Issuing Securitized Bonds Secured by 'Future Receivables'

Construction Companies Seek Alternative Financing Amid Worsening Conditions

Construction companies facing a triple burden of high construction costs, high interest rates, and project financing (PF) defaults are scrambling to secure cash liquidity by mobilizing tenant deposit guarantees or future construction payments. As market sentiment toward construction company loans or corporate bond investments worsens, they have no choice but to seek alternative financing methods to repay borrowings or secure operating funds.

Issuance of Securitized Bonds Using Tenant Deposit Guarantees and Construction Payments as Collateral

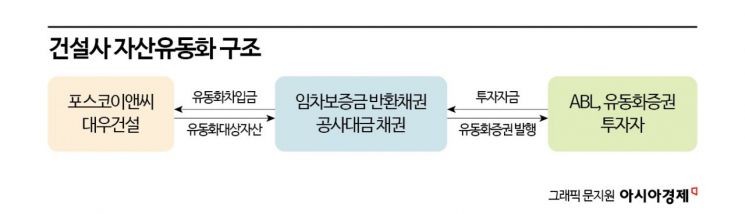

According to the investment banking (IB) industry on the 29th, Posco E&C, a construction company affiliated with the Posco Group, raised 70 billion won by securitizing tenant deposit refund claims with Mirae Asset Securities as the lead underwriter the day before. The method involves transferring tenant deposit claims to a special purpose company (SPC) and then issuing securitized bonds backed by these assets.

The deposits paid by Posco E&C to landlords through 181 lease contracts serve as collateral. When the lease contracts expire and landlords return the deposits to Posco Construction, these funds are used to repay the securitized bonds. If the returned deposits are insufficient to cover the bond repayments, Posco E&C has agreed to supplement the shortfall or transfer equivalent assets to the SPC.

On the same day, Daewoo Engineering & Construction raised 100 billion won by utilizing construction payment accounts receivable. An SPC established under the lead of Shinhan Bank received 50 billion won in asset-backed loans (ABL) and issued 50 billion won worth of securitized bonds, using the construction payment claims as underlying assets.

Daewoo E&C's long-term and short-term credit ratings are subject to a condition that if they fall below BBB+ or A3+, or if the credit rating is withdrawn, the benefit of the loan term will be lost. This means that if the credit rating declines, Daewoo E&C must immediately repay principal and interest even before maturity. Currently, Daewoo E&C's credit ratings are A and A2, leaving two rating levels before triggering this condition.

Previously, Daewoo E&C also raised 50 billion won twice with credit guarantees from the Korea Credit Guarantee Fund. This method involves several companies, including Daewoo E&C, issuing private bonds with guarantees from the Credit Guarantee Fund to issue primary collateralized bond obligations (P-CBOs). Medium and small-sized construction companies such as Hanshin Engineering & Construction and World Construction also participated in the Credit Guarantee Fund guaranteed CBO issuance.

Seeking Alternative Funding Amid Concerns Over Construction Company Defaults and Profitability Deterioration

Posco E&C and Daewoo E&C are ranked within the top 10 construction companies by contract amount and are considered relatively sound companies with less concern over PF defaults. Notably, Posco E&C successfully issued 155 billion won worth of corporate bonds earlier this month, an unusual achievement among construction companies. They initially planned to issue 90 billion won in corporate bonds but increased the issuance size due to strong investor demand.

A corporate bond market insider evaluated, "Posco E&C has relatively lower PF default risk compared to other construction companies, and the possibility of support at the Posco Group level worked favorably in raising funds."

However, it is difficult to say that Posco E&C is free from the risk of defaults due to the downturn in the real estate market. Korea Credit Rating Agency reported that as of the end of last year, Posco E&C had an outstanding guarantee balance of 1.3 trillion won for unstarted PF projects. Unstarted PF projects are considered highly likely to become distressed as construction is delayed due to sluggish sales and they do not convert into main PF projects. Profitability is also sharply declining due to rising construction costs.

Daewoo E&C has relied on private bonds to secure funds as public bond issuance has become difficult. Since private bond interest rates rose to the 7% range in September last year, Daewoo E&C has not issued private bonds based on its own credit rating. This year, it only raised 50 billion won at an interest rate in the 5% range with a guarantee from the Credit Guarantee Fund. Meanwhile, the need for funds for loan repayments and operating expenses continues.

An IB industry official said, "Issuing securitized bonds backed by tenant deposit guarantees or construction accounts receivable makes it easier to secure investor demand compared to corporate bond issuance and reduces interest burdens. It is widely used as an alternative financing method for construction companies that need to repay loans or secure operating funds but find it difficult to obtain loans or issue corporate bonds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.