Improvement of 33 Regulations in 6 New Industry Sectors

'Dollar Dutch Pay' and 'Yen Recharge Remittance' Also Allowed

Escrow Permitted for Safe Transactions in Overseas Direct Purchases

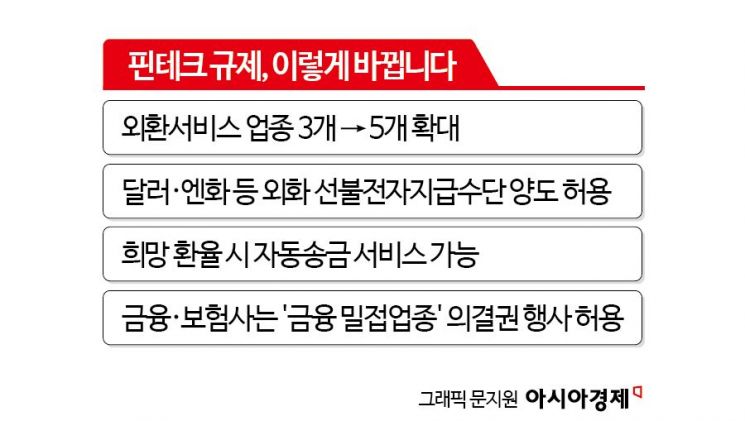

The government will ease foreign exchange service regulations to revitalize new industries. It will become possible to send and receive foreign currencies such as the dollar or yen as money on fintech (finance + technology) platforms, or to pre-charge and remit at desired exchange rates. The safe transaction service "escrow," which was not available for overseas online shopping malls, will also be permitted.

On the 13th, the Ministry of Economy and Finance held an emergency economic ministers' meeting at the Seoul Government Complex and unveiled the "Regulatory Innovation Plan for New Industry Sectors," which includes these measures. The plan focuses on improving 33 regulations across six new industry sectors.

Pre-charge Dollar and Remit at Desired Exchange Rates

According to the plan, the government will promote a regulatory sandbox to allow individuals to transfer "prepaid electronic payment instruments" denominated in foreign currencies. Prepaid electronic payment instruments refer to means used for mobile remittance or payment, commonly called "○○Pay" or "○○Money." Under current law, foreign currencies cannot be sent or received using Pay or Money and can only be used for purchases. Sending foreign currency via electronic payment instruments effectively results in foreign exchange remittance, which raises concerns about side effects.

However, as public demand for convenient foreign exchange services has increased, the government has decided to ease the relevant regulations. The Ministry of Economy and Finance expects various foreign exchange services to emerge due to the deregulation. A representative example is the "foreign currency Dutch pay" service, where travel companions split expenses during overseas trips. After finishing a trip abroad, leftover foreign currency can be kept as prepaid funds and used later. However, the transfer limit will be restricted to 2 million KRW per day, the same as for Korean won, to ensure fairness.

It will also be allowed to temporarily deposit foreign currency for remittance purposes on fintech platforms. Until now, small overseas remittance operators had to immediately transfer funds upon receipt from customers for each transaction, due to risks of financial accidents if consumers deposited foreign currency in a prepaid manner. With the regulation change, consumers will be able to deposit foreign currency within certain amounts and periods. Services that automatically remit foreign currency at specific exchange rates or times will also be possible. The government explained that this will expand overseas remittance options for travelers and international students.

Additionally, "payment escrow business" and "electronic notification payment business" have been added to the list of foreign exchange business-permitted industries. Both sectors have seen increased demand for foreign exchange services but faced inconveniences due to regulations. Payment escrow business is an escrow service that intermediates money and goods between sellers and buyers in online transactions, mainly used to prevent fraud, but it was not possible for overseas online shopping using foreign currencies. Electronic notification payment business is a service that allows timely payment of domestic taxes while residing abroad but required reporting to the Bank of Korea each time. Going forward, these inconveniences will be removed, allowing smoother foreign exchange services.

Even Large Financial Companies Allowed Voting Rights in 'Fintech'

The plan also includes measures to revitalize industries. To promote new industry investments by existing financial and insurance companies, the government will partially ease voting rights restrictions. Under the Fair Trade Act, financial and insurance companies belonging to large business groups cannot exercise voting rights even if they hold shares in non-financial or non-insurance companies. The issue is that many fintech companies are classified as "professional, scientific, and technical services," which are non-financial industries. Therefore, even if financial and insurance companies invest, they cannot exercise voting rights, reducing investment incentives. The government’s plan is to allow voting rights for fintech companies closely related to finance, even if they are non-financial companies, to promote new industry investments.

Regulations in advanced strategic industries such as semiconductors and secondary batteries will also be revised. First, customs clearance procedures for semiconductor equipment repair parts will be shortened. Repair parts must be exempted from safety certification during customs clearance, but if holidays overlap, the process stops, causing repair delays. The government will introduce a "fast track" procedure to allow import and customs clearance even on holidays. In the Ulsan secondary battery advanced industry specialized complex, plans to expand industrial water supply for resident companies will be implemented. A research project will be launched to survey companies' industrial water demand and prepare supply plans.

In addition, regulations closely related to citizens' daily lives will be adjusted. To provide driving training, classrooms and training facilities must be equipped, but these facility requirements will be waived when targeting people who have already obtained a driver's license. The previously illegal "rental car pet transportation service" will be recognized as an animal transportation business, and broadcasting advertising regulations will be fully converted to a negative regulation system for freer business activities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)