Cost ratio accounts for 70~80%

Raw material naphtha price increase

Not reflected in ethylene product prices

Bottom loan cold water... concerns over prolonged slump

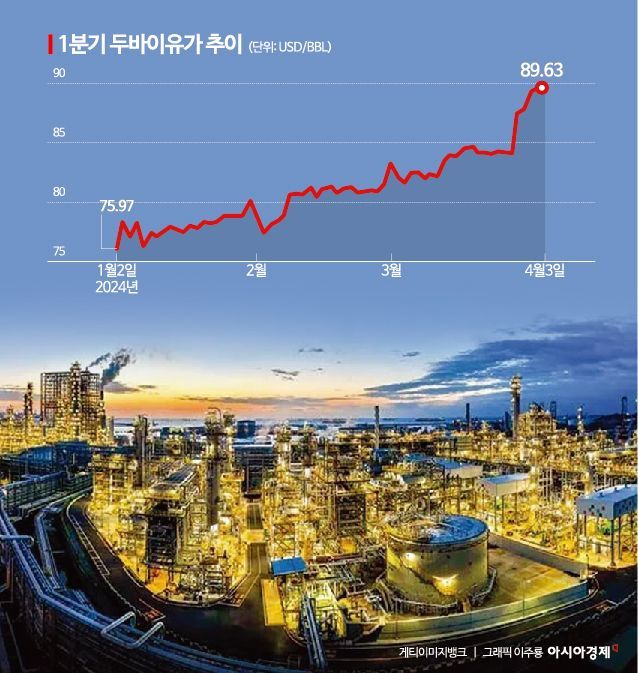

As international oil prices strengthen, the domestic petrochemical industry is on high alert. The dual burden of rising costs has hit the industry due to a supply glut originating from China and worsening Middle East tensions, pushing international oil prices to a five-month high. Higher oil prices are disadvantageous for domestic companies producing ethylene using naphtha, a petroleum product, as a raw material. Petrochemical products, which have a cost ratio of 70-80%, usually have prices linked to oil prices, but even this linkage is currently not functioning.

According to raw material price information from the Ministry of Trade, Industry and Energy on the 4th, the price of naphtha was $716 per ton as of the 28th of last month, and the price of ethylene was $931 per ton. The price difference is only $215 per ton. The ethylene spread, which averaged $262 in February, has dropped 18% in one month.

The ethylene spread is the value obtained by subtracting the price of naphtha, the raw material, from the selling price of ethylene, and is considered an indicator of profitability in the chemical sector. Brent crude and West Texas Intermediate (WTI) futures prices rose to $89.99 and $85.43 per barrel respectively on the 3rd (local time), approaching the $90 mark. Both are the highest since October last year.

Although international oil prices continue to rise daily, the petrochemical industry is expected to face another difficult year as the increase in naphtha prices is not reflected in product prices. International oil prices rose 5.8% in March alone, but ethylene prices actually fell by 2.3%.

Kim Pyeong-jung, head of the Korea Petrochemical Industry Association, said, "Product prices are influenced by costs (oil prices) and market conditions, but currently, due to oversupply, cost reflection is not happening," adding, "The price stagnation issue is even more severe for synthetic resins such as polyethylene (PE) and polypropylene (PP), which use ethylene and propylene as raw materials." Prices of PE and PP (as of last month) fell 8.1% and 5.3% year-on-year, respectively.

The strong oil prices are a variable that dampens the 'first-quarter bottom theory' of the petrochemical industry. Lee Hoon-ki, CEO of Lotte Chemical, the largest domestic company based on ethylene production volume, said in a press conference after last month's regular shareholders' meeting, "The fourth quarter of last year and the first quarter of this year are the bottom," adding, "It is difficult to expect a full-fledged recovery like in the past, but it will slightly improve compared to last year as we move into the second half." This reflects expectations due to the slowdown in the pace of global ethylene capacity expansion.

However, if the burden of raw material costs increases due to strong oil prices, it will be difficult to secure margins even if demand increases. Global ethylene demand is expected to rise from 6.85 million tons last year to 7.15 million tons this year.

Kim Pyeong-jung said, "Looking at the global supply and demand conditions, the petrochemical market is expected to improve in the second half of the year compared to the previous year after passing the first-quarter bottom," but added, "Since oil prices have recently surged again and supply is saturated, the possibility of product prices rising as much as in the past seems very low."

Office of the Ministry of Trade, Industry and Energy, Government Sejong Complex

Office of the Ministry of Trade, Industry and Energy, Government Sejong Complex Photo by Yonhap News

The government has stepped up support for the petrochemical industry, which has been in long-term stagnation. The Ministry of Trade, Industry and Energy recently held an industry meeting chaired by First Vice Minister Kang Kyung-sung and decided to pursue an additional extension of the tariff exemption on naphtha. Naphtha accounts for about 70% of the manufacturing cost of petrochemical products. On the same day, the 'Petrochemical Industry Competitiveness Enhancement Council' was also launched.

Yoo Jun-wi, a researcher at Korea Ratings, said, "Considering the weakening front-end demand due to China's rising self-sufficiency rate and the accumulation of oversupply, it will be difficult to resolve the oversupply in the medium to long term, making it unlikely that the previous industry boom will be reproduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)