Luxury Market Growth Rate in Single Digits Amid Economic Recession

Used Goods Market Booms...Used Luxury Goods Companies' Performance Soars

The secondhand luxury market is showing rapid growth. While demand for new luxury goods has decreased due to the economic downturn, transactions have increased as luxury products are sold at lower prices in the secondhand market. As money flows into the secondhand luxury market, the performance of companies selling used products is also on the rise.

According to the Financial Supervisory Service's electronic disclosure on the 14th, the three major online luxury platforms?Mustit, Trenbe, and Ballan, collectively known as 'Meoteubal'?all recorded operating losses last year.

Trenbe and Ballan's sales last year dropped by more than 50% compared to the previous year. Trenbe's sales last year were 40.1 billion KRW, down 54.5%, and Ballan's sales were 39.2 billion KRW, down 56%.

Trenbe and Ballan posted operating losses of 3.2 billion KRW and 9.9 billion KRW, respectively. Mustit’s sales last year were 24.98 billion KRW, down 24.5%, with an operating loss of 7.8 billion KRW.

This poor performance is attributed to reduced luxury consumption amid the ongoing economic recession. During the COVID-19 period, there was even an "open run" phenomenon where people lined up from early morning to buy bags worth 10 million KRW. However, as the economy declined, demand for luxury purchases at department stores sharply decreased. Prolonged high inflation and high interest rates led consumers to tighten their wallets.

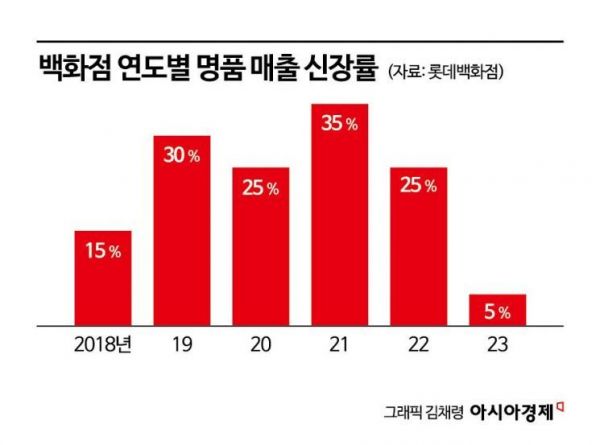

According to Lotte Department Store, the luxury market sales growth rate in 2023 fell to single digits due to reduced consumption. Since 2018, it had consistently recorded double-digit growth rates, reaching 25% in 2022, but dropped sharply to 5% last year.

However, luxury demand is shifting to the secondhand market. In Trenbe’s case, last year’s operating loss decreased by 17 billion KRW compared to the previous year (-20.8 billion KRW).

The background lies in the secondhand luxury business started as a new venture in 2022. Trenbe launched the secondhand luxury business as luxury purchases declined. Previously, it only sold parallel-imported luxury products to consumers, but it also began buying and consigning secondhand luxury goods, pricing and selling them. A Trenbe representative explained, “Secondhand products have an average price 50% lower than new products, reducing the purchase burden,” and added, “The perception has changed positively as secondhand luxury is approached not as vintage but as a re-sell concept or eco-friendly consumption.”

Another factor expanding the secondhand luxury market size is that secondhand luxury companies guarantee authenticity by distinguishing genuine from counterfeit products, unlike consumer-to-consumer transactions on platforms like Junggonara.

The secondhand luxury business structure earns a certain commission when selling, so it is difficult to generate large sales. However, with lower cost burdens, it is highly profitable for companies. Trenbe surpassed a cumulative transaction amount of 100 billion KRW early this year and expects to double last year’s transaction volume this year. The estimated cumulative transaction amount is around 200 billion KRW.

The luxury industry expects steady demand for secondhand luxury goods this year as well. Demand is expanding from high-demand bags and watches to clothing and jewelry products.

According to Gugus, an online and offline secondhand luxury company, clothing transaction volume (GMV) in the first quarter of this year rose 24% compared to the first quarter of last year, and jewelry increased by 38%. Gugus recorded 62.4 billion KRW in transaction volume in the first quarter, the highest quarterly transaction volume ever. A distribution industry official said, “Demand for secondhand luxury markets is increasing as people seek hard-to-obtain ultra-high-end luxury items like Hermes and Rolex,” and predicted, “As the entry barrier to luxury lowers, demand for secondhand luxury will continue to grow.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.