'Short-term Trading' vs 'Long-term Value-up' Support Group Distinction Needed

Shareholder Proposals and Past Track Record Analysis Must Be Considered

As major companies prepare for their regular shareholder meetings, there is a growing call for a clear distinction regarding shareholder proposals from activist funds. Although the government's 'Value-Up' policy has created an environment that empowers the claims of activist funds, there are concerns that excessive pursuit of short-term profits or management interference should not hinder the long-term growth of companies. To differentiate these, many advise carefully examining shareholder proposals and evaluating the past performance of activist funds.

Activist Funds' 'Shareholder Proposals' Should Be Examined to Ensure Corporate Sustainability

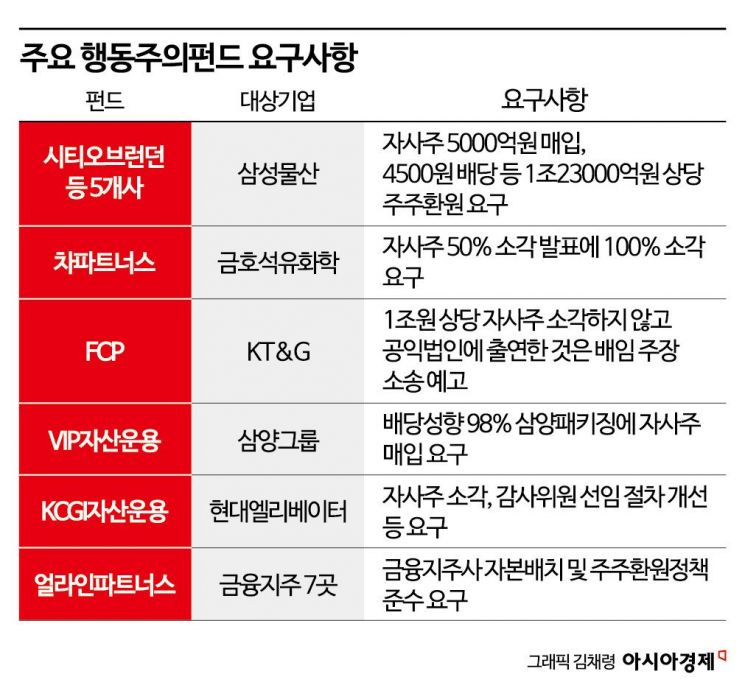

According to the financial investment industry on the 14th, following the trend of expanding shareholder proposals by activist funds, companies such as Samsung C&T, Taekwang Industrial, JB Financial Group, KT&G, Hyundai Elevator, and Samyang Group have become targets of activist funds this year. As a result, noise is increasing ahead of shareholder meetings.

Experts advise minority shareholders to carefully review activist funds' shareholder proposals and track records. They emphasize the need to see whether these proposals improve unreasonable corporate governance and ensure long-term growth potential.

Professor Kim Dae-jong of Sejong University's Department of Business Administration said, "There is no definitive answer when it comes to shareholder returns. While American companies are often thought to pay dividends well, Amazon and Tesla do not pay dividends," adding, "Some believe it is better to invest in the future and increase stock prices to reward shareholders rather than paying dividends."

Professor Kim added, "Of course, it is positive when activist funds, like SM and Align Partners Asset Management in Korea, come in to improve irrational and unreasonable governance structures and demand expanded research and development (R&D) for the future. However, suddenly demanding 100% dividends does not seem desirable." He further noted, "General investors also need to distinguish whether the fund's demands are based on a long-term plan or merely seeking short-term gains."

Senior Research Fellow Hwang Se-woon of the Korea Capital Market Institute advised that to distinguish the quality of activist fund activities, it is necessary to carefully analyze the shareholder proposals they present. Hwang said, "The strategies proposed by activist funds vary by company," adding, "Investors need to judge whether their shareholder proposals help enhance the company's long-term sustainability and efficiency and make decisions accordingly."

Growing Presence of Activist Funds... Voices for Shareholder Proposals Rise Riding the 'Value-Up' Wave

Most activist funds exert influence over various aspects such as CEO appointments, governance, dividends, and share buybacks with relatively small shareholdings. Unlike last year, when their impact was limited to a 'storm in a teacup,' this year the presence of activist funds has grown significantly. This is because they have gained legitimacy from the government's 'Value-Up' policy and market demands for increased shareholder returns. However, concerns remain that excessive demands from activist funds may affect corporate management activities.

In particular, there are many concerns about shareholder harm as management disputes and repeated short-term surges followed by corrections in the stock prices of companies targeted by activist funds occur. While most activist funds strive to improve corporate governance and increase corporate value, there is worry about the emergence of 'mukttwi' funds that ignore long-term growth and only seek short-term profits.

A coalition of five activist funds, including the UK-based asset management firm City of London, submitted a shareholder proposal to Samsung C&T demanding a 500 billion KRW share buyback and dividends of 4,500 KRW per common share and 4,550 KRW per preferred share. Samsung C&T responded, "The total amount of dividends and share buybacks requested by the shareholder proposal is 1.2364 trillion KRW, which exceeds 100% of Samsung C&T's free cash flow," adding, "If such cash outflows occur, it will be impossible to secure investment funds for future competitiveness."

The situation is similar at Kumho Petrochemical. Cha Partners submitted a shareholder proposal demanding the cancellation of all treasury shares (18.4% stake) held by Kumho Petrochemical to enhance shareholder value. Subsequently, Kumho Petrochemical announced plans to cancel 50% of treasury shares over the next three years, but Cha Partners insists on 100% cancellation.

Samyang Packaging, an affiliate of Samyang Group, is being pressured by VIP Asset Management to buy back treasury shares to boost the stock price. Tobacco company KT&G is targeted by Flashlight Capital Partners (FCP). FCP recently announced plans to file a lawsuit seeking compensation in the trillion KRW range against current and former board members, claiming KT&G caused damage by donating about 1 trillion KRW worth of treasury shares to a public interest foundation.

Since August last year, Hyundai Elevator has been receiving demands from KCGI Asset Management for treasury share cancellation and improvements in the appointment process of audit committee members. Align sent shareholder letters to seven financial groups including KB, Shinhan, Hana, Woori, JB, BNK, and DGB Financial Group, urging them to implement shareholder return policies according to performance. According to global research firm Diligent Market Intelligence, the number of Korean companies targeted by activist funds or minority shareholder activist groups rose sharply to 73 last year, up from 10 in 2020 and 49 in 2022. This ranks fourth highest worldwide.

However, some argue that viewing the active shareholder activities of activist funds as threatening corporate management rights and obstructing management activities is an overinterpretation.

Professor Lee Chang-min of Hanyang University's Department of Business Administration said, "Activist funds pursue profits, but they do not engage in hostile mergers and acquisitions (M&A) or ultra-short-term investments to achieve optimal results," explaining, "Such methods are inappropriate from a profit-seeking strategy perspective." He added that hostile M&A is virtually impossible in the Korean market and that the 'wolf pack' strategy, where funds unite to attack, is not something companies should seriously worry about.

He said, "There is no precedent for hostile M&A in the Korean market, and it is practically impossible," adding, "Even in the U.S. market, hostile M&A accounts for only about 3%, making it a difficult endeavor." He further noted, "From the perspective of activist funds, they are extremely cautious because a 'mukttwi' image and bad reputation from pursuing only short-term gains would disrupt future investment strategies." He continued, "While shares are private property, management is better handled by those who perform well through competition, which benefits corporate development," adding, "Activist activities provide appropriate tension to companies, which is a positive factor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.