Korea Federation of SMEs Announces 'April SME Business Outlook Survey'

Average Operating Rate of Small Manufacturing Firms Falls by 0.3p in February

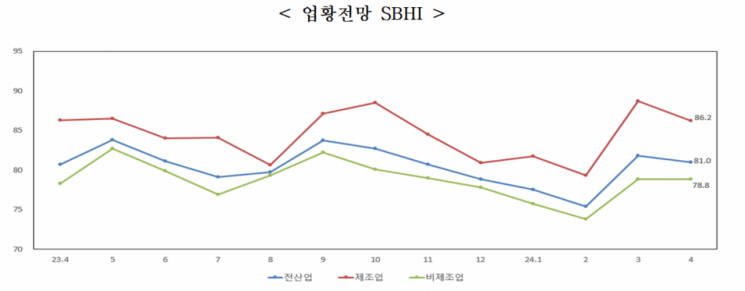

The business outlook for small and medium-sized enterprises (SMEs), which had rebounded after five consecutive months of decline, has dropped again.

The Korea Federation of SMEs announced the results of the "April 2024 SME Business Outlook Survey," conducted from March 14 to 21 with 3,082 SMEs, on the 28th.

The April Business Outlook Index (SBHI) for business conditions was 81.0, down 0.8 points from last month’s 81.8, failing to continue the previous month’s upward trend (6.4 points increase). Compared to the same month last year, it rose by 0.3 points. An SBHI above 100 means more companies have a positive outlook on the economy than those who do not, while below 100 indicates the opposite.

The manufacturing sector’s business outlook for April fell 2.5 points from the previous month to 86.2, while the non-manufacturing sector remained steady at 78.8. Construction (81.1) rose 7.9 points from the previous month, whereas the service sector (78.3) declined by 1.7 points.

Within manufacturing, 13 industries showed month-on-month increases centered on ▲Leather bags and footwear (78.0→83.8, 5.8 points↑) ▲Beverages (96.5→102.0, 5.5 points↑) ▲Medical substances and pharmaceuticals (84.5→89.9, 5.4 points↑). Conversely, 10 industries declined, including ▲Other machinery and equipment (96.1→89.3, 6.8 points↓) ▲Automobiles and trailers (95.8→89.9, 5.9 points↓) ▲Rubber and plastic products (86.3→80.7, 5.6 points↓).

In non-manufacturing, construction (73.2→81.1) increased by 7.9 points month-on-month, while services (80.0→78.3) decreased by 1.7 points.

Within services, 5 industries rose, including ▲Business facilities management, business support, and rental services (86.9→93.1, 6.2 points↑) ▲Repair and other personal services (74.5→80.5, 6.0 points↑) ▲Arts, sports, and leisure-related services (82.3→87.9, 5.6 points↑). Meanwhile, 5 industries declined, including ▲Real estate (79.6→75.7, 3.9 points↓) ▲Wholesale and retail trade (78.2→75.2, 3.0 points↓).

Exports (84.2→88.0) rose month-on-month, whereas ▲Domestic sales (81.4→79.2) ▲Operating profit (79.5→77.9) ▲Financial conditions (78.9→78.5) declined. Employment level (94.9→94.0), which is a counter-trend indicator, is expected to improve slightly compared to the previous month.

Comparing the SBHI for April 2024 with the average SBHI for the same month over the past three years by category, manufacturing shows deterioration in overall business conditions, domestic sales, inventory, and employment. Other categories are expected to improve compared to the previous three-year average. In non-manufacturing, financial conditions and employment outlook are expected to improve, while other categories are forecasted to worsen compared to the past three-year average.

The top management difficulties for SMEs in March were domestic demand slump (59.0%), followed by ▲Rising labor costs (48.6%) ▲Excessive competition among companies (35.7%) ▲Rising raw material prices (34.2%).

The response rates for ▲Excessive competition among companies (34.8%→35.7%) ▲Rising labor costs (47.1%→48.6%) ▲Rising raw material prices (33.1%→34.2%) increased compared to the previous month, while ▲Domestic demand slump (61.6%→59.0%) ▲Delayed collection of sales proceeds (18.5%→18.0%) ▲High interest rates (26.0%→24.9%) decreased.

The average operating rate of small and medium-sized manufacturing enterprises in February 2024 was 71.8%, down 0.3 percentage points from the previous month but up 0.3 percentage points year-on-year. By company size, small enterprises (68.4%→68.2%) decreased by 0.2 percentage points month-on-month, and medium enterprises (76.1%→75.7%) decreased by 0.4 percentage points.

By company type, general manufacturing (71.2%→71.0%) fell 0.2 percentage points month-on-month, while innovative manufacturing (74.4%→73.7%) declined by 0.7 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)