Lithium Battery Stocks Continue Weakness This Year

Entering Uptrend After Confirming Lithium Price Bottom

Potential for Lithium Battery Rise as Current Market Leading Sector Momentum Fades

This year, the domestic stock market has been led by artificial intelligence (AI) and corporate value-up related stocks, while secondary battery-related stocks continued to show a weak trend. Recently, with the rebound in lithium prices and growing expectations for the mass production of all-solid-state batteries, there is renewed anticipation for a rebound in secondary battery-related stocks, which have undergone sufficient correction since the second half of last year.

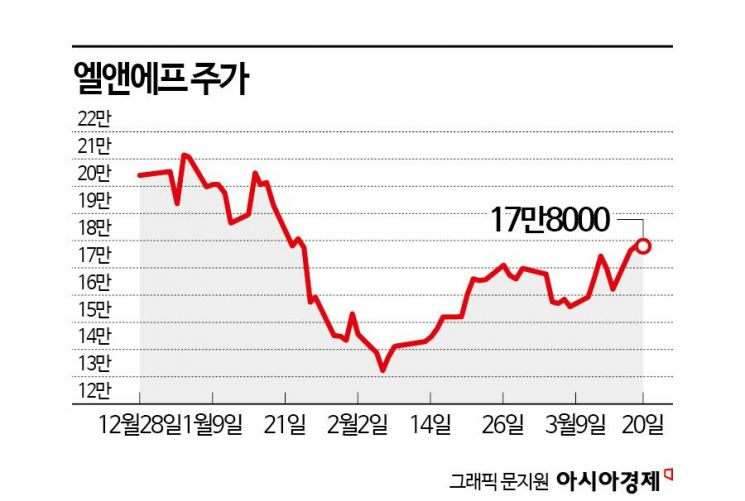

According to the Korea Exchange on the 21st, Samsung SDI and L&F closed at 453,000 KRW and 178,000 KRW respectively on the previous day. These figures represent declines of 3% and 13% compared to the beginning of the year. The KODEX Secondary Battery Industry ETF, which invests in the secondary battery value chain, also fell by 5.6% during the same period.

Although stock prices have been sluggish, analysis suggests a rebound as the second half of the year progresses. L&F recorded a large inventory asset impairment loss due to the decline in lithium prices. According to Korea Resource Information Service, lithium prices have plummeted by about 80% over the past year. Choi Boyoung, a researcher at Kyobo Securities, explained, "The inventory impairment loss will continue to affect until the first half of this year, but the purchase contract volume for lithium carbonate has been renegotiated to reduce quantities," adding, "As the proportion of consignment supply, where customers and other delivery destinations supply lithium, increases, uncertainties will gradually ease." He further stated, "Psychological burdens due to weak electric vehicle sales and secondary battery company earnings have already been reflected, and in the second half of this year, there will be benefits from the recent rise in lithium prices."

Lithium prices hit a low point early this year and began to rebound last month. Jang Jaehyuk, a researcher at Meritz Securities, explained, "Lithium prices had fallen below production costs during a period of oversupply," adding, "We are entering a phase where the demand growth rate exceeds the supply growth rate, resolving the oversupply."

Samsung SDI has recently attracted attention by announcing the timing for mass production of all-solid-state batteries. Kang Dongjin, a researcher at Hyundai Motor Securities, said, "Samsung SDI plans to mass-produce all-solid-state batteries for electric vehicles (EVs) by 2027," and "This is the earliest among the three domestic battery companies." He added, "Successful mass production ahead of competitors is a positive factor in securing technological leadership and establishing industry standards," and "We also consider its valuation to be the most undervalued among global secondary battery companies."

If governments worldwide begin to cut interest rates in earnest, it is expected to create a favorable environment for secondary battery company stocks. Lee Woongchan, a researcher at Hi Investment & Securities, predicted that the expected interest rate cuts in the second half of this year will present opportunities for the secondary battery sector. He explained, "Unless inflation rises significantly, it is possible to start insurance-type interest rate cuts by the end of the second quarter or at the latest early third quarter," adding, "The stock market has room to rise further on the signal of interest rate cuts." He emphasized, "With the momentum of AI and value-up fading, the secondary battery sector, which was one of the sectors neglected in the market in the first quarter this year, could lead additional stock market gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)