37% of Donors Are Aged 70 or Older, Up 14%P from 2020

Timing of Gifts to Children Delayed Due to Aging Population

Increase in Recipients in Their 30s Since Establishment of Marriage Gift Property Deduction

The age group of donors gifting collective buildings such as apartments, multi-family houses, and commercial buildings is gradually increasing. Four out of ten donors are aged 70 or older. Since the introduction of the marriage gift property deduction this year, the proportion of gifts to children in their 30s has rebounded.

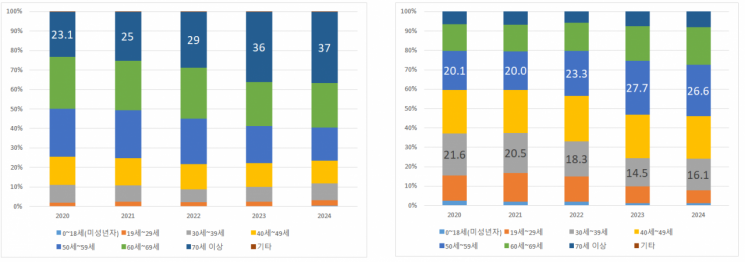

On the 27th, Woori Bank's Real Estate Research Lab analyzed the number of donors registered in the corporate registration information plaza this year and found that the largest age group of donors was 70 years or older, accounting for 37%. The proportion of donors aged 70 or older was 23.1% in 2020 but entered the 30% range at 36% in 2023 and continues to rise.

The timing of gifting collective buildings by direct ascendants often exceeds age 60. The combined proportion of donors aged 70 or older (37%) and those aged 60-69 (23%) reaches 60%. Next are the age groups 50-59 (17%) and 40-49 (12%). Due to aging, more parents prefer to manage their assets rather than gift them early, naturally delaying the timing of gifts.

The number of donors gifting collective buildings has been declining for three consecutive years. This is due to the sharp rise in the base interest rate in the second half of 2022, the contraction of the real estate market, and the postponement of asset gifting by the elderly with limited earned income. The number of donors decreased from 80,389 in 2020 to 70,683 in 2021, 54,083 in 2022, and 32,450 in 2023.

Proportion of Donors' Age Groups and Recipients' Age Groups for Condominium Gifts by Year (Source: Woori Bank Real Estate Research Lab)

Proportion of Donors' Age Groups and Recipients' Age Groups for Condominium Gifts by Year (Source: Woori Bank Real Estate Research Lab)

The age of recipients receiving collective buildings is also gradually increasing. This year, those aged 50-59 (26.6%) represent the largest share, up 6.5 percentage points from 20.1% in 2020. Recipients aged 60-69 (19.3%) also increased by 5.6 percentage points from 13.7% in 2020. Those aged 40-49 (22%) decreased by 0.6 percentage points from 22.6% in 2020.

Since the beginning of this year, with the introduction of the marriage gift property deduction, the proportion of recipients in their 30s increased to 16.1%, up from 14.5% in 2023. This is the only age group under 40 that saw an increase in gifts. This is because an additional deduction of 100 million KRW is now available for property gifted within two years before or after the child's marriage registration date (a total of four years). Previously, the gift property deduction limit was 50 million KRW over ten years (20 million KRW for minors), but from this year, the bride and groom can each receive a gift deduction of 150 million KRW, totaling 300 million KRW, leading to increased gifts to children in their 30s.

Ham Young-jin, head of Woori Bank's Real Estate Research Lab, explained, "Through trend analysis of donors and recipients of collective buildings amid the low birthrate and aging population, the generational transfer of real estate assets is gradually being delayed. In South Korea, where real estate assets constitute a large portion of wealth, policy considerations are needed to assist asset transfer to recipients by improving the efficiency of asset management after retirement for the elderly and reducing the tax burden of gift taxes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.