Bank Loan-Deposit Interest Rate Spread Hits Lowest Since 1998

Effect of Government Pressure to Lower Loan Interest Rates

On the 4th, as loan interest rates fell and the interest rate spread between deposits and loans narrowed, a banner displaying deposit interest rates was posted on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

On the 4th, as loan interest rates fell and the interest rate spread between deposits and loans narrowed, a banner displaying deposit interest rates was posted on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

The interest rate spread between deposits and loans (deposit-loan spread) at domestic banks has narrowed to its lowest level since the 1998 foreign exchange crisis. This is interpreted as a result of a combination of government pressure to lower bank loan interest rates and the possibility of a base interest rate cut. There is also a possibility that the banks' profits, which reached an all-time high last year, may decrease this year.

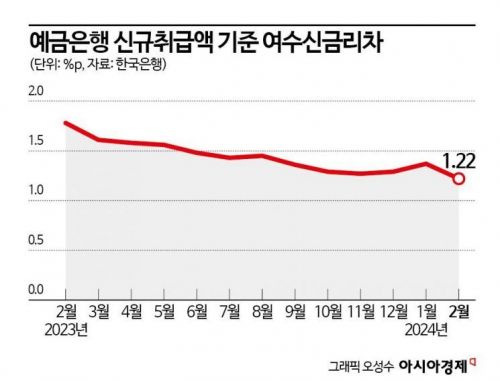

According to the Bank of Korea on the 4th, as of February, the interest rate on new savings deposits at deposit banks was 3.63% per annum, and the loan interest rate was 4.85% per annum, resulting in a deposit-loan interest rate spread of only 1.22 percentage points. This is the lowest level in 25 years and 9 months since May 1998 (0.44 percentage points) during the foreign exchange crisis.

The deposit-loan interest rate spread has been steadily decreasing for a year since reaching a peak of 1.78 percentage points in February last year. This is because the loan interest rates are falling faster than the savings deposit interest rates.

In February last year, the loan interest rate at deposit banks was 5.32%, but it fell by 0.47 percentage points to 4.85% in February this year, while the savings deposit interest rate rose by 0.09 percentage points from 3.54% to 3.63% during the same period. In particular, mortgage loan (Judaemdae) interest rates have fallen for four consecutive months through February. Seojungseok, head of the Financial Statistics Team at the Bank of Korea's Economic Statistics Bureau, explained, "Loan interest rates, especially fixed-rate mortgage loans, have fallen significantly, while deposit interest rates have not changed much, resulting in a significant narrowing of the deposit-loan interest rate spread."

Corporate loan interest rates have also fallen for three consecutive months. The decline in interest rates for small and medium-sized enterprises (SMEs) is steeper than that for large corporations. As of February, the loan interest rates for large corporations (5.11%) and SMEs (4.98%) fell by 0.05 percentage points and 0.30 percentage points, respectively, compared to the previous month. It is the first time in 14 years and 7 months since July 2009 that large corporation loan rates have been higher than those for SMEs. Seojungseok said, "Banks have actively pursued SME loan businesses, and the expansion of SME loan handling through financial intermediation support loans has also contributed to this."

The rapid decline in loan interest rates is interpreted as a result of the government’s pressure to lower rates, which began in earnest after criticism that banks were easily making profits through deposit-loan margins during the period of rising interest rates. According to the Financial Supervisory Service, domestic banks' net income last year was 21.3 trillion won, an increase of 2.8 trillion won (15.0%) from the previous year, marking an all-time high. Interest income from deposit-loan margins alone reached 60 trillion won, leading to criticism that banks were enjoying a money feast. As banks continued to post record profits, pressure from the presidential office and financial authorities to lower interest rates persisted, resulting in a rapid decline in loan interest rates, especially for mortgage loans.

Along with government pressure, the increased possibility of base interest rate cuts in various countries is also cited as a cause of the interest rate decline. The 5-year AAA-rated bank bond yield, which serves as the benchmark for mortgage loan interest rates, peaked at 4.810% in October last year and fell to 3.914% as of the end of February. Combined with banks lowering their additional margins, loan interest rates have dropped significantly.

As the deposit-loan interest rate spread narrows, there is a growing possibility of a negative impact on banks' profitability. According to FnGuide, the estimated net income of the four major financial holding companies (KB, Shinhan, Hana, and Woori) for the first quarter of this year is about 4.4 trillion won, expected to decrease by about 12% compared to the same period last year.

Along with the decrease in interest income, banks have also had to compensate for large losses related to Hong Kong H-Index (Hang Seng China Enterprises Index, HSCEI) equity-linked securities (ELS) starting from the first quarter, further increasing the scale of profit decline. Securities firms estimate the total compensation amount for the four major banks to be between 1.4 trillion and 1.5 trillion won. Banks are likely to reflect this as a provision from the first quarter. Choi Jungwook, a researcher at Hana Securities, predicted, "Losses related to voluntary compensation for Hong Kong ELS are likely to be reflected in banks' first-quarter earnings, and the estimated net income for all banks in the first quarter could decrease by up to 16.2% compared to the previous year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)