Alibaba Group to Invest 15 Trillion KRW in Korea Over 3 Years

260 Billion KRW to Build Integrated Domestic Logistics Center Within the Year

Expected to Serve as Forward Base for 'Next-Day Delivery'

Chinese e-commerce platform AliExpress is reportedly planning an investment exceeding 1 trillion KRW to target the Korean market. They plan to build a logistics center within this year that is equivalent in size to 25 soccer fields combined, and if Ali, which is encroaching on the Korean e-commerce market with an ultra-low price strategy, establishes a large-scale logistics center, it is expected to significantly shorten delivery times.

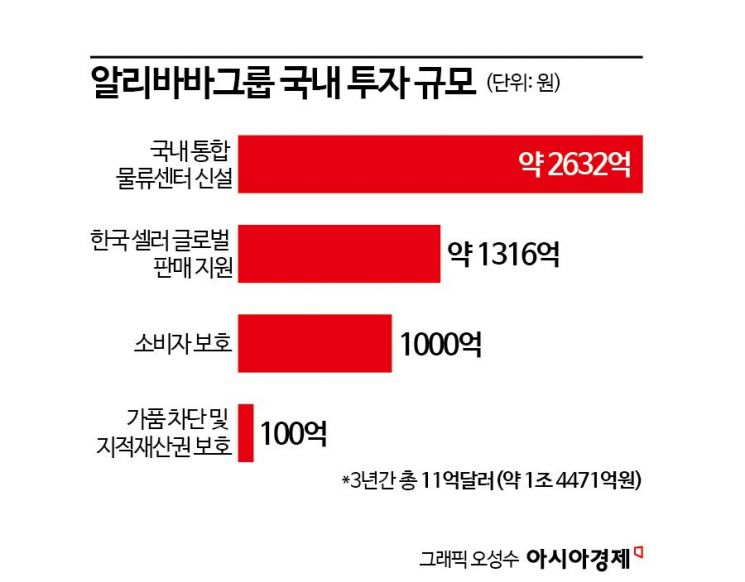

According to industry sources on the 14th, Alibaba, Ali's parent company, submitted a business plan to the government to invest 1.1 billion USD (approximately 1.4471 trillion KRW) over three years to expand its business in Korea.

"Shortening Delivery Times"... Ali Builds Yonsei Korea Logistics Center

First, Alibaba plans to invest 200 million USD (approximately 263.2 billion KRW) to establish an integrated logistics center (fulfillment center) of 180,000㎡ (about 54,450 pyeong) in Korea within this year. This area is equivalent to 25 soccer fields and is one of the largest single facilities in the country. Once the logistics center is secured, the product delivery time, which has been considered Ali's biggest weakness, is expected to be greatly reduced.

Currently, Ali offers '7-day delivery' for some products by shipping goods from logistics centers in China to Korea via sea freight. Although the logistics centers are located near ports in China and products are shipped immediately, making the sea freight delivery time relatively short, it is still slower compared to domestic e-commerce platforms that provide next-day or dawn delivery. Ali is believed to plan to overcome this disadvantage by using a domestic logistics center. It is expected that products manufactured in China will be stored in the domestic logistics center and shipped immediately upon order, making next-day delivery fully possible.

The domestic distribution industry also views Ali's logistics center as a 'forward base' to expand its market share in Korea. An industry insider said, "Building a logistics center involves not only construction costs but also high operating costs," but added, "From Ali's perspective, securing even one domestic logistics center can significantly reduce delivery times, which likely motivated their investment decision."

AliExpress held a press conference on December 6 last year at the Lotte Hotel in Seoul to announce the 'Strengthening of Intellectual Property Rights and Consumer Protection.' Ray Jang, CEO of AliExpress Korea, is discussing measures to prevent consumer rights violations such as counterfeit and poor-quality sellers. Photo by Younghan Heo younghan@

AliExpress held a press conference on December 6 last year at the Lotte Hotel in Seoul to announce the 'Strengthening of Intellectual Property Rights and Consumer Protection.' Ray Jang, CEO of AliExpress Korea, is discussing measures to prevent consumer rights violations such as counterfeit and poor-quality sellers. Photo by Younghan Heo younghan@

The approximately 260 billion KRW investment planned by Ali for the logistics center is still at an early stage compared to domestic competing e-commerce platforms. Coupang, known for its Rocket Delivery and own logistics network, has invested over 6 trillion KRW since 2014 in logistics centers and delivery network operations. Coupang plans to continue investing by securing additional logistics centers and delivery camps to expand logistics capacity.

Ali Also Positions Itself as a Platform for Exporting K-Products

Alibaba will also invest 100 million USD (approximately 131.6 billion KRW) to help Korean sellers with global sales. They plan to establish a sourcing center to discover excellent Korean products and open a global sales channel serving as an export platform in June. There are also plans to sell Korean products on Alibaba's other e-commerce platforms such as Lazada in Southeast Asia and Miravia in Spanish-speaking regions. Through this, they aim to support the global export of up to 50,000 Korean small and medium-sized enterprises over three years.

Recently, the government has targeted Ali with a 100 billion KRW investment in 'consumer protection.' Since entering the Korean market, Ali has faced criticism for insufficient consumer protection policies regarding counterfeit sales, illegal distribution of hazardous food and pharmaceuticals, and unfair advertising. As a result, the Fair Trade Commission conducted an on-site investigation at Ali Korea's office in Jung-gu, Seoul, earlier this month. The commission reportedly checked whether Ali was properly fulfilling consumer protection obligations under the Electronic Commerce Act and other regulations.

In response, Ali will officially open a customer service center with 300 professional counselors through this investment. For direct purchase (cross-border) products, customers will be able to receive a 100% refund within 90 days of purchase without any questions asked. If the direct purchase product is suspected to be counterfeit or fake, a full refund will be provided.

Ali will also actively work to block counterfeit products, which have been considered its biggest weakness. They plan to invest 10 billion KRW to filter suspected counterfeit products on the platform and protect the intellectual property (IP) of Korean brands. From October last year to this month, Ali has expelled 5,000 sellers handling suspected counterfeit products and removed 1,824,810 suspected counterfeit items. During this period, they received 42,819 refund requests from domestic consumers who purchased suspected counterfeit products and processed refunds for 42,476 cases. Refund procedures are ongoing for the remaining requests.

Alibaba expects this investment to create about 3,000 direct and indirect jobs over three years. An Alibaba official said, "Although we cannot disclose specific plans yet, we will continue to expand our investment in Korea," adding, "We will support long-term cooperation with Korean local sellers, consumer protection, and the global market entry of small and medium-sized enterprises."

Ali "Strengthens Consumer Protection in Korea"... 100% Refund Within 90 Days for Direct Purchase Products

Ali announced its Korean consumer protection policy on the same day, just one day after the government unveiled measures to strengthen consumer protection for overseas e-commerce platforms at the Emergency Economic Ministers' Meeting.

First, Ali officially launched a customer center phone consultation service to respond quickly to customer complaints and inquiries. Customers can use the phone consultation service on weekdays from 9 a.m. to 6 p.m.

They also improved the refund service for overseas direct purchase products. Customers can return products and receive a 100% refund unconditionally within 90 days from the payment completion date without any additional proof. If a product is suspected to be counterfeit or fake, or if the ordered product is lost or damaged, customers can also apply for a full refund. Ali introduced a refund compensation system for 'delivery promise' products. If '5-day' or '7-day' delivery products are not received within 14 days from the shipping date, a 100% refund is issued, and other delivery promise products have a 30-day refund period.

Starting from the 1st of next month, if a product is not received within 30 days from the shipping date, an automatic refund will be processed. Additionally, customers can apply for a 1,300 KRW coupon per order that exceeds the delivery promise period.

Ali also plans to support refund approvals within 24 hours when customers apply for refunds and logistics companies collect the products, starting from the 17th of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.