Shinsegae Group Real Estate Investment Company Shinsegae Property Investment

Starfield in Yeoksam-dong Leaves Its Nest, Heads to Yeouido, the Financial Investment Hub

First Step Toward Expanding from Distribution to Investment Business

Shinsegae Group's real estate investment company, Shinsegae Property Investment (Shinsegae REITs), is relocating its headquarters to Yeouido, the financial investment hub. By moving into Yeouido, Shinsegae REITs plans to accelerate the process of listing its REITs to securitize Shinsegae Group's prime real estate assets. This move is seen as a stepping stone for Shinsegae Group to expand beyond retail into the investment business.

According to the investment banking (IB) industry on the 29th, Shinsegae Group's real estate REIT asset management company (AMC), Shinsegae REITs, which recently received official establishment approval from the Ministry of Land, Infrastructure and Transport, has appointed former NH Nonghyup REITs Management CEO Seo Cheolsu as its inaugural CEO and is working on relocating its headquarters.

Shinsegae REITs has decided to move its headquarters to Yeouido, the center of investment networks and information, to clearly establish its identity as an investment company. Previously, Shinsegae Group's real estate development company, Shinsegae Property, and its subsidiary Shinsegae REITs were based in Centerfield, Yeoksam-dong, where Chairman Chung Yongjin's office is located. Shinsegae REITs plans to relocate in May to the TP Tower office building in Yeouido, which is the Teachers' Pension headquarters. The company will conduct full-scale investment operations in a space independent from the group.

Jung Yong-jin, Chairman of Shinsegae Group (left), Seo Cheol-su, former CEO of NH Nonghyup REITs Management (right)

Jung Yong-jin, Chairman of Shinsegae Group (left), Seo Cheol-su, former CEO of NH Nonghyup REITs Management (right)

Shinsegae REITs is a company 100% funded by Shinsegae Property, a subsidiary of E-Mart. A REIT is a form of joint-stock company that pools funds from multiple investors to invest in real estate and distribute profits, allowing simultaneous real estate development and fund management. Additionally, when making new real estate investments, it can attract public funds not only from external institutions but also from individual investors.

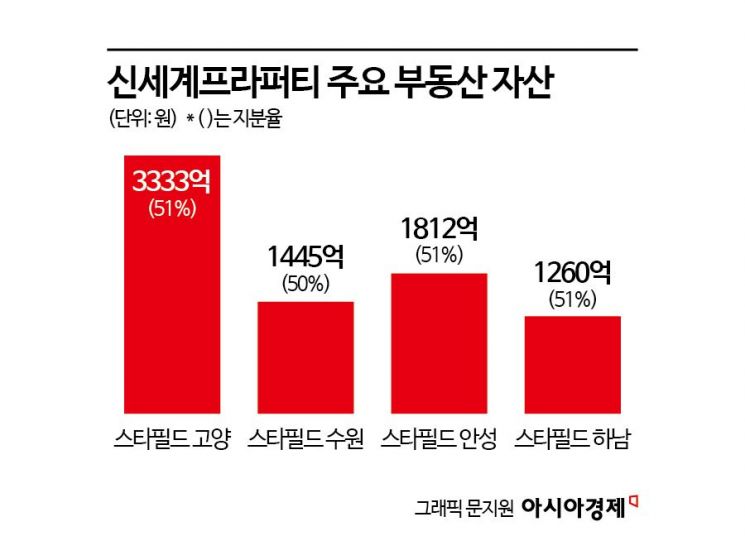

Shinsegae REITs is expected to serve as a channel for asset securitization and fundraising for Shinsegae Group. In a situation where issuing corporate bonds is difficult, securitizing affiliate assets through REITs allows the group to raise funds while maintaining ownership within the group. The company plans to review and incorporate Shinsegae Group's real estate assets for future REITs listing. Shinsegae Group owns various prime assets including E-Mart and Traders stores, Starfield, and Chosun Hotel. The company can expand by raising investment funds for newly developed Starfield through development REITs or raise funds from various investors by listing REITs that incorporate key assets such as Starfield.

Although large corporations like Shinsegae are prohibited from entering the financial industry, creating a listed REIT under the Real Estate Investment Company Act enables them to acquire equity in the equity capital market (ECM) and raise funds through various types of bonds such as corporate bonds, convertible bonds (CB), and bonds with warrants (BW) in the debt capital market (DCM). Homeplus and Lotte Shopping also utilize their owned real estate such as buildings and land by incorporating them into their own REITs as a means of asset securitization.

Meanwhile, Seo Cheolsu, who will oversee Shinsegae Group's REITs business, was born in 1966 and graduated from Hanyang University with a degree in accounting. He worked in the fund planning and finance departments at the Korea Development Bank and served as a project manager in the investment finance division. He also held positions as head of the real asset division and chief investment officer at Korea Investment Trust Management. Seo later contributed to the rapid market establishment of Nonghyup REITs, successfully securing a second term as CEO. At the end of 2018, he introduced private REITs and achieved a public REITs listing in 2019, quickly dominating the market. Nonghyup REITs currently has two listed REITs: NH All One REITs and NH Prime REITs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.