SK Stoa Operating Profit of 100 Million KRW Last Year

SK Broadband Transmission Fees Surge to 42.7 Billion KRW

90% of Transmission Fee Increase Over 3 Years Attributed to Affiliates

Last year, among large conglomerate-affiliated data home shopping (T-commerce) companies, SK Stoa was the only one to experience poor profitability. Due to a significant decline in TV viewership, demand for home shopping dropped sharply, leading to a decrease in sales volume. Additionally, aggressive betting on transmission fees to dominate the home shopping market became a burden. Within the home shopping industry, there are complaints that SK Stoa, which has IPTV operator SK Broadband as an affiliate, raised transmission fees, thereby driving up fees across the entire industry.

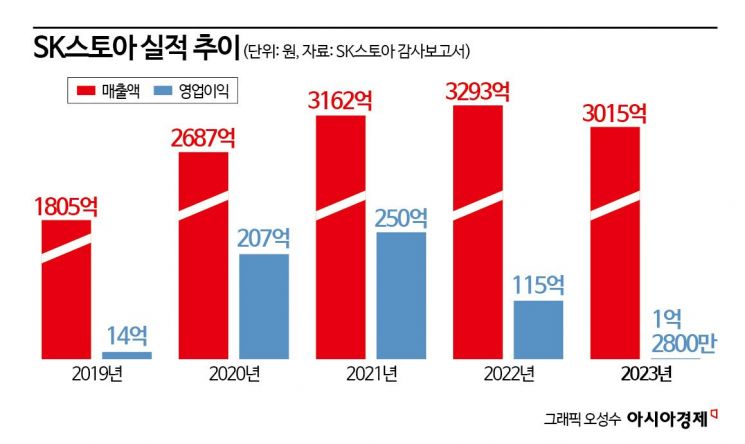

According to SK Stoa’s audit report on the 16th, the company’s operating profit last year was just over 100 million KRW, shrinking by 99% compared to the previous year (about 11.5 billion KRW). Operating revenue (sales) decreased by 8% (28 billion KRW), from 329.3 billion KRW to 301.5 billion KRW. The company also recorded a net loss of 1.4 billion KRW. Established in December 2017, SK Stoa posted operating losses in the following year (2018: -17 billion KRW; excluding 2017), then increased its profits annually. However, after a sharp drop in operating profit in 2022, profitability worsened to the brink of losses last year.

The main culprit behind SK Stoa’s deteriorating performance is transmission fees. These are channel usage fees paid by home shopping companies to paid broadcasting operators. SK Stoa spent 130.4 billion KRW (telecommunication equipment usage fees) last year, accounting for 43% of the company’s operating expenses (301.4 billion KRW). An SK Stoa official explained, "Home shopping transmission fees are the biggest reason for the reduced profits," adding, "Costs also increased due to rising labor expenses amid inflation."

Since 2019, SK Stoa has entered the transmission fee competition to capture the data home shopping market. The strategy involved paying higher channel usage fees to broadcasters to move to lower channel numbers, thereby boosting sales. As a result, the company spent around 10 billion KRW more annually on channel usage fees, with 111.8 billion KRW in 2021 and 121.8 billion KRW in 2022.

CEO Park Jung-min held his first town hall meeting since taking office last month at the headquarters building in Sangam-dong.

CEO Park Jung-min held his first town hall meeting since taking office last month at the headquarters building in Sangam-dong.

The transmission fees paid by SK Stoa to its affiliate SK Broadband have also increased annually. SK Stoa paid 26 billion KRW in transmission fees to SK Broadband in 2021, which rose to 42.7 billion KRW last year. Most of the increased transmission fees (90%) were concentrated on SK Broadband.

Because of this, the home shopping industry has expressed dissatisfaction, claiming that SK Stoa has driven up transmission fees across the entire home shopping sector. The transmission fee rate in the home shopping industry soared vertically from the 40% range in 2019 to the 60% range. An industry insider said, "At that time, data home shopping companies including SK Stoa moved to lower TV channel numbers, influencing the increase in industry-wide fee rates."

SK Stoa, the Only One Among the Big Three Conglomerates with Poor Performance

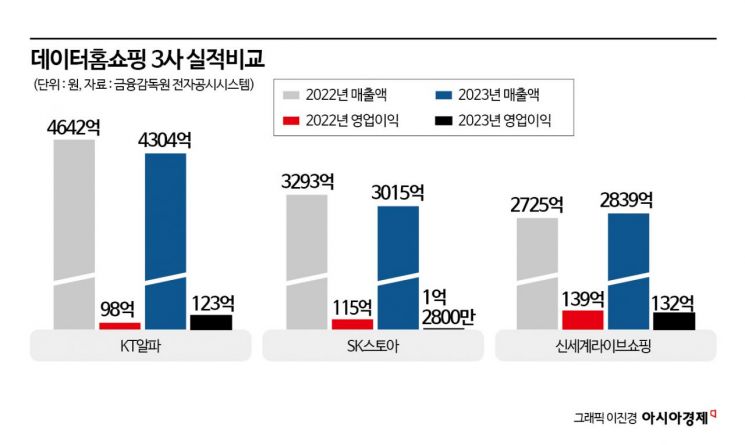

The company’s poor performance stands out even more when compared to data home shopping competitors affiliated with large conglomerates. Shinsegae Live Shopping recorded sales of 284 billion KRW last year, an increase of 10 billion KRW from the previous year. During the same period, operating profit decreased by only 5%, from 13.9 billion KRW to 13.1 billion KRW. Shinsegae Live Shopping continued its upward performance trend by strengthening its high-profit fashion segment.

In the case of KT Alpha Shopping, sales decreased by 7.26% to 430.4 billion KRW compared to the previous year, but operating profit increased from 9.8 billion KRW to 12.2 billion KRW. KT Alpha Shopping was able to defend profitability despite the home shopping market downturn by expanding its business into content media and mobile gift commerce.

SK Stoa’s worsening performance inevitably places a burden on its parent company, SK Telecom. SK Stoa was originally established as a subsidiary of SK Broadband and was incorporated as a 100% subsidiary of SK Telecom in 2019, with its results reflected in the media division’s performance.

Meanwhile, SK Stoa plans to strengthen personalized services using artificial intelligence (AI) this year. Park Jeong-min, CEO of SK Stoa, emphasized, "SK Stoa has strengths in analyzing and utilizing data," adding, "It is an important time to provide differentiated experiences amid fierce competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.