Domestic Infant and Toddler Health Supplement Market Grows 3.6% Annually Over 4 Years

Arrival of the 'Gold Kids' Era... Premiumization of the Food Market

The 'Gold Kids' are emerging as the largest consumer group in human history. In the food industry, despite the continuing trend of low birth rates and a decrease in the number of newborns, the cost spent on raising a single child is increasing, leading to a strategy focused on premium infant food products.

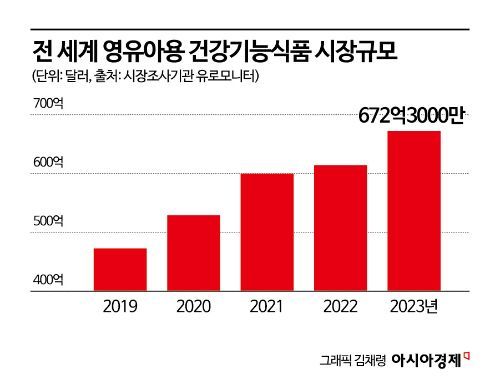

According to market research firm Euromonitor on the 8th, the global market size for infant health functional foods last year was $67.233 billion (approximately 90.8 trillion KRW), showing a 9.5% growth compared to the previous year ($61.42 billion). The infant health functional food market, which was around $47.28 billion (approximately 64.8 trillion KRW) in 2019, surpassed $50 billion the following year and exceeded $60 billion in 2021, demonstrating a steep growth trend.

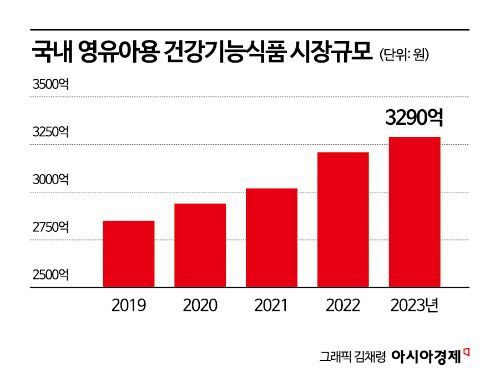

This trend is similarly observed domestically. Last year, the domestic infant health functional food market size was 329.3 billion KRW, maintaining an average annual growth rate of 3.6% since 2019 (285.4 billion KRW).

In the case of infant health functional foods, the increase in parents' interest in boosting immunity and nutritional balance for their children after the COVID-19 pandemic has had an impact. According to a survey by the Korea Health Supplements Association, the health concerns most worried about by consumers with children were 'immune system enhancement (22.0%)', 'overall health improvement (16.9%)', and 'nutritional balance (16.4%)'. Among them, 39.4% answered that they purchase health functional foods to improve their children's immunity.

As the era of 'Gold Kids' (children raised like princes or princesses) who invest generously in their children arrives, the growth momentum of the infant specialized food market, including health functional foods, is accelerating. As more parents want to feed their children better food even if it is expensive, the trend toward premiumization in the infant food market is becoming more distinct, and the industry is rapidly responding to this demand by using high-quality ingredients such as eco-friendly and organic products.

In fact, CJ Freshway, one of the pioneers, recorded related sales of 130 billion KRW last year, growing at an average annual rate of 25% over the past three years, becoming a core business group. Earlier, CJ Freshway launched the kids food specialized brand 'Ainuri' in 2014 as customer demand for high-quality infant-exclusive foods gradually increased. CJ Freshway plans to strengthen its market dominance with differentiated products such as 'Bebecook' (baby food and nutritional meals) and 'Nature Dream' (eco-friendly and organic foods).

Latecomers are also entering the market one after another. Chorokmaeul launched the infant brand 'Chorok Bebe' last year, offering over 80 types of various infant foods ranging from fresh to processed foods. Chorok Bebe plans to gain an advantage in the market focused on ingredients that can be prepared and fed directly, unlike the existing fully cooked baby food market. Harim also introduced the children's food brand 'Foodie Buddy.' Harim aims for annual sales of 30 billion KRW for Foodie Buddy and plans to continuously expand the business.

As global demand for infant food increases, exports of related products are also rising based on the high recognition and preference for Korean food. Last year, infant food exports amounted to $2.94 million, a 36.3% increase from the previous year, with Vietnam, China, and Mongolia accounting for 95.8% of exports. However, imports ($10.1 million) still exceed exports during the same period.

Due to the nature of consumption that emphasizes safety and quality levels, infant food imports have been dominated by countries with strict food safety regulations and a clean image. As of last year, France accounted for the highest share at 48.1%, followed by Australia, Austria, and Germany.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)