Hankyung Association Surveys Top 600 Companies by Sales

"Sluggish but Export Improvement, Economic Recovery Expectations"

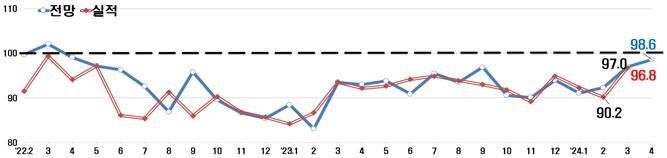

The Business Survey Index (BSI), which reflects the perceived business conditions of our companies, still recorded negative figures. However, it was the highest in the past two years, leaving room for improvement.

The Korea Economic Association (KEA) announced on the 26th that, based on a survey of the top 600 companies by sales, the BSI outlook for April this year was 98.6. A BSI outlook above 100 means a more positive economic outlook compared to the previous month, while below 100 indicates a negative outlook.

Although the April BSI was below the baseline of 100, it was the highest in two years since May 2022 (97.2).

By sector, manufacturing recorded 98.4 and non-manufacturing 98.9. The manufacturing BSI exceeded the baseline of 100 in March at 100.5 for the first time in 24 months but fell below the baseline again after one month.

On the other hand, the non-manufacturing BSI rose by 5.4 points compared to the previous month. Among manufacturing sectors, general and precision machinery and equipment (120), petroleum refining and chemicals (109.4), food and beverages and tobacco (105.9), and metals and metal products (104) exceeded the baseline of 100, showing a positive outlook.

Three sectors?wood, furniture and paper; pharmaceuticals; and non-metallic materials and products?were around the baseline of 100, while the remaining three sectors (automobiles and other transportation equipment, electronics and telecommunications equipment, textiles, clothing and leather) were expected to experience sluggish business conditions.

Among non-manufacturing sectors, leisure, accommodation and dining (121.4), professional, scientific, technical and business support services (107.1), and wholesale and retail trade (101.9) showed favorable outlooks.

The other four sectors (construction, information and communications, transportation and warehousing, electricity, gas and water) were predicted to face sluggish business conditions.

The BSI by survey category showed negative outlooks across all areas. Profitability was 93, investment 94.3, financial conditions 94.9, domestic demand 97, employment 98.6, exports 98.9, and inventory 105.1, marking the 19th consecutive month of pessimistic forecasts in all sectors.

Lee Sang-ho, head of the Economic and Industrial Division at KEA, said, "Although corporate sentiment remains sluggish, the improving exports and growing expectations for economic recovery seem to be gradually improving business sentiment. To ensure a definite rebound in corporate sentiment, it is necessary to continue efforts to improve laws and systems aligned with global standards, as well as to enhance tax and labor market competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.