Lotte Corporation, Lotte Shopping, Lotte Chilsung, Hi-Mart, and Others Issue Corporate Bonds

1.3 Trillion KRW Issued in the Past Month Alone

Proactively Raising Funds to Repay Debt Amid Low Interest Rates and High Liquidity

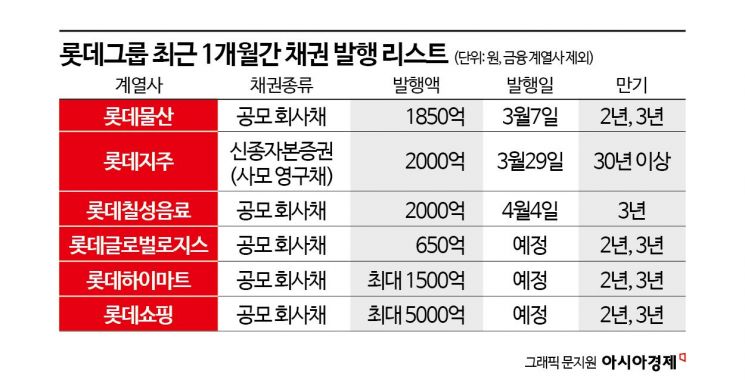

Affiliates of Lotte Group are consecutively issuing corporate bonds. The total amount of bonds issued or to be issued within the past month is approaching 1.3 trillion KRW. With market funds flowing into the corporate bond market due to expectations of interest rate cuts, the strategy is to proactively raise funds needed for debt repayment.

According to the investment banking (IB) industry on the 5th, Lotte Hi-Mart received 260 billion KRW in funds, more than three times the 80 billion KRW target amount, during the corporate bond demand forecast conducted the previous day. Hi-Mart is expected to increase the bond issuance amount to 150 billion KRW reflecting the demand forecast results. It is reported that most investors expressed willingness to invest at prices lower than the individual average market interest rate (the average bond evaluation rate by private bond rating agencies).

Lotte Shopping will conduct a corporate bond demand forecast on the 8th with Kiwoom Securities, Samsung Securities, and Hana Securities as underwriters. With funds flooding into the corporate bond market, there is a high possibility of increasing the bond size to up to 500 billion KRW. Lotte Global Logistics, which conducted a demand forecast ahead of Lotte Hi-Mart, also decided to issue corporate bonds worth 65 billion KRW, exceeding the planned issuance amount of 50 billion KRW, thanks to the abundant investment volume.

Relatively creditworthy Lotte Chilsung Beverage bonds attracted a whopping 1.25 trillion KRW in funds for a 100 billion KRW target. The 3-year maturity bonds were increased to 200 billion KRW and issued at an interest rate of 3.727%. Lotte Property & Development also increased its issuance to 185 billion KRW after receiving orders worth 450 billion KRW for a 100 billion KRW target in the demand forecast conducted earlier this month.

Lotte Holdings, the holding company of Lotte Group, privately issued 200 billion KRW worth of hybrid bonds (perpetual bonds). Perpetual bonds have high interest rates but no mandatory redemption, allowing them to be recognized as capital in accounting. It is interpreted that the company issued perpetual bonds, accepting high interest rates to manage its debt ratio.

A bond market official said, "In the case of Lotte Holdings, if subsidiaries increase borrowings, it could negatively affect the debt ratio," adding, "It seems they are proactively expanding capital by issuing perpetual bonds to manage financial ratios."

Most of the funds raised by Lotte affiliates are used to repay maturing borrowings. Lotte Shopping plans to use funds to resolve contingent liabilities of 173 billion KRW related to borrowings of Lotte Suwon Station Shopping Town, which was recently merged. It will also repay 100 billion KRW in corporate bonds maturing in June, and any remaining funds will be used sequentially to repay maturing borrowings.

Lotte Hi-Mart plans to repay 140 billion KRW in corporate bonds maturing in June and repay short-term commercial paper (CP) maturing in April. Lotte Chilsung Beverage will respond to the maturity of corporate bonds and CP scheduled for April and also repay general loans maturing in November. Lotte Global Logistics will use the funds raised for bond repayment and facility investment.

The influx of funds into the corporate bond market is analyzed to be driven by expectations of interest rate cuts in the second half of the year. The market evaluation yield of AA-rated unsecured corporate bonds fell from the early 4% range at the beginning of this year to the 3.9% range in March and recently further dropped to the 3.8% range. Although Lotte affiliates have higher rates due to concerns about Lotte Construction, they are successfully issuing bonds at rates lower than the market evaluation yields for individual companies.

An IB industry official said, "With the expectation that interest rate cuts will begin in the second half of the year, market investment funds are flocking to corporate bonds due to the psychology that it will be difficult to buy bonds at higher rates later," adding, "Lotte Group, which has a high burden of maturing borrowings, is also taking advantage of the market situation to extend debt maturities and strengthen financial stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.