Business Restructuring Focused on Mass Brands After Windsor Sale

Profitability Improvement Through Sale and Restructuring

Capturing Market with Tequila 'Don Julio'

Diageo Korea, which restructured its portfolio focusing on mass-friendly products after selling Windsor Global last year, has chosen tequila as a partner for its core whiskey business and is accelerating brand diversification.

On the afternoon of the 12th, Diageo Korea held a media event called ‘Don Julio Brand Passion’ in Seongsu-dong, Seoul, to introduce the tequila brand ‘Don Julio.’ Diageo Korea first introduced Don Julio to the domestic market in 2008 and strengthened its lineup last September by launching ‘Don Julio 1942,’ the brand’s top-tier product priced around 300,000 KRW at retail.

Tequila is a type of Mexican distilled spirit called ‘Mezcal,’ which is made by distilling the succulent plant agave. Among Mezcals, only those made from blue agave in the Jalisco state near Guadalajara are called tequila. Depending on the aging period, tequila aged for less than two months is called ‘Blanco,’ meaning white, and is mainly used for cocktails. Those aged in oak barrels for less than one year are called ‘Reposado,’ up to three years ‘A?ejo,’ and over three years ‘Extra A?ejo.’

The exterior view of the 'Highlander Bar' operated by Diageo Korea at Galleria Department Store Luxury Hall WEST.

The exterior view of the 'Highlander Bar' operated by Diageo Korea at Galleria Department Store Luxury Hall WEST.

Diageo Korea’s push to promote tequila stems from the need for a beverage category to support its core whiskey business. Previously, Diageo Korea sought to improve its business structure by reducing brands centered on the nightlife market and expanding products of mass-market brands, leading to the sale of the domestic Scotch whiskey brand ‘Windsor.’ Windsor was the largest brand accounting for about 60% of Diageo Korea’s whiskey division sales but was heavily concentrated in nightlife sales channels, limiting its ability to expand consumer base and sales venues. Especially after the COVID-19 pandemic, as the nightlife market faced difficulties, Diageo Korea’s willingness to sell intensified.

To sell the Windsor-related business division, Diageo Korea split the company in July 2022 into Windsor Global and Diageo Korea. The existing corporation was renamed Windsor Global, and the remaining business excluding Windsor was separated into a newly established corporation retaining the name Diageo Korea. Subsequently, in October last year, Diageo sold 100% of Windsor Global’s shares to Pine Tree Asset Management.

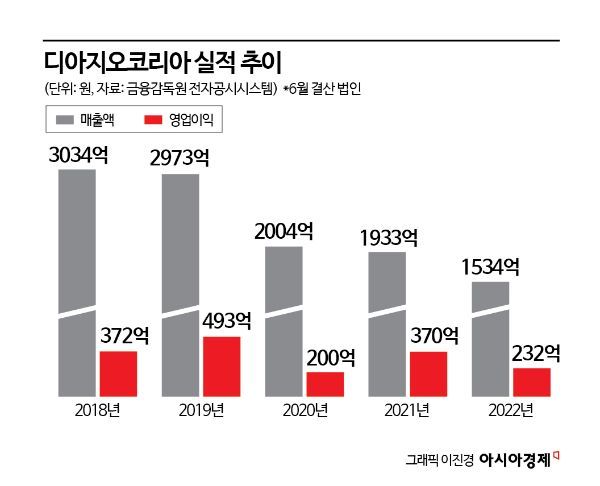

After selling Windsor Global, the downsized Diageo Korea faces the challenge of expanding its scale and improving profitability through brand diversification. Diageo Korea’s sales have been steadily shrinking since the early 2000s when the nightlife market was booming. At one point, sales approached 400 billion KRW, led by core brands like Windsor, but have been declining steadily since the 2016 fiscal year (July 2015?June 2016). The introduction of the Kim Young-ran Act (Anti-Graft and Bribery Act) in 2016 and the spread of a culture avoiding nightlife consumption had the greatest impact.

In the first fiscal year after the split from Windsor Global, 2023 (July 2022?June 2023), sales and operating profit dropped to approximately 153.4 billion KRW and 23.2 billion KRW, respectively. As a result, since last month, a voluntary early retirement program (ERP) has been underway for employees with over 10 years of service. It is reported that those who apply for early retirement will receive severance pay equivalent to 8 to 36 months of salary as compensation.

Diageo Korea, accelerating profitability improvement through the sale of the Windsor division and voluntary retirement, plans to focus on brand diversification centered on mass-market products starting this year, with the tequila brand Don Julio leading the way. Diageo Korea judged that there is potential for luxury tequila in the domestic market due to the significant increase in demand for premium alcoholic beverages, especially among younger generations. A Diageo Korea official explained, “Recently, domestic MZ generation (Millennials + Generation Z) consumers are not hesitant to discover their own tastes and tend to delve deeper once they become familiar, which is connected to the demand to experience luxury tequila.”

Additionally, the average annual growth rate of Don Julio in the domestic market from 2017 to 2022 reached 25.2%, which further encourages Diageo Korea’s expectations for tequila. According to data published last year by the alcohol industry research firm IWSR regarding the Korean market, agave-based spirits recorded a growth rate of about 59.4% from 2021 to 2022.

Diageo Korea plans to carry out various marketing activities to establish Don Julio 1942 as a toast drink used in luxurious celebratory gatherings. A Diageo Korea representative said, “Recently, Don Julio has become a luxury tequila that appears without fail at major events, including prestigious award ceremonies such as the Academy Awards in the U.S.,” adding, “We intend to continue brand campaigns so that it is recognized as a symbol of a luxury lifestyle in Korea as well.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)