Samsung Electronics Listed as Global M&A Buyer

Lotte, LG, Hanwha Revise M&A Strategies

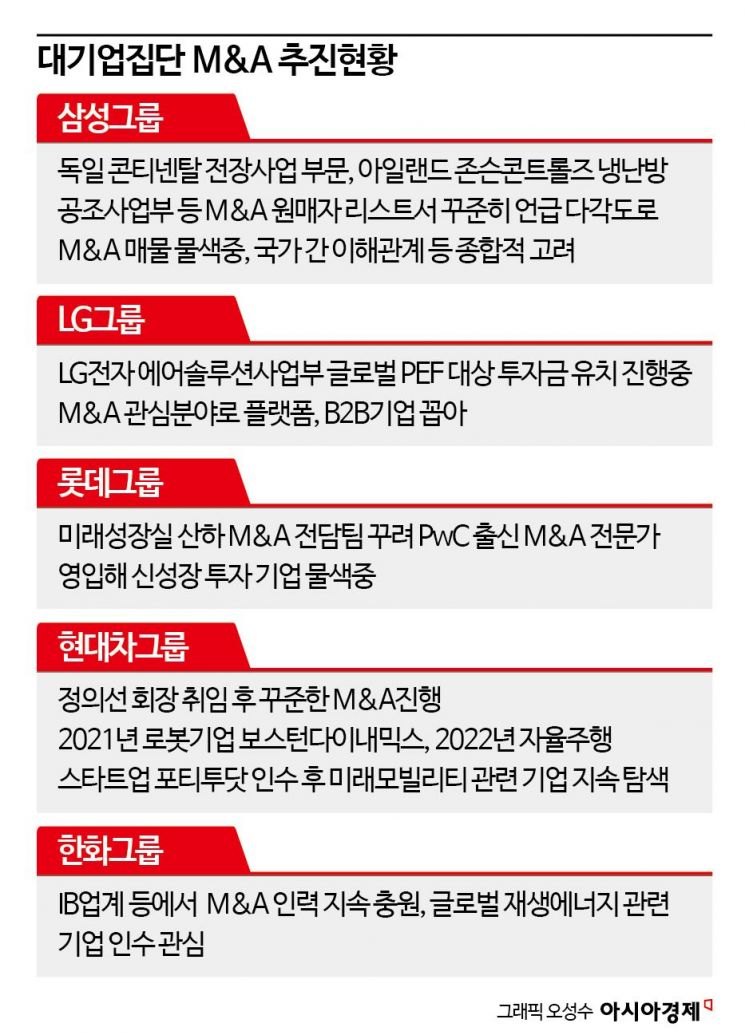

Domestic conglomerates are knocking on the door of the global mergers and acquisitions (M&A) market once again. Since Samsung Electronics' acquisition of Harman worth 10 trillion won in 2017, there have been no major M&As, but now Samsung Electronics has made the list of potential buyers for multi-trillion won global M&As. Other groups such as Lotte, LG, and Hanwha are also reorganizing their strategies and stoking the fires to join the corporate acquisition battle.

Samsung Joining the M&A Battle, LG Charging Ammunition

According to major foreign media reports and the investment banking (IB) industry on the 28th, Samsung Electronics' name is circulating among potential buyers in global M&A deals, including the sale of the German company Continental's automotive electronics division and the sale of the heating, ventilation, and air conditioning (HVAC) division of Ireland's Johnson Controls International.

Among these, there is news of participation in a mega M&A deal worth $6 billion (approximately 8 trillion won). Foreign media reports indicate that Samsung Electronics is pursuing the acquisition of Johnson Controls' HVAC business unit in Ireland.

Samsung Electronics Vice Chairman Han Jong-hee told Asia Economy, "That's just a rumor, so don't think too deeply about it," showing little weight on the possibility of acquiring Johnson Controls. Instead, he added, "We are looking at various companies," and "There are many complexities including international interests, but we are watching for opportunities."

At the regular shareholders' meeting on the 20th, Vice Chairman Han also stated, "Many aspects of Samsung Electronics' M&A have progressed," and "There will be an opportunity to inform shareholders soon." It is known that Samsung Electronics has been reviewing the acquisition of the German company Continental's automotive electronics division from various angles since last year. Founded in 1871, Continental is one of the world's top 10 automotive parts companies, comparable to Bosch, Denso, ZF, and Magna. If the acquisition is successful, it will be the first major M&A in seven years since the acquisition of Harman in 2017.

At LG Group, groundwork for M&A is also underway. The Air Solution Business Division at LG Electronics, which is planning air conditioner and air purifier businesses, is raising investment funds from global private equity funds (PEFs). Since LG Electronics acquired ZKW (worth 1.4 trillion won) in 2018 and LG Chem acquired Aveo (about 700 billion won) in 2022, there have been no deals considered major M&As within LG Group.

However, expectations are rising again as LG Electronics President Cho Joo-wan shared M&A plans with shareholders at the recent shareholders' meeting. President Cho said, "When we announced the 2030 future vision last year, we declared an investment of 50 trillion won for portfolio transformation," adding, "We will increase capital investments such as joint ventures (JV), equity investments, and M&As and create opportunities." He said, "We are currently very interested in JVs and M&As, and the fastest results we can show would be equity investments," and "I think I will be able to talk about it soon." President Cho identified platforms and B2B (business-to-business) as areas of interest for M&A.

Lotte Forms Dedicated M&A Team, Hyundai Motor and Hanwha Group Eye New Business Opportunities

Lotte Group is actively securing new growth engines while reorganizing the Future Growth Office under the leadership of Shin Dong-bin's eldest son, Shin Yoo-yeol, Executive Director of Lotte Holdings. Notably, Seosung Wook, born in 1977, was appointed as head of the New Growth Team under the Future Growth Office. Seosung Wook, formerly of the global strategy consulting firm PricewaterhouseCoopers (PwC), has been responsible for the group's M&A at Lotte Holdings' ESG Management Innovation Office's New Growth Team 1 since joining Lotte. He participated in the sale of Lotte's financial companies in 2018 and led Lotte's equity investment in Doosan Solus in 2020. It is expected that Seosung Wook, appointed as head of the New Growth Team this year, will carry out additional M&As to expand future new businesses.

Since Chairman Chung Eui-sun took office in October 2020, Hyundai Motor Group has continued significant M&As. In 2021, it acquired the global robotics company Boston Dynamics, and in 2022, it purchased the autonomous driving startup Pony.ai. It has also actively invested in promising startups such as all-solid-state battery developers. As it accelerates business restructuring centered on new businesses such as electric vehicles and robotics, it is expected to seek additional M&A opportunities. Hanwha Group is also exploring M&A opportunities alongside restructuring existing businesses. While Hanwha Group has focused on acquiring Daewoo Shipbuilding & Marine Engineering (now Hanwha Ocean) and completing the 'Korean Lockheed Martin' business plan, recently, Vice Chairman Kim Dong-kwan has been leading efforts to expand renewable energy businesses such as solar power. It is reported that the group is working on recruiting M&A and divestiture experts related to renewable energy, mainly in the IB industry. Regarding renewable energy, the group is keeping open the possibility of M&A throughout the entire process from design to operation. Recently, Han Sang-yoon, Executive Director of Hanwha Solutions, stated at the shareholders' meeting, "We are continuously pursuing various businesses beyond simple module sales, including comprehensive design, engineering, procurement, and construction (EPC) of solar power plants and development to operation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)