Estimated Compensation Amount in Banking Sector Approaches 2 Trillion Won

Financial supervisory authorities are accelerating follow-up procedures related to the loss incident involving Hong Kong H Index (Hang Seng China Enterprises Index·HSCEI)-based equity-linked securities (ELS). They plan to soon select representative dispute cases and refer them to the Dispute Mediation Committee (DMC), while also initiating discussions on sanctions against sales companies.

According to the financial sector on the 3rd, the Financial Supervisory Service (FSS) is reviewing materials and seeking advice from law firms this month to select representative Hong Kong ELS dispute cases to be referred to the DMC.

The selected representative dispute cases will be referred to the DMC for discussion, and the mediation proposals issued by the DMC during this process will serve as detailed guidelines for subsequent voluntary adjustments. To ensure prompt dispute mediation, the authorities plan to select representative dispute cases for each sales company.

The banking sector is closely watching the selection of representative dispute cases and the results of dispute mediation, as the mediation proposals for these cases could set precedents for numerous disputes. Investor groups, such as the 'Hong Kong ELS Victims Association,' have already expressed their refusal to accept the dispute mediation standards proposed by the authorities and have repeatedly held off-site rallies.

Separately, banks are also moving quickly to proceed with compensation procedures for customers who agree to the dispute mediation standards. Hana Bank has already made its first compensation payment through agreements with some investors who agreed to the compensation plan at the end of last month, and Woori Bank, which has a relatively smaller scale of ELS sales, plans to begin related procedures from the 12th, when the maturity of the Hong Kong ELS products arrives.

A senior official from the FSS said, "So far, only Hana Bank has proceeded with compensation, and other banks are at the stage of contacting subscribers, so the full-scale compensation is expected to start around next week." He added, "Representative dispute cases will be selected by bank, focusing on many cases corresponding to the dispute mediation standards, and referred to the DMC. We plan to proceed as quickly as possible."

At the same time, supervisory authorities will also initiate sanction procedures against sales companies such as banks and securities firms. The sanction plan will be finalized through steps including sending the supervisory opinion letter, sending the subject's statement of defense, preparing a pre-sanction measure plan, and discussions at the Sanction Review Committee. The authorities are speeding up related procedures to send the supervisory opinion letters to sales companies within this week.

The banking sector is paying close attention to the level of sanctions, especially the scale of fines estimated to be in the trillions of won. Under the current Financial Consumer Protection Act (FCPA), if a sales company fails in its duty to explain or engages in unfair solicitation, fines can be imposed up to 50% of the income obtained from the violation. Here, income refers to the investment amount or loan amount, and considering the total Hong Kong ELS sales in the banking sector (about 17 trillion won) since the enforcement of the FCPA, imposing substantial fines is inevitable. Given that the compensation amount for Hong Kong ELS in the banking sector has already reached about 2 trillion won, this could cause significant damage.

However, FSS Governor Lee Bok-hyun previously stated during the process of encouraging voluntary compensation by banks, "Efforts for post-settlement such as compensation will be taken into account when determining the level of sanctions such as fines according to relevant laws and procedures." Since all banks have confirmed their voluntary compensation policies, there is interest in whether this will affect the level of fines.

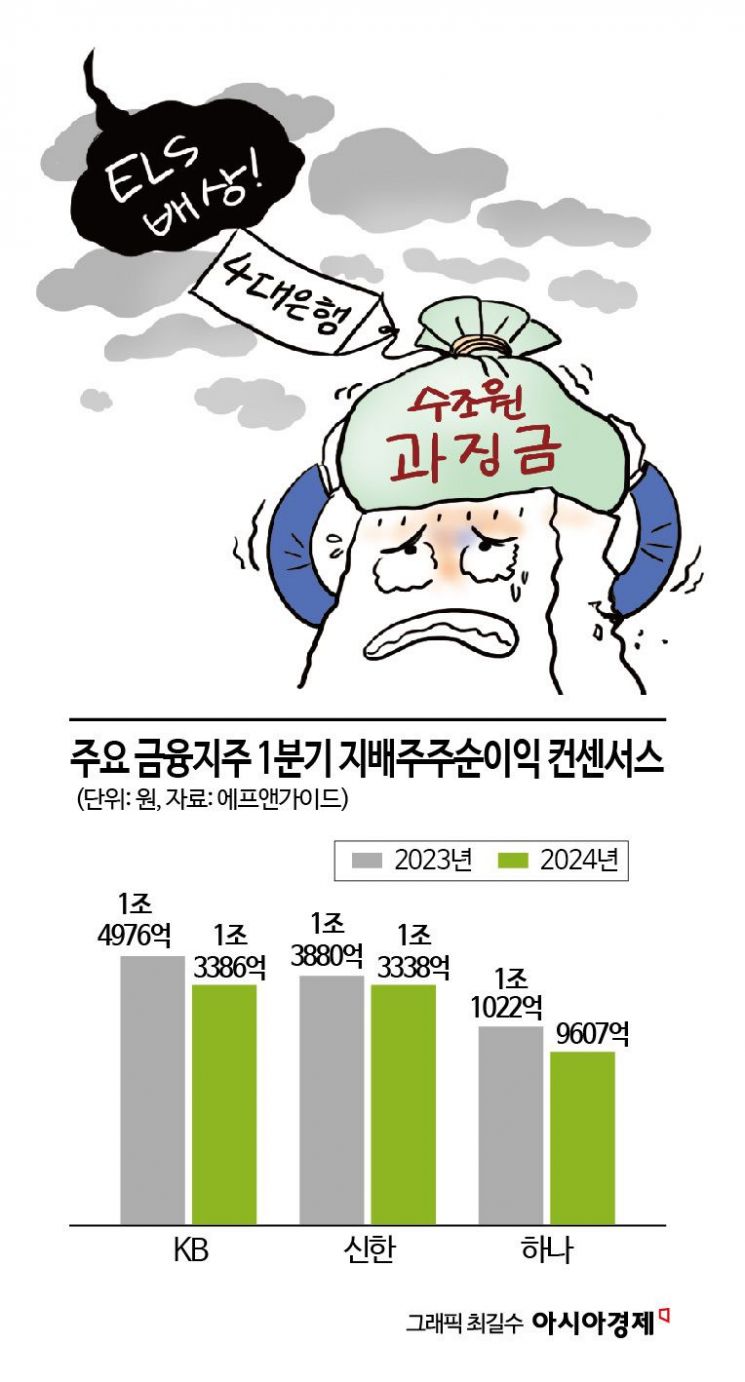

Meanwhile, as banks accept voluntary compensation, dark clouds seem to be looming over the first-quarter earnings of major financial holding companies. According to financial information analysis firm FnGuide, the consensus net income attributable to controlling shareholders for the four major financial holding companies (KB, Shinhan, Hana, Woori) in the securities industry was 4.4522 trillion won for the first quarter. This represents a 9.17% (449.3 billion won) decrease compared to the same period last year.

KB Financial, the largest ELS seller, is expected to post net income of 1.4976 trillion won, down 10.62%. Shinhan Financial and Hana Financial are also predicted to record net incomes of 1.3338 trillion won and 960.7 billion won, down 3.90% and 12.84%, respectively. Korea Credit Rating recently estimated in a report that KB Kookmin Bank’s compensation amount is about 990 billion won, Shinhan Bank’s is 287 billion won, and Hana Bank’s is 257 billion won.

A financial sector official said, "The first quarter performed well in terms of net interest margin (NIM), but the impact of compensation related to ELS was significant." He added, "This year, there are negative factors such as a decline in loan-deposit margin due to future interest rate cuts, restructuring of real estate project financing (PF) starting in May, and related provision settings, so the overall performance of financial holding companies is expected to show a slight downward trend compared to previous years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.