New Shares Like Christmas Gifts

IPO Price 100,000 Won, Rose to 495,000 Won the Day After Listing

Stock Price Retreats as Trading Volume Declines

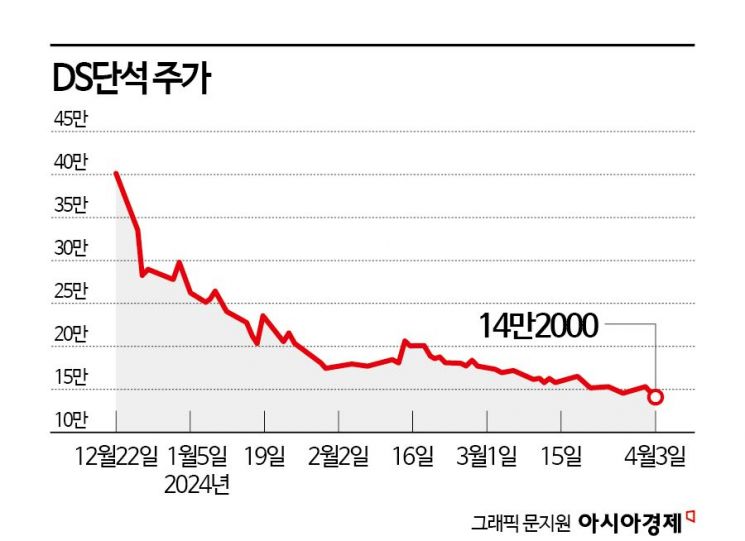

The stock price of DS Danseok, which successfully attracted attention at the time of its listing on the domestic KOSPI market and rose 300% compared to the initial public offering (IPO) price on the day of listing, has been declining day by day. Within just three months of listing, the stock price fell to about 30% of its peak. Since the expansion of the price fluctuation range on the day of listing in June last year to enhance the soundness of the IPO market, many newly listed companies have experienced a brief surge in the early stages but have been ignored by investors.

According to the financial investment industry on the 4th, DS Danseok's stock price once reached 495,000 won intraday on December 26 last year but dropped to 142,000 won after three months. This is the lowest price since listing. The decline rate compared to the peak is 71%.

DS Danseok is engaged in bioenergy production, battery and plastic recycling businesses. It manufactures biodiesel and bio-heavy oil. Biodiesel, which shows fuel performance similar to diesel, is an eco-friendly renewable fuel synthesized from waste cooking oil and vegetable oil. More than 50% of the biodiesel produced is supplied to major refineries in the United States and Europe. Since 2017, it has maintained the number one export market share in biodiesel. The battery recycling division collects waste lead-acid batteries generated worldwide to extract recycled lead metal. With the growth of the electric vehicle market, it is also preparing for secondary battery recycling business. The plastic recycling division manufactures major additives based on naphtha. DS Danseok recorded sales of 1.0704 trillion won and operating profit of 76.2 billion won last year. Sales decreased by 5.6% compared to the previous year, but operating profit increased by 3.0%.

Due to strong demand from institutional investors during the demand forecast, the IPO price was set at 100,000 won, exceeding the expected range of 79,000 to 89,000 won. Despite the high IPO price, the subscription competition rate for general investors was 984 to 1. Subscription deposits amounted to 15 trillion won. A representative from the lead underwriter explained, "Most investors who participated in the demand forecast highly evaluated DS Danseok's long business history, stability, and growth potential."

Among the IPO shares, institutions that took 915,000 shares, accounting for 75% of the total, sold 410,000 shares on the first day of listing and have continued to steadily put shares up for sale since then. The cumulative net selling volume by institutions after listing reached 825,000 shares.

By using all the funds raised through the IPO to repay debt, DS Danseok's debt ratio decreased from 304% in 2022 to 156% at the end of last year. It was expected that the financial structure would improve by lowering the debt ratio and reducing interest expenses.

Although there were criticisms of overvaluation of the IPO price due to prioritizing debt repayment over facility investment, market funds poured into the subscription for general investors. The trading volume on the first and second days of listing recorded 401.5 billion won and 1.6294 trillion won, respectively. However, the high interest in the early stage did not last more than three days. On December 27 last year, the stock price plunged more than 10% and fell below 300,000 won. Since then, trading volume sharply declined, and the stock price failed to rebound properly, dropping below 200,000 won within a month.

A financial investment industry official said, "There are many newly listed companies that receive great attention initially but are quickly forgotten," and pointed out, "If this trend repeats, the purpose of early discovery of appropriate stock prices will be undermined."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.