CNBC Delivering Alpha Stock Survey

Fed Rate Cuts Expected Twice This Year

Preference for Nasdaq and Tech Stocks... "AI Should Be Sold"

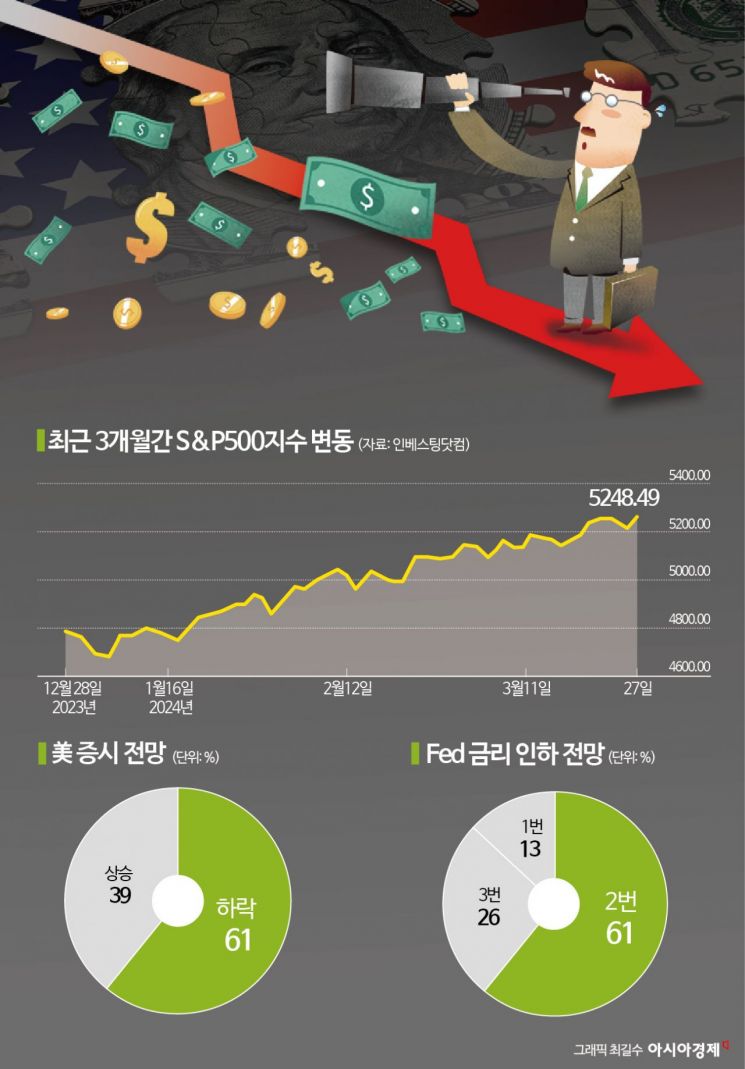

Six out of ten global experts have diagnosed that a decline in the U.S. stock market is imminent. This analysis draws attention as it comes amid the S&P 500 index, centered on large-cap stocks, continuously hitting record highs.

On the 27th (local time), CNBC reported that a survey conducted among over 300 chief investment officers (CIOs), equity strategists, portfolio managers, and other fund managers found that 61% of respondents believed a market correction was imminent. They generally assessed that the market had moved too fast and too far.

The S&P 500 index has risen more than 9% so far this year. On this day, the S&P 500 closed at a record high of 5,248.49, up 44.91 points (0.86%) from the previous day. However, only 39% of respondents said there was room for further gains.

Regarding the market’s biggest concern, the U.S. Federal Reserve’s (Fed) interest rate cut outlook, the majority of respondents (61%) predicted that rates would be cut twice this year. Although the Fed hinted at the possibility of three rate cuts through its dot plot on the 20th, only 26% of respondents in the survey expected three rate cuts this year. Thirteen percent said there would be only one rate cut this year. No respondents expected the Fed to cut rates more than three times or not cut rates at all this year.

Regarding the timing of rate cuts, only 9% said rates should be cut immediately. Ninety-one percent said rate cuts should be implemented slowly and steadily.

When asked about preferred investment targets, 26% chose the Nasdaq 100 index, which is technology stock-focused. Only 13% preferred the S&P 500. Thirteen percent said they would invest in oil. The proportion of respondents who preferred Bitcoin was 9%, which CNBC described as a record high for Bitcoin preference. Bitcoin had risen to the $70,000 level the previous day but slightly declined on this day, trading in the $69,000 range.

When asked to select the top three investment sectors to watch, 61% of respondents chose the technology sector. However, regarding stocks related to artificial intelligence (AI), which have recently driven the U.S. stock market’s rise, 39% said it was "time to sell."

Regarding the outlook for 2025, 52% said there was a risk of a recession. In the previous quarter’s survey, only 23% predicted a recession, so this figure has doubled. Thirty-nine percent said there were no signs of a recession. In the previous survey, only 14% responded that the economy would not enter a recession.

Recently, global stock markets including those in South Korea, Japan, the United Kingdom, Europe, and Canada have been booming. When asked about optimistic regions outside the U.S., 40% chose Japan, and 26% chose Europe. However, 26% of respondents said they would not invest outside the U.S. Only 4% selected China as the best place to invest outside the U.S. China’s representative stock index, the CSI 300, fell to its lowest level in five years last month due to ongoing U.S.-China tensions and domestic demand slowdown. The Hong Kong H-Share Index (Hang Seng China Enterprises Index, HSCEI) also recorded its lowest level in about 19 years.

If the stock market suddenly declines, 65% said they would invest in cash, 26% in bonds, and 9% in high-dividend stocks. No respondents preferred gold, cryptocurrencies, or real estate.

Over the past 10 years, the S&P 500 index has delivered an average annual return of about 13%. Twenty-two percent of respondents forecast that the S&P 500 will continue to deliver an average annual return of over 10% for the next 10 years. Other respondents expected annual returns of 5-10% over the next decade.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)