Guarantee Support for 2 Large Corporations, 25 Mid-sized Companies, and 205 Small Businesses

Including Haitai Confectionery, Redcap Tour, and H Line Shipping

Liquidity Secured at Interest Rates Lower Than Market Demand

Including large corporations such as Daewoo Engineering & Construction and Hyosung Chemical, a total of 232 companies will issue private corporate bonds backed by guarantees from the Korea Credit Guarantee Fund (KODIT). Companies facing difficulties in securing funds from the market due to deteriorating credit ratings will be able to raise urgent funds at relatively low interest rates.

According to the investment banking (IB) industry on the 23rd, 232 companies will issue private bonds or receive loans guaranteed by KODIT on the 28th. The method involves pooling corporate bonds and loan receivables issued by multiple companies and then issuing Primary Collateralized Bond Obligations (P-CBOs) backed by KODIT guarantees. Accordingly, KODIT plans to provide guarantees for private bonds and loans totaling 727.2 billion KRW. The support targets include 2 large corporations, 25 mid-sized companies, and 205 small and medium-sized enterprises (SMEs).

Among the large corporations, Daewoo Engineering & Construction (10 billion KRW) and Hyosung Chemical (20 billion KRW) are included. Daewoo Engineering & Construction has been unable to issue public bonds due to deteriorating investor sentiment caused by concerns over project financing (PF) defaults. After issuing 40 billion KRW worth of private bonds with KODIT support in February, this is the second time this year that the company is raising funds with KODIT guarantees.

Hyosung Chemical is in an extremely deteriorated financial state, including capital erosion due to consecutive poor earnings. It is reported to be struggling to secure liquidity with debts exceeding 2 trillion KRW that must be repaid within one year. Recently, the company has begun selling its specialty gas business unit to improve its financial situation.

Among mid-sized companies, Haitai Confectionery & Foods (40 billion KRW), Redcap Tour (32 billion KRW), H-Line Shipping (25 billion KRW), Clean Nara (25 billion KRW), and Dongwon Systems (15 billion KRW) will also receive KODIT guarantee support. Among construction companies, Hanshin Engineering & Construction (30 billion KRW) and World Gunyoung (4 billion KRW) will receive guarantees for private bonds.

Support has also been provided to semiconductor and secondary battery parts and materials companies. Semiconductor packaging company Hanamicron (45 billion KRW) and secondary battery module case manufacturer Aluco (24 billion KRW) will be able to secure funds for facility investment and operating capital. These companies applied for KODIT guarantees to secure operating funds amid increasing recent orders.

Among SMEs, SJ Tech (6.5 billion KRW), Seoyoung Industrial Development (4 billion KRW), Hyundai J-COM (3.2 billion KRW), and Gyeyang Precision (3.2 billion KRW) are included in the support targets. Most mid-sized and small companies’ private bonds are provided with joint guarantees from the CEO in addition to KODIT guarantees.

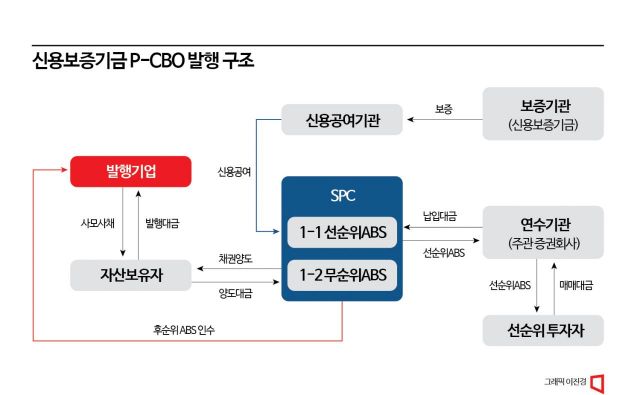

Securities firms and comprehensive financial companies (such as Woori Comprehensive Finance) participate as lead managers to assist these companies in raising funds. After conducting financial due diligence on the companies they manage, the lead managers underwrite the private bonds and loans, which are then transferred to a special purpose company (SPC). The SPC obtains KODIT guarantees and reissues the bonds divided into senior CBOs and subordinated CBOs. Institutional investors purchase the senior CBOs, while the issuing companies acquire the subordinated CBOs.

An IB industry official said, "Companies that find it difficult to raise funds due to deteriorating credit or have to pay high interest rates can now secure urgent funds at interest rates lower than those demanded by the market through government guarantees. However, since there are so many companies applying for KODIT guarantees, there is a limit to the amount of funds companies can receive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.