Statistics Korea Wage Workers' Debt

Highest in 40s at 76.39 Million Won

It was found that the average debt per office worker is 51.15 million KRW. The loan amount for workers in their 40s remained the largest.

According to the '2022 Job Administration Statistics: Wage Workers' Debt' data released by Statistics Korea on the 28th, the average loan amount for wage workers as of the end of 2022 was 51.15 million KRW, a decrease of 870,000 KRW (1.7%) compared to the previous year.

By loan type, mortgage loans increased slightly by 0.6%, while credit loans decreased significantly by 6.0%. The sharp decline in credit loans is attributed to the increased interest burden due to the high-interest rate trend. As of the end of 2021, the increase rates for mortgage and credit loans were 5.6% and 4.9%, respectively.

The delinquency rate based on outstanding loan balances was 0.43%, up 0.02 percentage points compared to one year earlier.

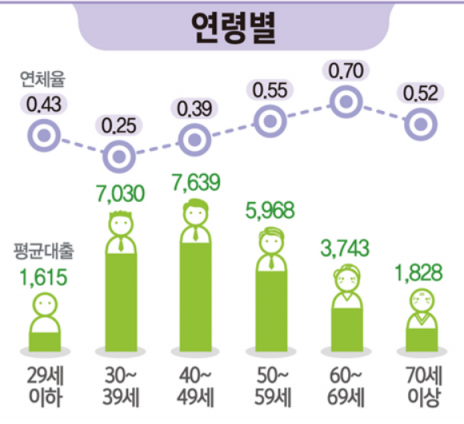

By age group, workers in their 40s had the highest average loan amount at 76.39 million KRW, followed by those in their 30s (70.30 million KRW), 50s (59.68 million KRW), and 60s (37.43 million KRW). The delinquency rate was highest among those in their 60s (0.70%), followed by those in their 50s (0.55%) and those aged 70 and above (0.52%).

This indicates that the elderly, who have lower economic capacity, are more likely to fail to repay loans on time.

The age group with the largest decrease in loan amount was those aged 29 and under, with a loan amount of 16.15 million KRW, down 4.5% compared to the previous year.

By industry, workers in the finance and insurance sector had the highest loan amount (101.62 million KRW), while those in accommodation and food services had the lowest (20.74 million KRW). Compared to the previous year, loans for workers in education (-5.2%) and transportation and warehousing (-3.9%) decreased, while loans for workers in business support and rental services increased by 3.3%.

Also, the higher the income of the worker, the higher the average loan amount. Workers earning between 50 million and 70 million KRW had loans averaging 83.74 million KRW, a decrease of 8.2% in one year, and those earning between 70 million and 100 million KRW had loans averaging 111.58 million KRW, down 7.6%.

By housing type, apartment residents had the highest average loan amount at 62.44 million KRW, followed by officetel and others (46.64 million KRW), row houses and multi-family houses (39.94 million KRW), and detached houses (30.02 million KRW). Compared to one year earlier, the largest decreases were in officetel and others (-5.9%) and apartments (-1.9%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.