Statistics Korea February Industrial Activity Trends

All-industry Production Up 1.3%

Ministry of Economy and Finance: "Economic Recovery Trend Becomes Clearer"

Industrial production in February continued its growth for the fourth consecutive month, supported by semiconductor production. Facility investment also recorded the largest increase in 9 years and 3 months. The Ministry of Economy and Finance evaluated that the economic recovery trend is clearly emerging, centered on production and exports. However, retail sales declined by 3.1% compared to the previous month, due to decreases in food and beverage products and cosmetics.

According to the February 2024 Industrial Activity Trends released by Statistics Korea on the 29th, total industrial production last month increased by 1.3% compared to the previous month. This marks the fourth consecutive month of growth following a rebound of 0.3% in November last year, 0.4% in December, and 0.4% in January this year.

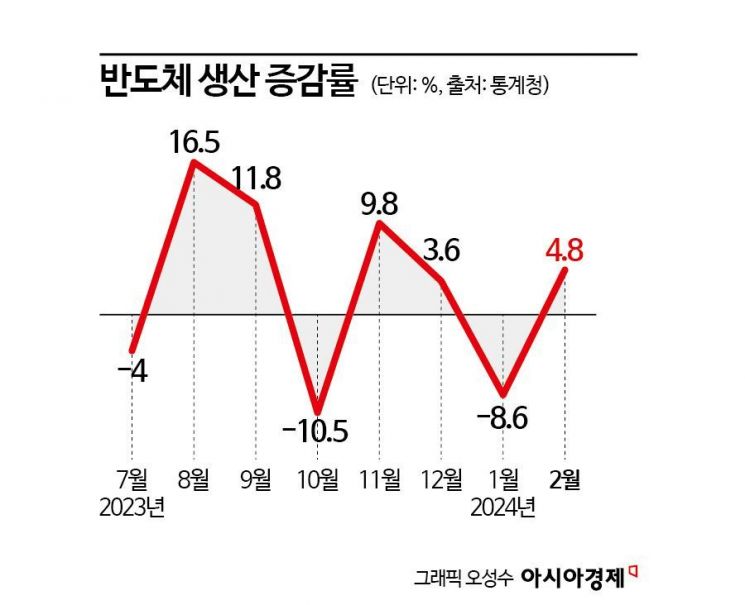

The increase in semiconductor and machinery equipment production significantly contributed to a 3.1% rise in manufacturing production compared to the previous month. Manufacturing production had continued a negative trend for two months since December last year (-0.5%) but turned positive after three months. In particular, semiconductor production, which had sharply declined by 8.6% in January this year, increased by 4.8%, returning to a growth trend. This was due to increased production of memory semiconductors such as DRAM and flash memory.

Gong Mi-sook, Director of Economic Trend Statistics at Statistics Korea, explained, “(Although production was negative in January as well,) the index itself was not at a low level,” adding, “The quarterly positive turnaround is because the semiconductor industry as a whole is in a good situation.” Semiconductor production increased by 65.3% compared to the same month last year. Semiconductor inventory also decreased by 3.1%.

On the other hand, production of communication and broadcasting equipment, which surged by 46.8% in January, decreased by 10.2%. This is seen as a base effect from the previous month’s sharp increase due to the launch of the Galaxy S24 by Samsung Electronics. Construction, which had increased by 13.8% in January, also turned to a decline with a 1.9% decrease. Service sector production rose by 0.7%.

The Ministry of Economy and Finance assessed that the economic recovery trend is becoming clearer. The ministry stated, “Along with the improvement in semiconductors, the recovery trend has spread to other manufacturing sectors, leading to a significant increase in manufacturing production,” and added, “The average operating rate of manufacturing (74.6%) reached its highest level since July 2022, making the recovery trend centered on manufacturing production and exports more distinct.”

However, retail sales, which indicate the trend of goods consumption, fell by 3.1%, suggesting that it is premature to be optimistic about the economic recovery. The trend, which had increased for two consecutive months by 0.6% in December last year and 0.8% in January this year, turned to a decline. This is the largest decrease in seven months since July last year (-3.1%).

The decline was influenced by a 4.8% decrease in non-durable goods consumption such as food and beverages and cosmetics, and a 3.2% decrease in durable goods such as communication devices and home appliances. The ministry analyzed that the decrease in non-durable goods consumption was due to reduced sales of food and beverages and cosmetics during the Lunar New Year holiday period, and that durable goods consumption temporarily slowed down due to delayed electric vehicle sales as subsidies for electric vehicles began to be fully provided from March. A ministry official said, “Since retail sales had increased over the past two months, a correction was expected.” A Statistics Korea official explained, “Although consumption decreased, the base effect is at work for durable goods such as communication devices because many IT-related new products (such as the Galaxy S24) were released in the previous month.” Meanwhile, semi-durable goods consumption such as clothing increased by 2.4%, supported by higher-than-average temperatures (the highest in February since observations began).

Facility investment surged by 10.3%, marking the largest increase in 9 years and 3 months since a 12.7% increase in November 2014. Director Gong explained, “Facility investment has increased significantly due to rising cargo volumes leading to large investments in the shipbuilding sector, as well as increased investment in manufacturing machinery following the improvement in the semiconductor industry,” according to Statistics Korea.

A Ministry of Economy and Finance official said, “The recovery trend is becoming clearer, centered on production and exports, and although domestic demand is recovering at a different pace, it is steadily rising from the bottom,” adding, “We expect a strong recovery trend in March as well, with exports and imports turning positive despite the shortage of working days.” The coincident index of economic indicators, which reflects the current economic situation, rose by 0.2 points from the previous month to 99.9. The leading index, which predicts future economic phases, increased by 0.1 points to 100.4. Director Gong said, “There is a good trend in manufacturing and facility investment is also solid, so both the coincident and leading indices are in a good state,” adding, “Except for the consumption sector, the overall outlook looks positive.”

The Ministry of Economy and Finance stated, “With total industrial production increasing for four consecutive months, the economic recovery trend is becoming clearer,” and added, “We plan to make every effort to timely reinforce the domestic demand sector through the fastest execution of the highest-ever first-half fiscal budget, along with focused investment support in three major areas: enterprises, regions, and construction, to quickly enter the main track of balanced growth.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.