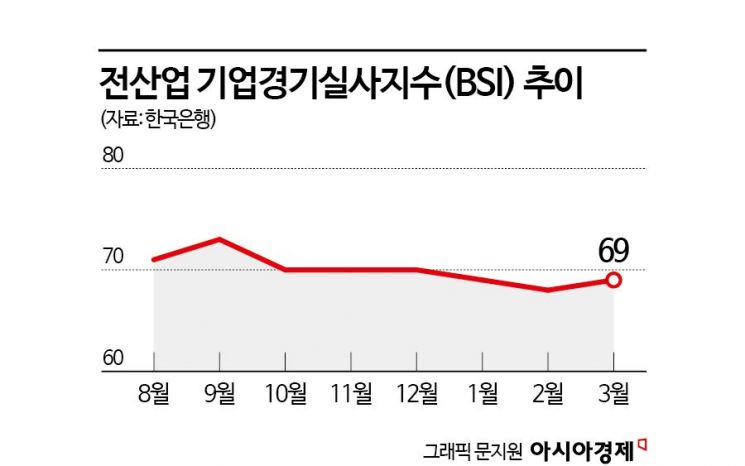

March All Industry Business Survey Index (BSI) Records 69, Up 1 Point from Previous Month

Corporate sentiment, which had declined for two consecutive months, showed a slight rebound in March. While the semiconductor industry's improvement boosted export prospects, companies' concerns about the real estate market persisted.

According to the results of the March Business Survey Index (BSI) and Economic Sentiment Index (ESI) released by the Bank of Korea on the 27th, the overall industry BSI for this month recorded 69, up 1 point from the previous month.

The BSI is an index derived from surveying business owners' assessments of their current business conditions and future outlooks; if negative responses outnumber positive ones, the index falls below 100.

The overall industry BSI had hit a low of 68 last month, marking the lowest point in 3 years and 5 months since September 2020. The rebound this month was due to improvements in the semiconductor sector.

Looking at the manufacturing industry BSI by sector, the electronics, video, and communication equipment sector, centered on semiconductors, surged 14 points from the previous month to 80. With the semiconductor industry's improvement, the manufacturing industry BSI also rose 1 point to 71 compared to the previous month. Conversely, the primary metals sector, including steel, dropped 9 points to 60 from the previous month.

Hwang Hee-jin, head of the Bank of Korea's Statistics and Survey Team, explained, "The electronics, video, and communication equipment sector performed well thanks to increased semiconductor exports, but the primary metals sector experienced a downturn due to decreased demand from a slowdown in the construction market and falling product prices caused by steel oversupply from China."

By company size in manufacturing, large enterprises (+3 points) saw an increase, while small and medium-sized enterprises remained unchanged from the previous month, indicating that the improved sentiment was mainly driven by large companies. Both export companies (+2 points) and domestic companies (+2 points) saw their BSI rise compared to the previous month.

The non-manufacturing industry performance BSI also rose 1 point from the previous month to 68 in March. The information and communication sector increased by 7 points due to higher sales from platform operators related to increased stock and virtual asset trading volumes. The transportation and warehousing sector rose 5 points, benefiting from increased sea freight rates due to Middle East geopolitical risks and a rebound in air cargo profits.

The BSI for business outlook in April was 71, down 1 point from the previous month. Manufacturing fell 2 points to 73, while non-manufacturing decreased 1 point to 69.

The Economic Sentiment Index (ESI) for February, which incorporates the Consumer Sentiment Index (CSI) into the BSI, recorded 92.2, down 1.1 points from the previous month. The seasonally adjusted ESI cyclical component was 92.7, a decrease of 0.2 points from the previous month.

This survey was conducted targeting 3,270 companies nationwide based on response criteria.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)