Zympenetra Listed in Major US PBM Formularies

Over 1 Trillion Increase from Last Year, Targeting 58% Growth

Uplima's Inclusion in Top 3 PBMs Is Key

Celltrion has set a sales target of 3.5 trillion KRW for this year, an increase of more than 1 trillion KRW compared to last year, leveraging its entry into the U.S. market. This is an aggressive goal representing a 58% growth over the previous year. The company plans to drive growth through the dual engines of the recently launched new drugs in the U.S., Jimpendra and Uplyma.

According to Celltrion on the 10th, the autoimmune disease treatment new drug Jimpendra was recently listed on the prescription formularies of one of the three major U.S. Pharmacy Benefit Managers (PBMs). Being listed on a PBM formulary means that insurers associated with the PBM guarantee reimbursement for prescriptions of the drug. If a drug is not listed on a PBM formulary, it is difficult for doctors to prescribe it to patients.

The main ingredient of Jimpendra, infliximab, has proven efficacy and safety for inflammatory bowel diseases such as ulcerative colitis and Crohn's disease. Existing drugs with this ingredient in the U.S. are only available as intravenous injections administered at hospitals or clinics. Given the difficulty of visiting medical institutions in the U.S., there has been strong market demand for a subcutaneous injection form that patients can self-administer. Jimpendra is currently the only infliximab subcutaneous injection developed.

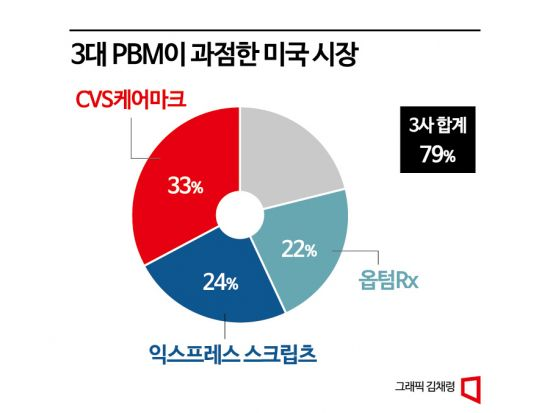

Leveraging this convenience of administration, Jimpendra was listed on the formularies of small and medium PBMs immediately upon its U.S. launch last month, and subsequently was listed on major PBMs as well. The three major PBMs (CVS Caremark, Express Scripts, OptumRx) dominate 80% of the U.S. prescription drug market, but the specific PBMs where Jimpendra is listed remain undisclosed at this time. Kim Hyung-ki, Vice Chairman of Celltrion, stated, "We expect to have Jimpendra listed on all three major PBMs within this year." Seo Jung-jin, Chairman of the Celltrion Group, has been residing in North America since early this year to directly lead local sales efforts.

On the other hand, Uplyma, an autoimmune disease biosimilar launched by Celltrion in the U.S. last year, is facing difficulties in getting listed on PBM formularies and is struggling to penetrate the market. As of February, Uplyma's market share in the U.S. was about 0.1%, while the original drug Humira holds a 96% share. Although Uplyma is listed on OptumRx among the three major PBMs, it has yet to be included in the formularies of the other major PBMs.

Celltrion is accelerating its efforts to capture the U.S. market for Uplyma this year. Negotiations are currently underway with the remaining two major PBMs for formulary listing. Vice Chairman Kim said, "Last year, as many Humira biosimilars were launched in the U.S., major PBMs demanded excessive rebates from pharmaceutical companies, but policy changes by PBMs are expected from the second half of this year." Kiwoom Securities analyst Heo Hye-min predicted, "As contracts between Humira and PBMs expire sequentially from mid-year, the likelihood of biosimilars like Uplyma being listed will increase."

Celltrion believes that if Jimpendra establishes itself early in the U.S. and Uplyma increases its market share, achieving the sales target of 3.5 trillion KRW this year is possible. Celltrion's sales last year were 2.1764 trillion KRW. To meet the target, the company needs to generate an additional 1 trillion KRW or more, equivalent to the annual sales of a top 5 domestic pharmaceutical company. However, the securities industry forecasts Celltrion's sales this year to be around 3.4 trillion KRW, suggesting it is not entirely impossible.

The company expects a sales mix of 1.6 trillion KRW from existing products and 1.9 trillion KRW from new drugs including Jimpendra and Uplyma. The targets are 1 trillion KRW from Jimpendra in the U.S. and globally, and 500 billion KRW from Uplyma. This also includes targets for the anticancer drug Vegzelma (300 billion KRW), and the asthma and urticaria biosimilar Omriclo (150 to 200 billion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.