Bridge Loan-Centered Real Estate PF Risks to Increase This Year

Risks for Securities Firms, Capital Companies, and Savings Banks

Construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul. Photo by Jin-Hyung Kang aymsdream@

Construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul. Photo by Jin-Hyung Kang aymsdream@

Warnings continue that real estate project financing (PF) risks remain high, especially among secondary financial institutions such as securities firms and capital companies. There are calls for expanding reserve fund accumulation and proactive restructuring of distressed projects to prepare for potential real estate PF defaults.

On the 12th, Korea Ratings issued a report titled ‘Assessment of the Impact of Real Estate PF Risks on Secondary Financial Sectors,’ forecasting that losses from real estate PF among secondary financial institutions will increase this year, particularly centered on bridge loans. Bridge loans are high-interest short-term loans taken out at the early stages of real estate PF projects.

According to Korea Ratings, the amount of real estate PF bridge loans maturing this year for securities firms is 4.9 trillion KRW, more than double last year’s 2.4 trillion KRW. Especially for small- and medium-sized securities firms with capital under 3 trillion KRW, the ratio of bridge loans to equity capital reached 14.5% as of last September, and when combined with the main PF loans maturing this year, it exceeds 30%. This indicates a significant vulnerability to real estate PF risks, and downward pressure on credit ratings may persist.

Capital companies and savings banks also face substantial bridge loan risks. For capital companies rated AA, the ratio of bridge loans to equity capital was 33% as of last September, while for those rated A, the ratio soared to 83%. Savings banks also had a bridge loan ratio of 68% relative to equity capital.

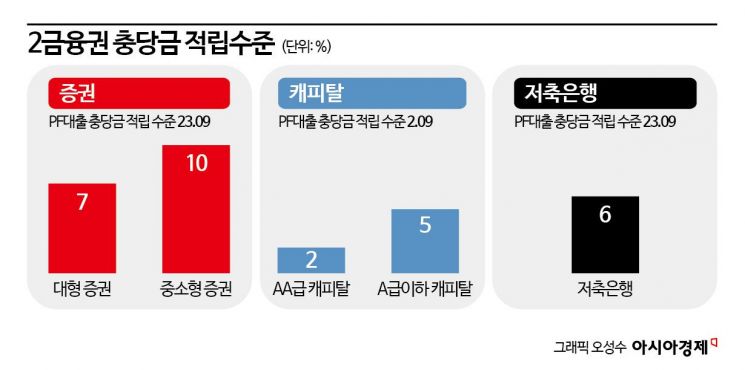

As the burden of bridge loans continues, the reserve fund accumulation burden for secondary financial institutions is expected to persist. As of last September, the reserve fund ratios for PF loans in the secondary financial sector were still low: 2% for AA-rated capital companies, 5% for capital companies rated A or below, 6% for savings banks, and 10% for small- and medium-sized securities firms. Financial authorities are requiring secondary financial companies to accumulate reserves in preparation for potential real estate PF defaults.

Wijiwon, Head of Financial Division 1 at Korea Ratings, emphasized, "The level of reserve fund accumulation in the secondary financial sector is still insufficient. The burden of reserve fund accumulation across the sector will significantly increase during the process of resolving PF defaults this year."

NICE Credit Rating also recently released a report titled ‘Current Status of Real Estate PF Risks,’ pointing out that despite considerable time having passed since the real estate PF issues began surfacing in the second half of 2022, the secondary financial sector has not meaningfully reduced related risks.

NICE Credit Rating also warned about bridge loans. For savings banks, the average proportion of bridge loans in real estate PF was 55% at the end of 2022 and remained at 55% at the end of the third quarter of 2023. During the same period, the ratio increased from 31% to 35% for capital companies and from 26% to 27% for securities firms.

It is expected that losses from these financial institutions’ bridge loans will expand. Although bridge loan projects are extending loan maturities to hold on, the ongoing real estate market downturn is leading to an increase in auctions and public sales of bridge loan land, which will result in losses for financial institutions. When projects at the bridge loan stage go to auction or public sale, they are likely to be sold at prices 30-40% lower than the invested amount, which would cause significant losses on bridge loans.

The next stage after bridge loans, the main PF, is also becoming riskier due to low sales rates. As of last September, the average sales rate for main PF projects was only 33.5% among 16 savings banks and 39.6% among 25 securities firms. Due to these low sales rates, measures such as price reductions are necessary, but the longer it takes to recover investments, the higher the likelihood of losses for the lending financial institutions.

Lee Hyukjun, Head of NICE Credit Rating, stated, "Among financial sectors, securities firms, capital companies, savings banks, and real estate trust companies face significant real estate PF risks. They need to sequentially resolve low-profitability projects over several years through capital increases and reserve fund accumulation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.