Emart Conducts First Company-Wide Voluntary Retirement Since Founding

11st Also Holds Second Voluntary Retirement Following Last Year

Lost 'Distribution Throne' to Coupang... Strong Invasions by Ali and Temu Continue

Retail companies that experienced poor performance last year have consecutively introduced voluntary retirement programs to downsize their workforce. Emart decided to accept voluntary retirements for the first time since its spin-off from the Shinsegae Group, and 11st expanded its voluntary retirement eligibility to all employees. As emerging powerhouses such as Coupang and C-commerce (Chinese e-commerce) companies encroach on the retail industry, the sense of crisis among existing retail companies is expected to intensify.

Emart’s First Voluntary Retirement Since Its Establishment in 1993…Targeting Employees with Over 15 Years of Service

According to Emart on the 25th, the company posted a company-wide voluntary retirement announcement in the afternoon. This voluntary retirement program targets employees with over 15 years of service and is conducted across the entire Emart organization rather than on a store-by-store basis. This is the first company-wide voluntary retirement since Emart was established in 1993.

The eligible employees for this voluntary retirement are those in Band 1, 2, and 3 with more than 15 years of service (employees who joined before March 1, 2009, based on the date of joining). In Emart’s rank system, Band 1 corresponds to Senior General Manager, Band 2 to General Manager, and Band 3 to Manager level. Applicants for voluntary retirement will receive a special retirement allowance equivalent to 24 months of their monthly salary (with a basic salary of over 40 months) in addition to the statutory severance pay. Additionally, a living support fund of 25 million KRW and career transition support funds ranging from 10 million to 30 million KRW depending on rank will be provided, along with reemployment consulting services.

Earlier this year, Emart accepted voluntary retirements from employees working at the Sangbong and Cheonan Pentaport stores ahead of their closures. Although there have been cases of store closures in the past, employees were generally reassigned to nearby stores. It is interpreted that voluntary retirement was prioritized for stores closing amid recent poor performance.

This voluntary retirement program is seen as an effort to reduce management burdens caused by deteriorating performance. Emart recorded an operating loss of 46.9 billion KRW on a consolidated basis last year. This is the first time Emart has posted an annual operating loss since its spin-off from the Shinsegae Group in 2011. During the same period, net loss reached 185.7 billion KRW, also turning negative. Emart explained that this was due to its affiliate Shinsegae Construction posting a loss of 187.8 billion KRW caused by large-scale unsold inventory.

Emart’s core business, large-scale marts, also suffered from poor performance. Emart’s standalone operating profit last year was 188 billion KRW, down 27% from 258.9 billion KRW the previous year. Sales also decreased by 2.1% year-on-year to 16.55 trillion KRW. Emart had set a goal to surpass 30 trillion KRW in sales last year based on its core large mart business but fell short of expectations.

Emart plans to provide appropriate compensation and the best support to employees who choose voluntary retirement. Han Chaeyang, CEO of Emart, conveyed in a CEO message, "We have implemented voluntary retirement with a very heavy heart," and "We sincerely ask for your generous understanding of this measure for a new leap forward."

Meanwhile, a representative from Gmarket, a Shinsegae affiliate e-commerce company, stated, "There are no plans to operate a voluntary retirement program."

11st’s Second Voluntary Retirement Following Year-End…Targeting All Employees

E-commerce company 11st is also conducting a voluntary retirement program. According to 11st, the company is accepting voluntary retirement applications from all employees until the 29th.

This is 11st’s second voluntary retirement program following the one at the end of last year. The first voluntary retirement since its founding in 2008 targeted employees aged 35 and older with at least five years of service, but this time the eligibility has been expanded to all employees. This is interpreted as a result of low participation in the previous program.

This voluntary retirement is part of the second Next Career program, and those confirmed for voluntary retirement will receive three months’ salary. A 11st representative emphasized, "The voluntary retirement program is operated to improve profitability and ensure stable management," and "Voluntary retirement is only conducted based on employees’ voluntary applications; no forced layoffs will be carried out."

11st has been experiencing financial difficulties after a failed sale attempt last year. Its parent company, SK Square, received a 500 billion KRW investment from financial investors (FI) in 2018 with the condition of an initial public offering (IPO) within five years. SK Square included a call option clause requiring repayment of the investment if the IPO was not completed within the deadline. If SK Square waived the call option, the financial investors could sell 11st, including SK Square’s shares, to a third party.

After SK Square waived the call option in November last year, 11st entered a forced sale process. At the end of last year, negotiations for equity investment with Qoo10, a Singaporean company owning Tmon and Wemakeprice, failed. The first voluntary retirement since the company’s founding was also conducted after the breakdown of negotiations with Qoo10.

Performance has also struggled to rebound. 11st posted an operating loss of 125.8 billion KRW last year, reducing the deficit by only 17% compared to 151.5 billion KRW the previous year. Sales increased by 10% year-on-year to 865.5 billion KRW during the same period.

Yielding the Throne to Coupang, Which Has Grown Larger…Threatening Attacks from Ali and Temu

The reason retail companies are cutting costs through voluntary retirement and other measures is interpreted as the impact of emerging powerhouses such as Coupang encroaching on the domestic retail industry. Coupang surpassed Emart to become the number one in the domestic retail industry last year by recording sales exceeding 30 trillion KRW for the first time in history.

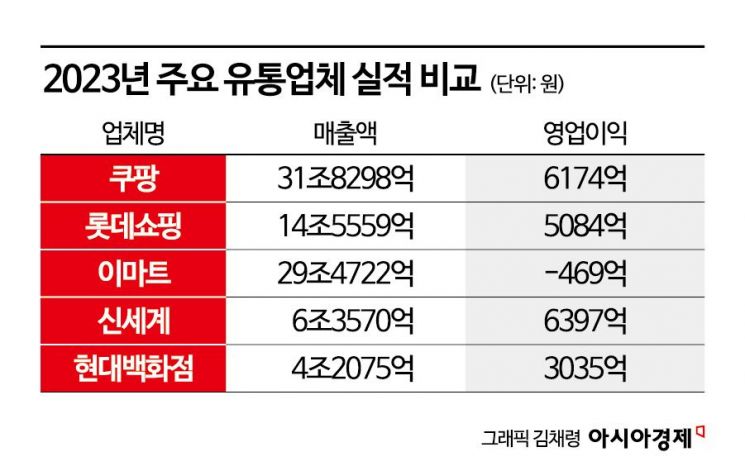

Coupang, which ranked first in the domestic e-commerce market in 2022, posted the highest sales in the entire retail market combining online and offline channels last year. Coupang has expanded its scale through continuous investment in its own logistics network. Coupang’s sales last year (approximately 31.8298 trillion KRW) are comparable to the combined sales of Emart and Shinsegae Department Store (35.8292 trillion KRW). Coupang also recorded an operating profit of 473 million USD (about 617.4 billion KRW) last year, achieving an annual profit for the first time since its founding. Coupang’s operating profit last year ranks second among domestic retail companies, following Shinsegae (639.7 billion KRW).

The aggressive attacks from C-commerce companies like AliExpress and Temu, which compete with ultra-low prices, are also fierce. According to Mobile Index, a big data analysis solution by IGAWorks, AliExpress’s monthly active users (MAU) last month were approximately 6.21 million, a 46% increase compared to about 1.36 million six months ago in September last year. Temu’s user growth is even steeper. Temu’s MAU last month was about 4.34 million, nearly tripling from 1.36 million six months prior.

The fact that these companies are strengthening their investment in the Korean market by establishing logistics centers and enhancing consumer protection policies is also expected to pose a threat to the domestic retail industry. Alibaba, the parent company of AliExpress, submitted a business plan to the government to invest 1.1 billion USD (about 1.4471 trillion KRW) over three years to expand its Korean business. Of this, 200 million USD (about 263.2 billion KRW) will be used to build an integrated logistics center (fulfillment center) of 180,000 square meters (about 54,450 pyeong) in Korea within this year. Once the logistics center is secured, the delivery time, which was considered Ali’s biggest weakness, is expected to be significantly reduced. The business plan also includes support for Korean sellers’ global sales, strengthening consumer protection, blocking counterfeit goods, and protecting intellectual property rights (IP).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)