TSMC's Q4 Market Share at 61.2%

Gap with Samsung Electronics at 49.9 Percentage Points

"Foundry Sales to Increase by 12% This Year"

The gap in foundry (semiconductor contract manufacturing) market share between Taiwan's TSMC and Samsung Electronics has widened. Intel has dropped out of the top 10 global foundry companies.

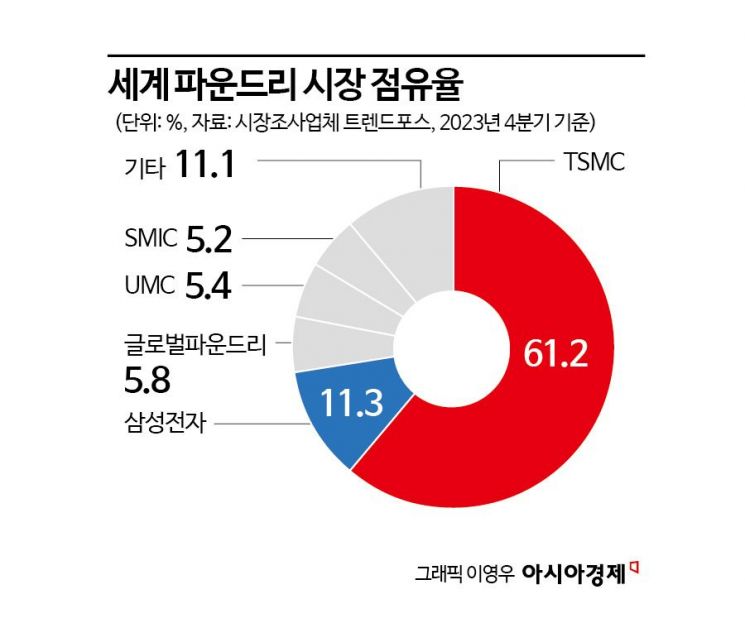

Market research firm TrendForce announced on the 12th that TSMC's market share in the fourth quarter of last year rose by 3.3 percentage points from the previous quarter to 61.2%. TSMC recorded sales of $19.66 billion in that quarter, a 14.0% increase compared to the previous quarter. After maintaining a market share in the 50% range for two consecutive quarters since the second quarter of last year, it has now regained a market share in the 60% range.

TrendForce explained, "TSMC's wafer shipments increased due to demand for smartphones, laptops, and artificial intelligence (AI)-related high-performance computing (HPC)." They added, "The revenue share of processes below 7 nanometers (nm; 1 nm = one billionth of a meter) rose from 59% in the third quarter of last year to 67% in the fourth quarter." They also forecasted, "As 3 nm production gradually increases, the revenue proportion from leading-edge processes will exceed 70%."

Samsung Electronics' market share in the fourth quarter of last year was 11.3%, down 1.1 percentage points from the previous quarter. Its sales recorded $3.619 billion, a 1.9% decrease from the previous quarter. The market share gap with TSMC widened from 45.5 percentage points in the third quarter of last year to 49.9 percentage points.

From third to fifth place, the rankings remained the same as before, with U.S. GlobalFoundries (5.8%), Taiwan UMC (5.4%), and China SMIC (5.2%) respectively. Compared to the third quarter of last year, all three companies experienced slight declines in market share.

Intel (IFS), which entered the top 10 foundry market for the first time in the third quarter of last year and ranked ninth, was excluded from the rankings in the fourth quarter. TrendForce explained, "Due to factors such as CPU generation changes and weak inventory momentum, Intel was pushed out of the rankings by PSMC and Nexchip."

The total sales of the top 10 global foundry companies in the fourth quarter of last year reached $30.489 billion, a 7.9% increase from the previous quarter. This was driven by continued demand for smartphone components such as mobile application processors (AP) and power management integrated circuits (PMIC) used in mid-to-low-end smartphones. Apple's launch of new iPhone models also contributed to increasing related demand.

TrendForce stated, "Last year was a challenging year for the foundry market, and the combined sales of the top 10 companies decreased by 13.6% to $111.54 billion." They predicted, "this year, due to AI-based demand, annual sales will increase by 12% to $125.24 billion."

Meanwhile, TrendForce recently projected in a separate report that this year's foundry market share rankings will be TSMC (62%), Samsung Electronics (10%), GlobalFoundries (6%), UMC (6%), and SMIC (5%) in that order.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.