SPC Samlip Approves Dividends at Today's Shareholders' Meeting

Abandons Differential Dividends for 'Owner Family High Dividends'

Government Pushes Tax Cuts for Companies Increasing Dividends

"Tax Benefits for Owner High Dividend Companies Should Be Reduced"

The Huh Young-in family, chairman of SPC Group, is set to receive over 10 billion KRW in dividends this year through the listed company SPC Samlip, while nearly 20,000 small shareholders will receive about 2.4 billion KRW. As the government is promoting tax incentives for shareholder-returning companies, such as dividend income tax reductions and increased dividends, there are calls to limit excessive benefits for companies where the owner family's stake is overwhelmingly large.

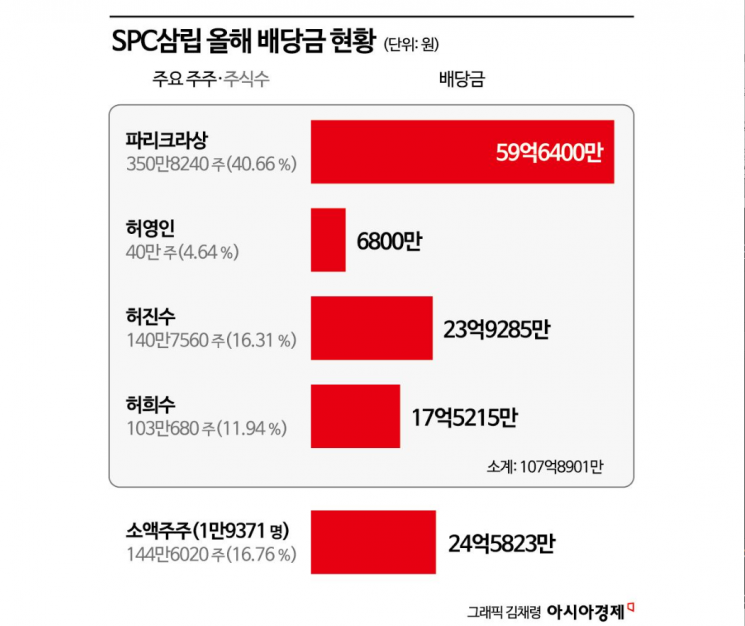

SPC Samlip will resolve a cash dividend of 1,700 KRW per share at the regular shareholders' meeting held on the 29th. Accordingly, Paris Croissant, the largest shareholder of SPC Samlip (40.66%), will receive 5.964 billion KRW in dividends. Chairman Huh (4.64%) will receive 68 million KRW, and his two sons (28.25%) will each receive 2.39285 billion KRW and 1.75215 billion KRW.

SPC Samlip Abandoned Differential Dividends Since 2022... Controversy Over High Dividends to Owners

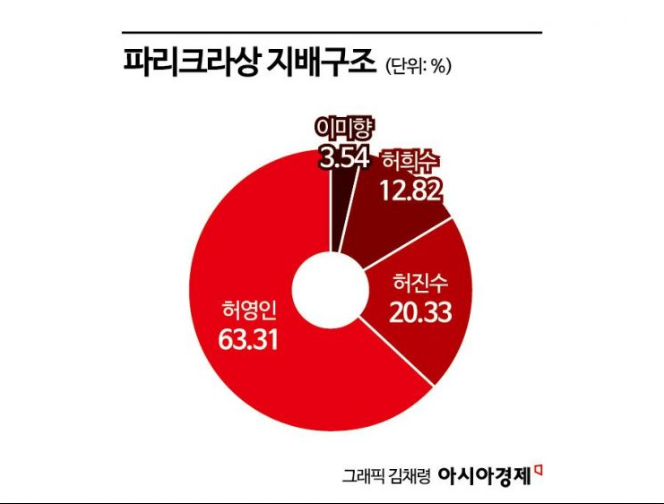

Paris Croissant, the holding company of SPC Group, is 100% owned by Chairman Huh's family, including Huh himself (63.31%), eldest son Huh Jin-soo, president of Paris Croissant (20.33%), second son Huh Hee-soo, vice chairman of SPC Group (12.82%), and Huh's spouse, Lee Mi-hyang (3.54%).

SPC Samlip is paying a total dividend of 13.77887 billion KRW this year, with 10.78901 billion KRW going to Chairman Huh's side. This accounts for 78% of the total dividends. Meanwhile, 19,371 small shareholders of the company receive a total of 2.45823 billion KRW in dividends. Dividends are concentrated on the four members of the owner family, while small shareholders make up 99.5% of SPC Samlip's shareholders.

Not all dividends paid to Paris Croissant go directly into the pockets of Chairman Huh's family. However, since Paris Croissant is a family company of Chairman Huh, the massive dividends have been criticized as a 'cash dispenser' for the owner family. In fact, to avoid such controversy, SPC Samlip implemented a 'differential dividend' system from 2013, paying more dividends to small investors than to major shareholders. However, since 2022, both major and ordinary shareholders have received the same dividends. Last year, SPC Samlip also paid 1,700 KRW per share, totaling 13.77887 billion KRW in dividends. The Huh family took about 10.7 billion KRW in dividends, similar to this year.

This contrasts with companies expanding 'differential dividends' at this year's shareholders' meetings. For example, Kyochon F&B at its shareholders' meeting held the day before resolved that ordinary shareholders receive 300 KRW per share, while the largest shareholder, Chairman Kwon Won-gang (69.2% stake), receives 200 KRW per share. Given Kyochon's previous controversies over 'high dividends to owners' due to Chairman Kwon's large stake, this is interpreted as a shareholder-friendly dividend policy.

KyoBo Securities also resolved at its shareholders' meeting on the 26th to pay 250 KRW per share to ordinary shareholders and no dividends to the largest shareholder. This appears to consider that KyoBo Life Insurance, the largest shareholder of KyoBo Securities, holds an 84.7% stake. Since surpassing 100 billion KRW in net profit in 2020, KyoBo Securities has been implementing differential dividends annually. Additionally, Neotis, BC World Pharm, Oisolution, Finger, and HPSP do not pay dividends to their largest shareholders at all, distributing dividends only to ordinary shareholders.

Government's 'Korea Value-Up' Initiative Contradicted... Experts Say No Tax Support for High-Dividend Owner Companies

This year, the government has been promoting a 'corporate value-up program' to resolve the undervaluation of the Korean stock market and is preparing tax support measures. Specifically, listed companies that increase shareholder dividends and actively retire treasury shares will receive corporate tax reductions, and shareholders of companies that increase dividends will benefit from reduced dividend income tax.

Choi Sang-mok, Deputy Prime Minister and Minister of Strategy and Finance, stated at the 'Capital Market Advancement Meeting' held on the 19th, "To encourage many companies to participate in expanding shareholder returns, we will ease corporate tax burdens on a portion of the increase in shareholder returns," and "We will reduce the high dividend income tax burden on shareholders of companies that expand dividends."

However, there are concerns that indiscriminate tax support for dividend-increasing companies should be limited for companies with high controlling shareholder power, as benefits tend to concentrate on the owner family rather than small shareholders. Similar to regulations on 'internal transactions' to prevent the owner family from easily gaining 'more' profits through unfair means within affiliates, dividend income tax reductions should be limited to shareholders holding less than 20% stakes. Lee Yong-woo, a member of the National Assembly's Political Affairs Committee from the Democratic Party, said, "Many listed companies in Korea have significant ownership by the controlling family, so providing uniform tax benefits is not appropriate," and "The government should establish standards similar to those for internal transactions when preparing specific measures." Lee Hyo-seop, head of the Financial Industry Division at the Korea Capital Market Institute, who attended the government meeting, said, "The meeting discussed Korea's stock market value-up measures, but there was no mention of limiting excessive dividends to major shareholders," adding, "It seems necessary to discuss this when the government formulates specific shareholder return policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.