Samsung Fire & Marine Insurance Suspends New Bancassurance Sales from January This Year

Impact of IFRS17 Adoption... Importance of Protection Insurance Increases

Banking Sector "25% Rule Needs Improvement"

Samsung Fire & Marine Insurance has decided to stop new bancassurance (insurance sold through banks) sales starting this year. This marks the withdrawal after 21 years since launching bancassurance in 2003.

Samsung Fire & Marine Insurance Withdraws from Bancassurance After 21 Years

According to the insurance industry on the 4th, Samsung Fire & Marine Insurance, the top player in the non-life insurance sector, has completely halted new bancassurance sales since January. The company will only continue managing insurance products previously sold through bancassurance agreements with banks. A Samsung Fire & Marine Insurance official explained the withdrawal by saying, "Bancassurance is actually a market that has lost much of its strength." However, overseas bancassurance operations, such as in the Vietnam branch, will continue sales while monitoring market conditions.

Samsung Fire & Marine Insurance's decision to stop bancassurance appears to be influenced by the new international accounting standard (IFRS17) introduced to the insurance industry last year. Under the IFRS17 framework, it is advantageous to sell protection-type insurance rather than savings-type insurance to secure the insurance contract service margin (CSM), a key profit indicator for insurers. Since bancassurance sales channels are banks, savings-type insurance products like pension insurance hold a large share. In this context, Samsung Fire & Marine Insurance likely judged that there was no need to invest effort in bancassurance while paying commissions to banks.

Will Non-Life Insurers Accelerate Exit from Bancassurance?

Previously, Meritz Fire & Marine Insurance and Heungkuk Fire & Marine Insurance also withdrew from the bancassurance market. It is suggested that, except for non-life insurers affiliated with financial holding companies owning banks, others may gradually exit the bancassurance market.

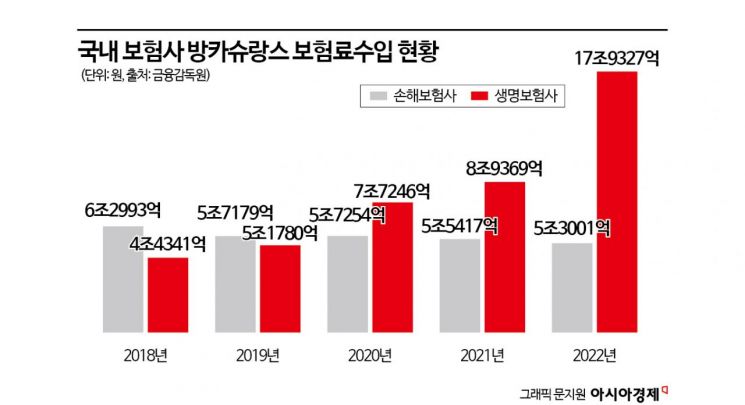

According to statistics from the Financial Supervisory Service, non-life insurers' bancassurance premium income decreased by 15.8%, from 6.2993 trillion KRW in 2018 to 5.3001 trillion KRW in 2022. In contrast, life insurers' premium income increased by 304%, from 4.4341 trillion KRW to 17.9327 trillion KRW during the same period.

Life insurers attracted subscribers in the bancassurance channel by raising interest rates on savings-type insurance, which is similar to deposits but with added insurance features. Especially during the liquidity crisis triggered by the Legoland and Heungkuk Life Insurance incidents, many savings-type insurance policies were sold. A representative from a major life insurer explained, "Bancassurance remains a key channel that helps insurers alleviate cash flow shortages" and "It is still an important sales channel for expanding contact points with high-income groups."

On the other hand, non-life insurers focus on protection-type insurance products, which are more complicated to explain, so they prefer face-to-face exclusive agents or corporate agency (GA) channels with higher product understanding rather than bancassurance. As of the first half of this year, non-life insurers accounted for only about 2% of total bancassurance performance (by contract count) in the insurance industry. Although banks can sell pure protection-type insurance, they mainly sell savings-type insurance structured similarly to deposits, which could increase the rate of incomplete sales.

Banking Sector Calls for Improvement of the "25% Rule"

With Samsung Fire & Marine Insurance exiting bancassurance, the major remaining non-life insurers are Hyundai Marine & Fire Insurance, KB Insurance, DB Insurance, and NH Nonghyup Insurance. As insurers have successively ceased operations, the share of bancassurance in total commission profits of the four major commercial banks decreased by 1.38 percentage points, from 8.55% in 2022 to 6.72% last year.

The banking sector anticipates difficulty in maintaining the "25% rule," which limits the sales proportion of a specific insurer's products to within 25%, due to the successive exits of non-life insurers from bancassurance. The 25% rule was introduced to prevent banks from favoring their affiliated insurers. When the bancassurance system was introduced in 2003, the regulatory ratio was 49%, but it was tightened to 25% from 2005. A representative from a commercial bank stated, "It is necessary to lift restrictions such as the 25% rule and the limit of two insurance salespersons per bank branch, and to allow currently blocked sales of whole life insurance and automobile insurance." He added, "Once the low-interest rate trend fully begins, even savings-type insurance, which is a popular high-interest product, will lose popularity, and bancassurance will be almost at a standstill."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)