Financial Supervisory Service to Disclose Pet Insurance Precautions on 27th

Pet Insurance Enrollment Rate 1.4% at End of Last Year

Coverage Details Must Be Verified

Mr. A treated his pet cat's periodontitis and filed an insurance claim through pet insurance, but it was denied. This was because the insurance policy covers oral diseases but does not cover dental treatment costs. Procedures such as tooth extraction or scaling are considered dental treatments and are not included in the medical expenses covered by the insurance.

The Financial Supervisory Service disclosed precautions for subscribing to pet insurance on the 27th. Pet insurance is a product that helps reduce the hospital expenses borne by owners due to treatment of companion dogs and cats.

Recently, the number of households raising pets has increased significantly, leading to a greater burden of veterinary medical expenses. According to the Ministry of Agriculture, Food and Rural Affairs, the number of companion animals (dogs and cats) surged from 6.35 million in 2018 to 7.99 million in 2022. Among the average monthly pet care expenses (150,000 KRW), hospital fees account for 40% (60,000 KRW). Consequently, pet insurance subscriptions are gradually increasing. At the end of last year, the number of pet insurance subscriptions was 109,000, with a subscription rate of about 1.4%.

Pet insurance is available for pets older than two months. Owners can receive compensation for medical expenses when their pets are hospitalized or receive outpatient treatment at veterinary hospitals. Premiums vary depending on the deductible rate (0-50%). Premiums are renewed every 1, 3, or 5 years based on the loss ratio of the pet insurance.

Pet insurance can be purchased through insurance company websites (direct), phone consultations, or insurance planners. Starting in April, it will also be possible to subscribe at veterinary hospitals and pet shops registered as ‘simple non-life insurance agencies.’ Around April to May, subscription through insurance comparison platforms is expected to be available.

Pet insurance is a premium-renewal product, so if you subscribe when your pet is young, a lower premium is set. Be cautious that premiums increase at renewal according to the pet’s age. If premiums become burdensome, it helps to subscribe to insurance products with a higher deductible rate (0-50%) or register your pet in the National Animal Protection Information System to receive a 2-5% premium discount. If you are worried about premium increases at renewal, subscribing to products with longer renewal cycles is also an option.

Currently, pet insurance is only available for companion dogs and cats raised for household purposes. Pets bred for sale at pet shops or those raised for special purposes such as police dogs, military dogs, or racing dogs are not eligible for subscription.

Before and after subscribing to pet insurance, you must truthfully inform the insurance company about the pet’s purpose of raising, diseases, medications, and residence. Failure to do so may result in contract termination or limited coverage.

Even if the pet was originally owned by the subscriber at the time of subscription, insurance benefits may not be paid if the pet is later entrusted to someone else for care.

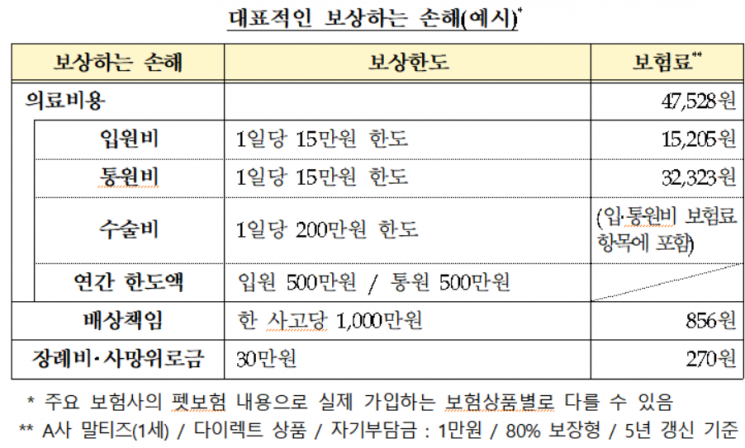

When subscribing to the basic contract, pet insurance compensates for hospitalization, outpatient, and surgery costs incurred at domestic veterinary hospitals due to illness or injury of the pet. The amount paid is the total medical expenses minus the deductible, within the compensation limits for hospitalization, outpatient, and surgery. By subscribing to additional riders, compensation can also be received for damages caused by the pet to others’ bodies or other companion dogs (liability coverage). In case the pet dies, funeral expenses or consolation money can be paid.

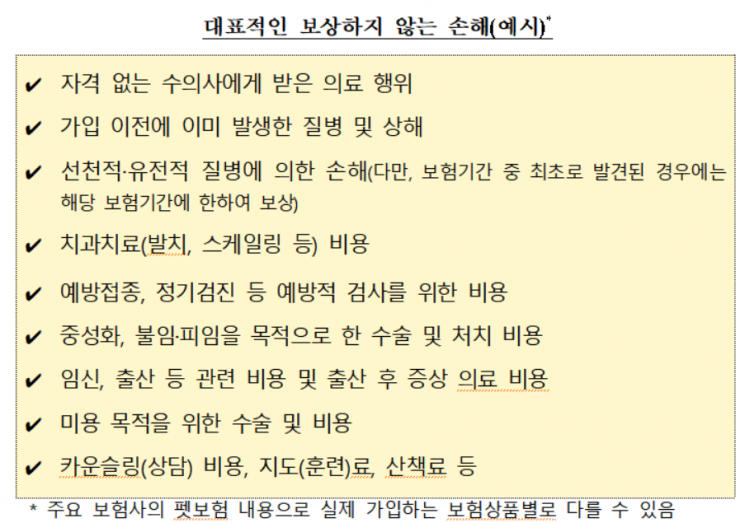

Pet insurance does not cover medical expenses for diseases or injuries that occurred before the coverage start date. Medical treatments performed by unqualified veterinarians or medical expenses due to congenital or hereditary diseases are also not covered. Dental treatment costs, vaccination fees, cosmetic surgery costs, and expenses related to pregnancy, childbirth, infertility, or contraception are excluded from coverage.

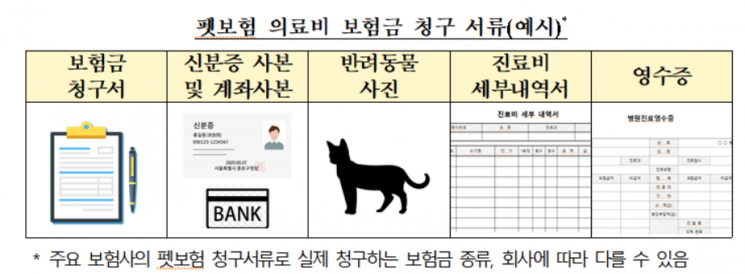

To claim insurance benefits, the pet owner must fill out an insurance claim form and submit the necessary documents to the insurance company via fax, email, or mail. Some insurance companies also offer claim services through mobile applications, which is helpful to note.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.