Oil Price Nears $90

Global Production Cuts and Geopolitical Risks

Q1 Oil Exports Up 3.8% YoY

Refiners' Earnings Rebound Anticipated

As international oil prices hit their highest levels this year, attention is focused on the possibility of improved refining margins, a key profitability indicator for domestic refiners. It appears that they have successfully rebounded in earnings in the first quarter after a sluggish performance last year, and with product prices rising due to strong oil prices, optimism is growing for second-quarter results as well.

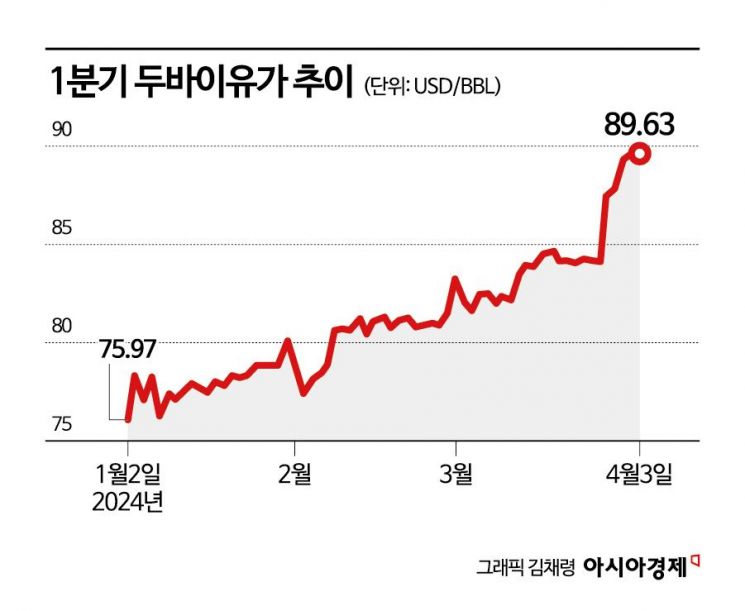

On the 3rd (local time), the closing price of May delivery West Texas Intermediate (WTI) crude oil futures on the New York Mercantile Exchange was $85.43 per barrel. Brent crude futures traded on the London ICE Futures Exchange also rose to $89 per barrel.

Both futures prices have been hitting new highs daily since October last year. The worsening situation in the Middle East has increased concerns over crude oil supply, sustaining the upward trend in oil prices.

The rise in oil prices is generally favorable for refiners. Since it takes about a month from importing and refining crude oil to selling the products, refiners can expand their margins by purchasing crude oil when prices are relatively low and selling products when prices are high.

Refining margins in January and February were $7.8 and $8.3 per barrel, respectively. Refining margin is calculated by subtracting transportation and operating costs from crude oil prices and is used as an indicator of refiners' profitability. The industry generally considers $4 to $5 per barrel as the breakeven point. Although margins have shown a downward trend since last month compared to January and February, they are reportedly still above the breakeven point.

An industry official explained, "It is true that margins were lower than expected at the beginning of the year due to increased supply from China," adding, "However, it is not believed to have a significant negative impact on earnings."

China and Russia also implemented production cuts to stimulate their domestic markets, reducing supply and contributing to the increase in refining margins. Geopolitical risks have further expanded supply chain uncertainties, pushing oil prices above $80 per barrel based on Dubai crude, which is mainly imported by South Korea.

The petroleum product export market continues to thrive. According to the Ministry of Trade, Industry and Energy, exports of petroleum products such as gasoline and diesel in the first quarter rose 3.8% year-on-year to $13.82 billion. The ministry explained, "Exports increased due to excess demand caused by petroleum supply shortages." This reflects significant benefits from reduced global supply as OPEC+ (Organization of the Petroleum Exporting Countries and non-OPEC allies) maintains its production cut policy.

The industry expects a recovery in the first quarter, building on the poor performance in the fourth quarter of last year. According to FnGuide, SK Innovation's operating profit forecast for the first quarter is 459.9 billion won. S-Oil, which posted an operating loss of 265.7 billion won in the refining sector in the fourth quarter last year, is expected to record an operating profit of 467.6 billion won in the first quarter. GS Caltex and HD Hyundai Oilbank, whose operating profits fell by 58% and 77.9% respectively last year, are also expected to rebound in the first quarter.

There are concerns that excessive strength in oil prices could have adverse effects. An industry official said, "If oil prices continue to rise strongly, demand may decrease, leading to lower operating profits," adding, "It is an industry with high uncertainty, so predictions are difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)