Domestic Stock Investment Scale Hits Record High at 24 Trillion Won

46.3% Increase Compared to Approximately 16.6 Trillion Won in 2022

Pro-Activist Funds... Also Active in Exercising Voting Rights

The Norwegian Government Pension Fund Global (NBIM), the world's second-largest pension fund by assets under management, has nearly increased its domestic stock investment by 50% in just one year. It is not only the investment amount that has grown. By actively exercising the Stewardship Code (guidelines for institutional investors' voting rights), its influence on shareholder meetings is also expanding.

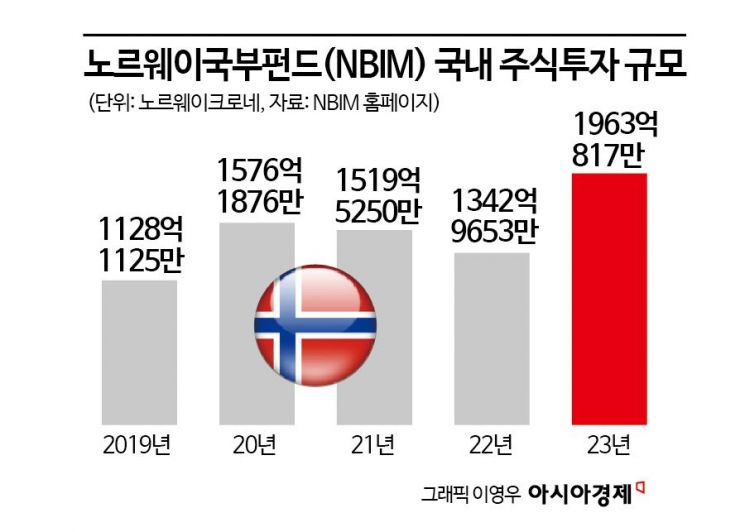

According to the 2023 financial statements recently disclosed by NBIM, the size of its domestic stock investments stood at 196.3817 billion Norwegian kroner (approximately 24 trillion KRW) as of the end of last year. This represents a 46.3% increase compared to 134.29653 billion Norwegian kroner (about 16.6 trillion KRW) in 2022. This amount also exceeds the previous largest investment in Korea in 2020 (157.61876 billion Norwegian kroner). Considering that the KOSPI rose by 18.7% in 2023, increasing the stock valuation, it appears that several trillion won of additional funds were injected into the domestic stock market.

The proportion in the total investment pool also increased... Samsung Electronics overwhelmingly dominant

Within NBIM’s investment pool, which spans 72 countries worldwide, the proportion of domestic stocks increased from 1.1% in 2022 to 1.2% in 2023, a 0.1 percentage point rise. NBIM’s assets under management rank second among global pension funds. As of the end of 2023, its assets totaled 1,576.47 billion Norwegian kroner (approximately 1,945 trillion KRW). It closely chased Japan’s Government Pension Investment Fund (GPIF), which holds the world’s largest pension fund position. GPIF’s assets under management during the same period were 224 trillion yen (about 1,996 trillion KRW). Norway, a major global oil and natural gas exporter, deposits the money earned from selling oil into its pension fund. The National Pension Service of Korea ranks third globally after NBIM and GPIF, with assets of 1,036 trillion KRW.

NBIM holds shares in 473 domestic listed companies. By amount, Samsung Electronics was the largest holding at approximately 5.58 trillion KRW. It was followed by SK Hynix (about 897 billion KRW), Shinhan Financial Group (about 444 billion KRW), Naver (about 395 billion KRW), and Hyundai Motor Company (about 387 billion KRW). The top five listed companies by market capitalization at the end of 2023 were Samsung Electronics, SK Hynix, LG Energy Solution, Samsung Biologics, and Hyundai Motor Company. Among these, NBIM holds no shares in LG Energy Solution, and its holding in Samsung Biologics was valued at 120 billion KRW, ranking only 21st among its listed company holdings. By shareholding ratio, NBIM held the largest stake in Ostem Implant at 4.4%.

An investment banking (IB) industry insider said, "NBIM, which currently prohibits private equity fund (PEF) investments, is discussing lifting related regulations. If PEF regulations are eased, 'Viking money' could flow not only into the stock market but also into alternative investments."

Helping shareholder-nominated directors enter financial holding company boards

NBIM holds less than 5% of shares in all domestic stocks it owns, so it is not required to disclose its shareholding ratios. It is difficult to know NBIM’s shareholding ratios for each stock before the annual financial statements are released. Until now, its presence at domestic shareholder meetings has been minimal. However, this year, it demonstrated its influence by supporting activist funds one after another. The shareholder meetings of JB Financial Group and Samsung C&T Corporation are representative examples.

NBIM, which holds a 2.92% stake in JB Financial Group, fully supported the directors proposed by the activist fund Align Partners, while opposing all nominees recommended by the board. After a vote battle, two of Align Partners’ recommended directors were newly appointed. This was the first time a shareholder-nominated director was appointed in a domestic financial holding company. At Samsung C&T’s shareholder meeting, where five foreign activist funds united to propose shareholder returns such as dividend increases, NBIM sided with the activist funds. Although the proposal ultimately failed, the tendency to be friendly toward activist funds is expected to continue.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.