Current Liabilities Nearly Double in Two Years

S&P Downgrades Credit Rating to 'BB+'

Low Feasibility of Battery Business Restructuring

SK Innovation's debt due within one year has approached 30 trillion won. Although funds earned from the refining business were poured into large-scale investments in the battery business, the battery business itself is experiencing negative growth. SK Group is currently undergoing a business structure reorganization, and SK Innovation is considered the affiliate requiring the most urgent adjustment.

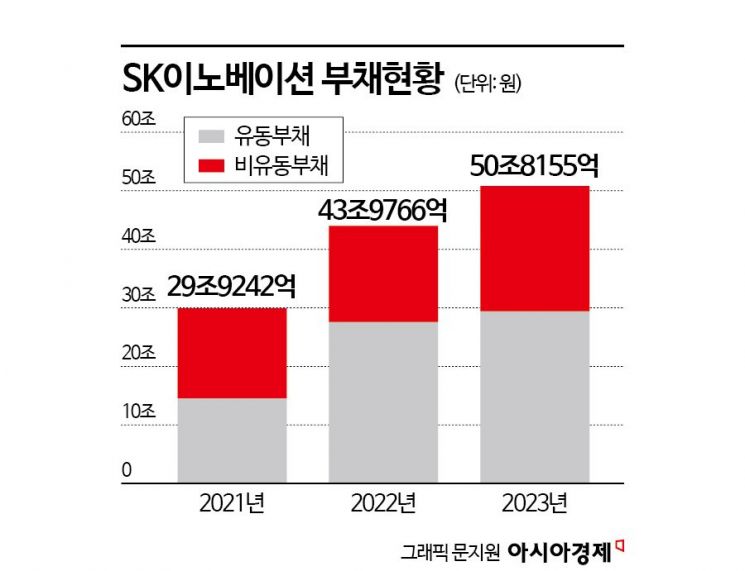

According to the electronic disclosure system on the 11th, SK Innovation's total consolidated debt stood at 50.8155 trillion won as of the end of last year, a 15.5% increase from 43.9766 trillion won the previous year. Among this, the scale of current liabilities, which are short-term debts, is rapidly increasing.

Current liabilities, which recorded 14.5124 trillion won in 2021, surged to 27.5572 trillion won in 2022 and 29.3991 trillion won last year, nearly doubling in two years. Non-current liabilities, such as bonds payable after one year, also increased from 15.4117 trillion won in 2021 and 16.4194 trillion won in 2022 to 21.4163 trillion won last year, a 30.4% rise.

The debt-to-equity ratio, which divides debt by equity capital, also rose from 117% in 2019 to 169% in 2023, increasing by 52 percentage points over four years. A high debt ratio makes it difficult to raise additional debt and worsens profitability due to excessive interest payments, increasing the risk of insolvency in the worst-case scenario.

External views on SK Innovation are also negative. Last month, international credit rating agency S&P Global downgraded the credit ratings of SK Innovation and SK Geocentric to speculative grade ‘BB+’ due to a slowdown in electric vehicle battery demand and the burden of large-scale facility investments.

S&P Global analyzed, "SK Innovation's borrowing burden may be larger and last longer than expected," adding, "Considering the slowdown in electric vehicle battery demand and this year's scale of facility investments, it seems difficult for the adjusted debt-to-EBITDA ratio to improve to below four times by the end of next year."

SK Innovation earned an operating profit of 4 trillion won in 2022 due to the COVID-19 endemic and the Russia-Ukraine war, but operating profit halved to 1.9038 trillion won last year due to falling oil prices and weak refining margins. In particular, the petroleum business recorded an operating loss in the fourth quarter of last year.

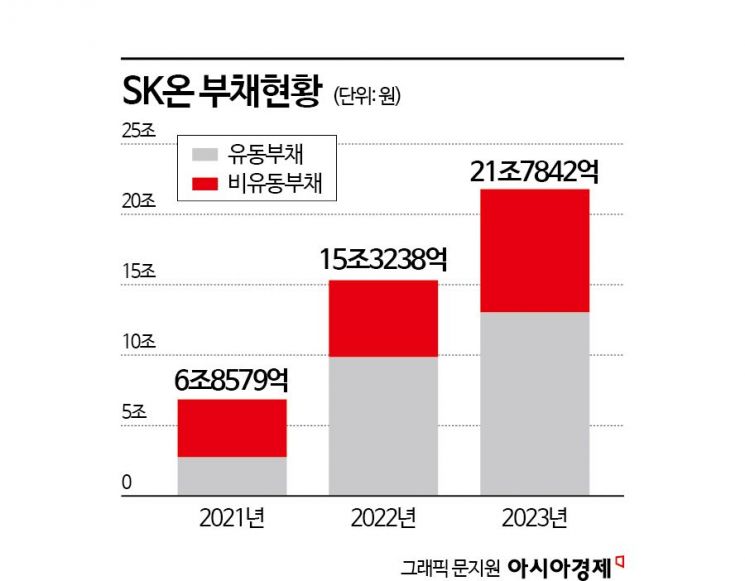

The rapidly increasing debt of subsidiary SK On, known as a ‘money-eating hippo,’ is considered the biggest burden for SK Innovation. SK On's total debt reached 21.7842 trillion won at the end of last year, a 42% increase from the previous year. However, during the same period, equity also increased, lowering the debt ratio from 258% in 2022 to 190%.

SK On's proactive investments in domestic and North American regions despite the electric vehicle ‘chasm’ (a temporary demand slump before mass adoption) also pose a burden from the parent company's perspective. The timing of performance improvement keeps getting delayed, and according to SNE Research's report on global electric vehicle battery market share for January and February this year, SK On was the only one among the three domestic battery companies to experience a decline in market share (-7.3%).

It is reported that the group is also contemplating solutions for SK Innovation. Currently, Boston Consulting Group has been commissioned for management consulting, but finding a solution is not easy.

There has been talk of merging SK On with SK Enmove, a ‘cash cow,’ to secure investment funds, but the feasibility is considered low. This is expected to be an obstacle to the merger as IMM Investment, a large private equity fund (PEF), holds 40% of SK Enmove's shares.

SK Group Chairman Chey Tae-won has been nurturing the so-called ‘BBC (Battery, Bio, Semiconductor)’ businesses as core growth engines, and his younger brother Chey Jae-won, SK Group Senior Vice Chairman, has been leading the battery business as SK On's CEO since 2021. SK Chairman Chey Chang-won is conducting the group's business restructuring work, so attention is focused on how SK Innovation will change as a result.

Securing mid- to long-term battery investment funds may become even more difficult. SK On plans to invest about 7.5 trillion won this year following 7 trillion won last year. Recently, SK On began modifying production lines at its factory in Georgia, USA, leading to forecasts of decreased production and shipment volumes this year.

Jeong Kyung-hee, a researcher at Kiwoom Securities, pointed out, "If shipment volumes decrease, battery profitability will further decline due to reductions in the Advanced Manufacturing Production Credit (AMPC) under the US Inflation Reduction Act (IRA)," adding, "This, along with the slowdown in electric vehicle sales growth, will delay profitability improvements."

An industry insider said, "Various business restructuring scenarios are being reviewed within SK Group, but it is understood that they do not view the business direction as wrong so far," adding, "The most important concern at this point is creating conditions to endure financial burdens and continue investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)