening stance is expected to continue for the time being. Lee Chang-yong, Governor of the Bank of Korea, also stated that it is difficult to anticipate a rate cut in the second half of this year if inflation instability persists.

The Monetary Policy Board (MPB) of the Bank of Korea unanimously decided to hold the base interest rate at a meeting on the morning of the 12th at the Bank of Korea headquarters in Jung-gu, Seoul. The MPB has kept the rate unchanged for ten consecutive times since February last year.

The Case for a Rate Cut Weakens Amid Inflation Instability

The primary reason for holding the base rate steady is unstable inflation. South Korea's Consumer Price Index (CPI) inflation rate recorded 3.1% in February and again 3.1% in March, marking two consecutive months in the 3% range. This figure is well above the Bank of Korea's inflation stabilization target of 2%.

Since the beginning of this year, prices of apples, pears, and agricultural products have surged, pushing inflation higher. Last month, apple prices rose 88.2% year-on-year, the largest increase since statistics began in the 1980s. Prices of pears, tangerines, tomatoes, green onions, and other agricultural products also surged.

Moreover, escalating military conflicts in the Middle East have driven international oil prices up to the $90 per barrel range, further increasing inflationary pressures.

After the MPB meeting, Governor Lee said at a press briefing, "Among the six Monetary Policy Board members excluding myself, five expressed the view that maintaining the rate at 3.5% three months from now is appropriate." He added, "The remaining one member suggested keeping open the possibility of lowering the rate below 3.5%."

He explained, "The five members emphasized the need to continue the tightening stance until there is confidence that core inflation and consumer price inflation rates will converge to the target (2%)."

Regarding rates six months from now, he mentioned, "It is important whether the consumer price inflation rate can reach around 2.3% by the end of the year."

Governor Lee stated, "If oil prices stabilize again and the consumer price inflation rate is expected to reach about 2.3% by year-end, the possibility of a rate cut in the second half cannot be ruled out." He added, "On the other hand, if the inflation rate is higher than the path toward 2.3%, a rate cut in the second half may be difficult."

According to Governor Lee's remarks, the timing of South Korea's base rate cut may be pushed back further than expected.

Kang Sung-jin, Professor of Economics at Korea University, emphasized, "Both the U.S. and South Korea still have inflation rates exceeding 3%. If South Korea cuts rates preemptively before the U.S., inflation could rise again, and various issues such as exchange rates could arise, so holding rates steady to control inflation is the top priority."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

U.S. Also Postponing Rate Cuts, Making It Difficult for Us to Cut First

The delayed expected timing of the U.S. Federal Reserve's rate cuts is another factor making the Bank of Korea cautious about lowering rates. The U.S. March CPI inflation rate announced the previous day exceeded market expectations, causing the probability of the Fed holding rates steady in June to surge from the 40% range to the 80% range in the U.S. interest rate futures market.

The market is increasingly expecting the U.S. to cut rates in the third quarter rather than the second quarter. Kim Sun-tae, an economist at KB Kookmin Bank, predicted, "The Fed will lower rates only after confirming that core inflation in the U.S. is definitely declining. The timing of the cut will be in the third quarter."

It is also analyzed that the Bank of Korea is likely to cut rates only after confirming that the U.S. has lowered its base rate. The current U.S. base rate is 5.25?5.50%, which is 2.0 percentage points higher than South Korea's.

Kang In-soo, Professor of Economics at Sookmyung Women's University, said, "Since the U.S. CPI index is also high, the Fed is cautious about cutting rates, so it is not easy for the Bank of Korea to cut rates preemptively. Also, oil and other commodity prices are not falling as quickly as expected, so from an inflation control perspective, the current rate level should be maintained for the time being."

The domestic economy showing signs of improvement, centered on exports, is also a factor supporting the continuation of the base rate freeze. According to the Ministry of Trade, Industry and Energy, South Korea's exports last month amounted to $56.56 billion, marking six consecutive months of growth. In particular, semiconductor exports reached $11.7 billion, the largest scale in 21 months.

Financial imbalances such as still-high household debt and real estate concentration remain problematic. At the end of the fourth quarter last year, household credit (debt) balance reached a record high of 1,886.4 trillion won, an increase of 8 trillion won from the previous quarter. This was due to the continued rise in mortgage loans despite high interest rates. The household credit-to-nominal GDP ratio also reached 100.6% as of the end of last year.

Ahn Jae-kyun, an economist at Shinhan Investment Corp., said, "This year, with exports increasing mainly in semiconductors and industrial production recovering, the case for a rapid rate cut has weakened. The Bank of Korea is expected to cut the base rate around August or October to stimulate domestic demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.