25-Year Prison Sentence, $11 Billion Asset Forfeiture Ordered

Second Highest Sentence After 'Ponzi Fraud' Madoff

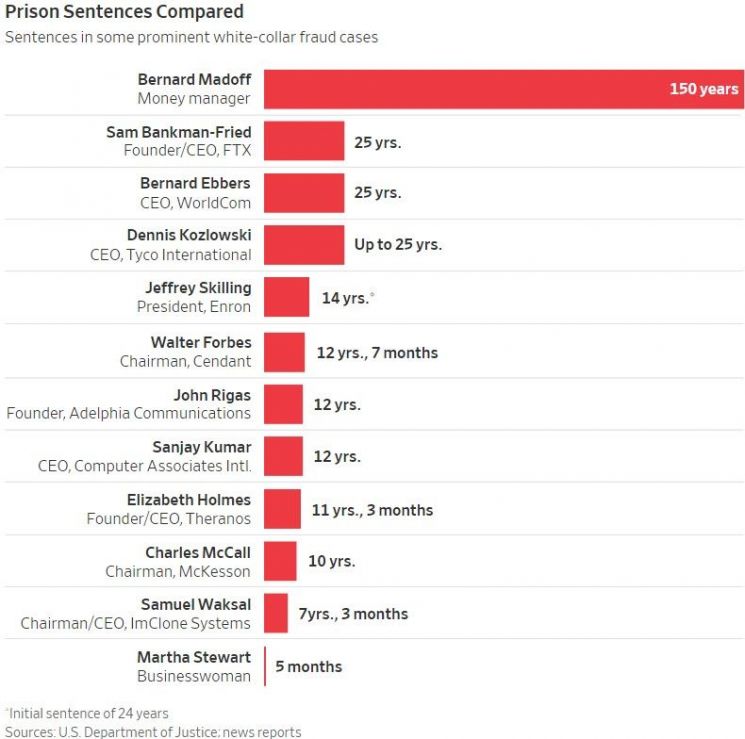

A U.S. court sentenced Sam Bankman-Fried (32), the founder of cryptocurrency exchange FTX, who was charged with embezzling $10 billion (approximately 13.5 trillion KRW) of customer funds, to 25 years in prison and ordered the confiscation of assets exceeding $11 billion (approximately 14.85 trillion KRW). Although this is about half of the maximum 50-year sentence sought by prosecutors, it is the second-highest sentence in U.S. history for a financial criminal, excluding Bernard Madoff, who received 150 years for the largest financial fraud in U.S. history. The New York Times (NYT) described the case as "an astonishing story that shook the trillion-dollar cryptocurrency industry and sounded a warning against greed and arrogance."

On the 28th (local time), U.S. District Judge Louis A. Kaplan of the Manhattan Federal Court in New York stated, "Considering the massive damage he caused, his brazen behavior, his exceptional flexibility with the truth, and his complete lack of genuine remorse," he sentenced Bankman-Fried to 25 years in prison and asset forfeiture.

He added, "There is a risk that Bankman-Fried will commit crimes again if he is released," and "This is by no means a trivial risk."

Judge Kaplan noted that, according to his calculations, FTX investors suffered losses of $1.7 billion (approximately 2.3 trillion KRW), lenders lost $1 billion (approximately 1.35 trillion KRW), and customers lost $8 billion (approximately 10.8 trillion KRW).

Before the sentencing, Bankman-Fried was given 20 minutes to speak, during which he said, "I am responsible for FTX, and I am responsible for the collapse of FTX," and apologized "for everything that happened at every stage." However, he claimed that he did not intentionally commit fraud and that he himself was a victim of the cryptocurrency market downturn in 2022. Judge Kaplan dismissed his claims, stating that Bankman-Fried is not genuinely remorseful.

The 25-year prison sentence handed down to Bankman-Fried is about half of the 40 to 50 years requested by prosecutors. Previously, Bankman-Fried was accused of embezzling $10 billion of customer funds from FTX between 2019 and November 2022, just before the bankruptcy, to pay off debts of FTX affiliates and purchase luxury real estate in the Bahamas. Prosecutors indicted him last October. In November last year, the court jury found Bankman-Fried guilty on seven counts including fraud and conspiracy, with a combined sentence potentially reaching 110 years. However, on the 16th, prosecutors requested a maximum sentence of 50 years. Although the court's sentence was lower than the prosecutors' request, Bankman-Fried received the second-highest sentence among financial criminals in U.S. history, following Madoff, who was sentenced to 150 years for the largest pyramid financial fraud. Until now, Bankman-Fried's defense team had argued that a sentence of 6 years and 6 months was appropriate. His defense team announced they will appeal the ruling.

NYT reported, "This sentence marks the finale of a fraud case that exposed the volatility and risks pervasive throughout the loosely regulated cryptocurrency world."

Kwon Do-hyung, CEO of Terraform Labs, who caused the cryptocurrency Terra and Luna crash, is also currently indicted in the U.S., drawing attention to Bankman-Fried's sentencing. The Montenegrin court, which has custody of Kwon, recently decided to extradite him to South Korea, but local prosecutors have filed objections with the court. Both South Korea and the U.S. are currently requesting Kwon's extradition.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)